Softbank’s acquisition in the ARM is its largest—and boldest—investment to date

Today’s news confirming the massive acquisition of UK-based chip designer and telecom firm ARM by Japanese telco Softbank for $31.6 billion came as a shock. Softbank is already mired in a very public booting of a top executive, and the UK is grappling with the possibility of more foreign buyouts post-Brexit.

Today’s news confirming the massive acquisition of UK-based chip designer and telecom firm ARM by Japanese telco Softbank for $31.6 billion came as a shock. Softbank is already mired in a very public booting of a top executive, and the UK is grappling with the possibility of more foreign buyouts post-Brexit.

More striking, though, is that the deal represents an unlikely marriage—a telco merged with a chip designer. It’s not clear what the two companies have in common, or what one can offer the other. But Softbank, which earns the bulk of its revenue from its mobile telco division and Sprint, has a history of investing in companies unrelated to telecommunications. Those acquisitions, usually smaller in scope (ARM is its largest-ever acquisition), have typically been tied to its internet holding company.

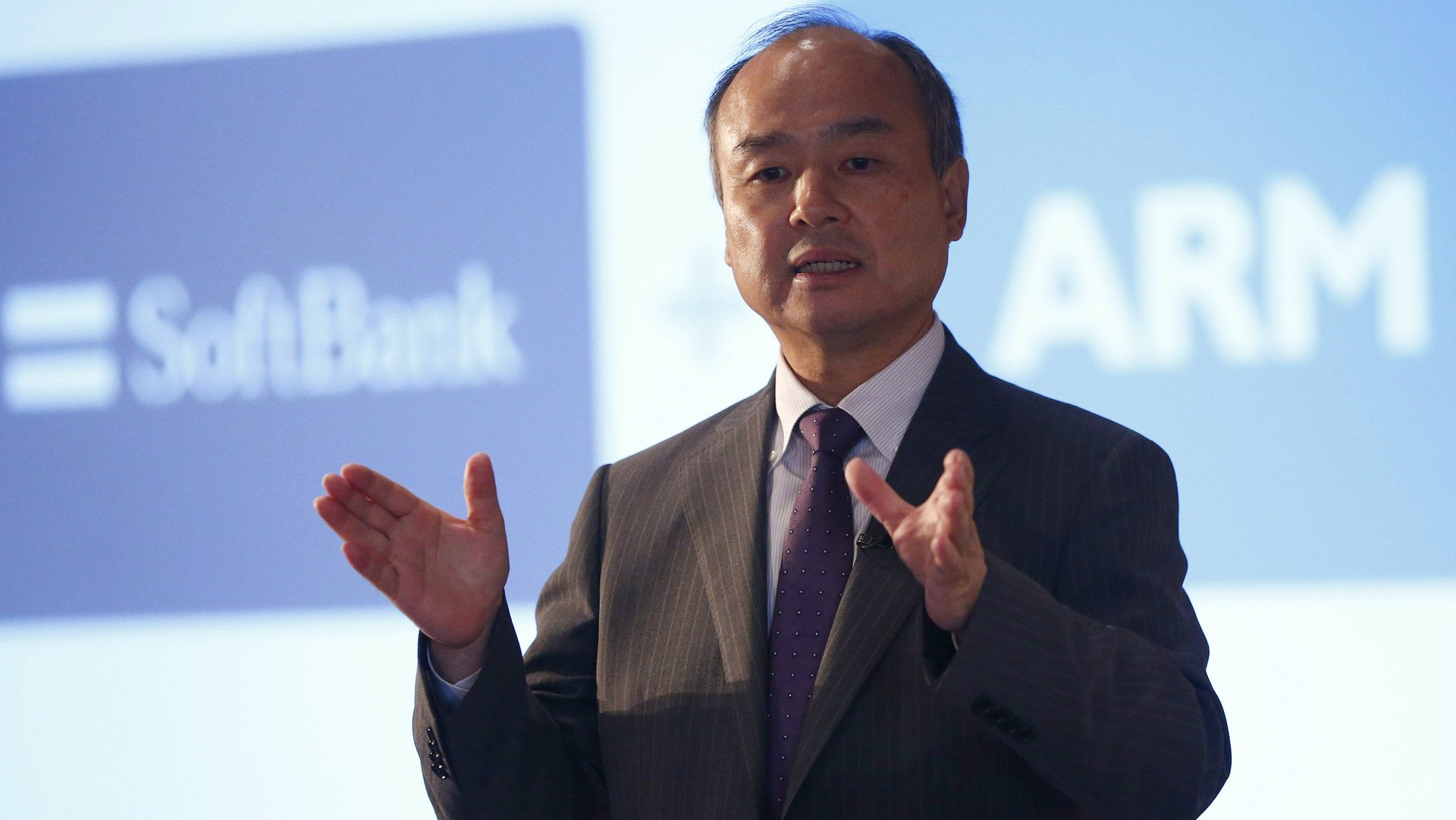

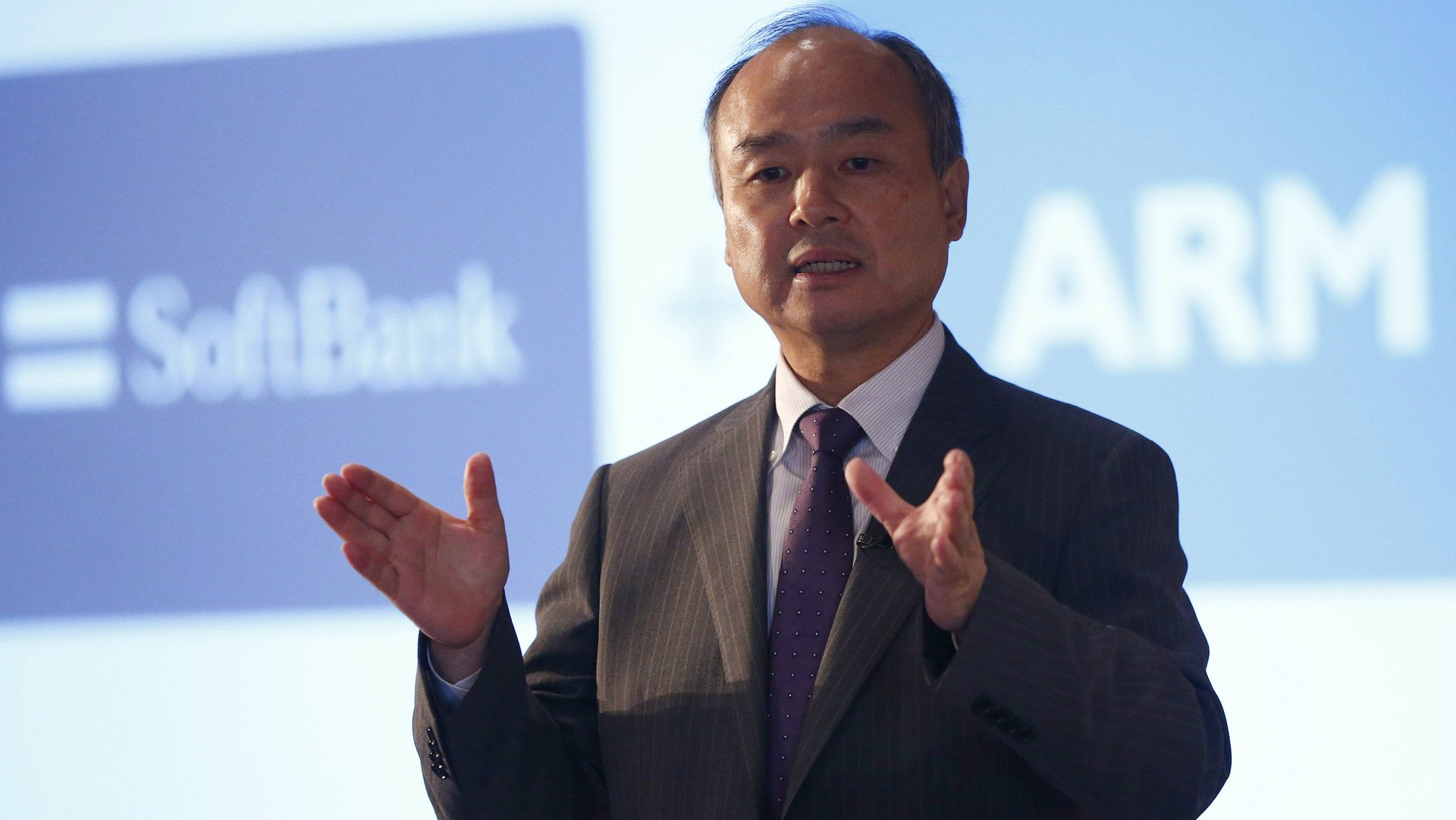

For the past fifteen years, under the leadership of CEO Masayoshi Son, Softbank has invested large sums of money in dozens internet companies. Its crown jewel is Alibaba, which it earned $75 billion from after making a $20 million investment in the company in 2000.

Its portfolio of internet companies spans the gamut of consumer and business-to-business companies, from games to app distribution. Some of Son’s high-profile bets include Yahoo and Yahoo Japan, anti-virus company Trend Micro, Words With Friends maker Zynga, and Chinese media giants Renren and PPTV.

Paying $31.6 billion for ARM, is arguably its boldest acquisition yet. As a chip designer, ARM creates the guts that power almost every smartphone on earth, and licenses out the rights to use it to companies like Qualcomm, Apple, and Samsung.

Beyond designing more chips for more smartphones, the company is banking on a future in the “internet of things,” wherein ordinary devices (light bulbs, factory machines) are connected to the internet. It’s a future that’s far from guaranteed, and that many are skeptical will ever happen.

While it’s a risky bet (some activities just don’t require the internet), Son has described the internet of things as a “paradigm shift“—equally impactful as the first smartphone boom.