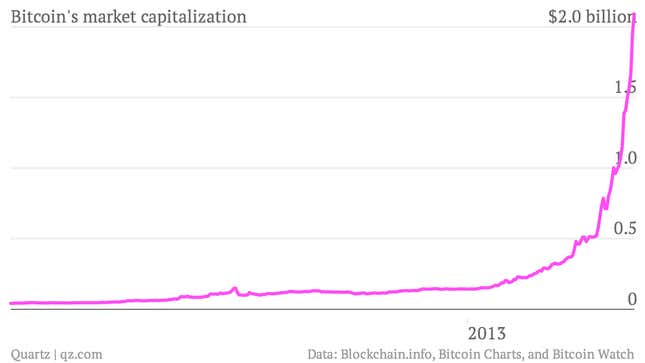

The total value of outstanding bitcoins surpassed $2 billion today, another milestone for the experiment in decentralized currency that was worth $1 billion just 11 days ago. It’s up about 1,300% since the beginning of the year.

So how high can this go? Well, first we have to know what’s driving the current surge, and my best explanation, as I’ve detailed before, is that bitcoin is going through a “demand crisis” or “deflationary spiral.” To put it simply, demand for bitcoins on the open market is going up, but the supply is also falling, which leads to wild deflation. That’s great if you’re investing in bitcoin as though it were a commodity, but not so great if you want to use it like an actual currency, that is, to buy and sell things.

Bitcoin is, in fact, deflationary by design: Only 21 million bitcoins can ever be minted, and the rate at which they are created slows over time. In December, for instance, the number of bitcoins created every 10 minutes dropped to 25, from 50, though the recent rise in value has more than made up for it.

All that is well known, and the fixed supply should be priced into bitcoin’s value. The question is what else would affect the currency’s supply and demand.

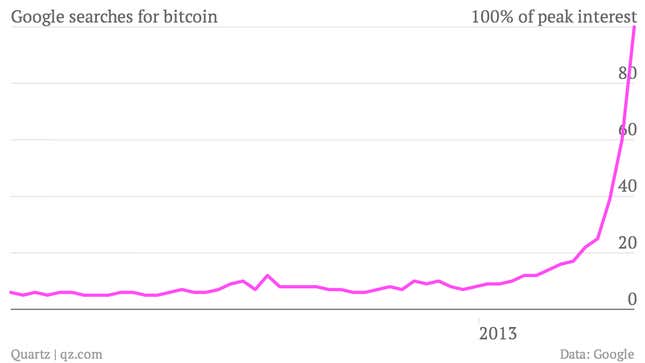

Demand is easy to see: Bitcoin is unusually sensitive to attention, and journalists like myself have been giving it plenty of that. (So have bitcoin believers.) Here’s a chart of Google searches for “bitcoin” over the past year:

Supply is a trickier question, however. We know exactly how many bitcoins are in circulation: 11,008,300 as of this writing. All transaction are also carried out more or less in public, so we should be able to tell whether people are actively using the currency or hoarding their bitcoins. When researchers examined the bitcoin universe last year, they found that between 55% and 73% of bitcoins, depending on how you count, were being held in dormant accounts (pdf) rather than being traded or used to buy things.

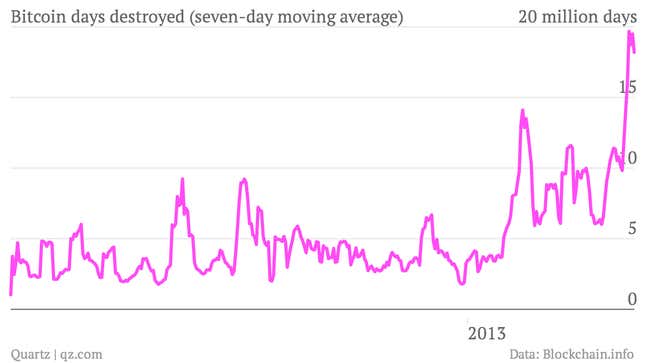

For normal currencies, there is a concept known as “velocity of money,” or the rate at which it is used to purchase goods, which is seen as a measure of the currency’s health. But that can’t be calculated for bitcoin, so the community developed an alternative metric meant to get at the same notion: “bitcoin days destroyed.” Say I have 10 bitcoins, and I do nothing with them for 100 days, then use them to buy myself a car. That would count as 1,000 bitcoin days destroyed at the moment the transaction occurs, making it a measure of both hoarding and selling. For instance, if I had bought 100 bitcoins a year ago—lucky me—and decided today to cash out of the entire investment, that would show up today as 36,500 bitcoin days destroyed.

OK, got it? Here’s a chart of bitcoin days destroyed, per day, over the past year:

Again, it’s not only showing people hoarding bitcoins, though that’s definitely part of it. The chart also shows people who were hoarding bitcoins and are now cashing out, like the “bitcoin millionaire” who posted on Reddit this weekend that he’s moving his investment into metals, a house, and some mutual funds.

Either way, what you’re looking at is the result of bitcoin hoarding, which is not great for its future as a currency, and affects the supply of available bitcoins on the open market. Lower supply makes the price go up, which should make people even less inclined to part with their bitcoins, reducing supply even further, and on and on. That’s happening at the same time demand just keeps going up and up. It’s a spiral or a crisis or whatever you want to call it. A bubble, perhaps?

To review: As bitcoin receives attention, demand for it goes up, which pushes the value higher, drawing still more attention, which should lead people who already own bitcoins to expect the price to rise even further, causing them to hold onto those bitcoins, reducing the available supply, sending the price up, and so on.

Which should work just fine until it doesn’t.