One chart that shows how damaged the European banking system really is

Once upon a time, the business model of banks was pretty simple. They borrowed money cheaply for short periods of time. Then they lent that money out for longer periods of time at a tidy mark-up. The thing is, that business model doesn’t work if banks can’t complete the first part of the equation. And for a few years now, many banks in troubled European countries haven’t been able to borrow short-term money cheaply.

Once upon a time, the business model of banks was pretty simple. They borrowed money cheaply for short periods of time. Then they lent that money out for longer periods of time at a tidy mark-up. The thing is, that business model doesn’t work if banks can’t complete the first part of the equation. And for a few years now, many banks in troubled European countries haven’t been able to borrow short-term money cheaply.

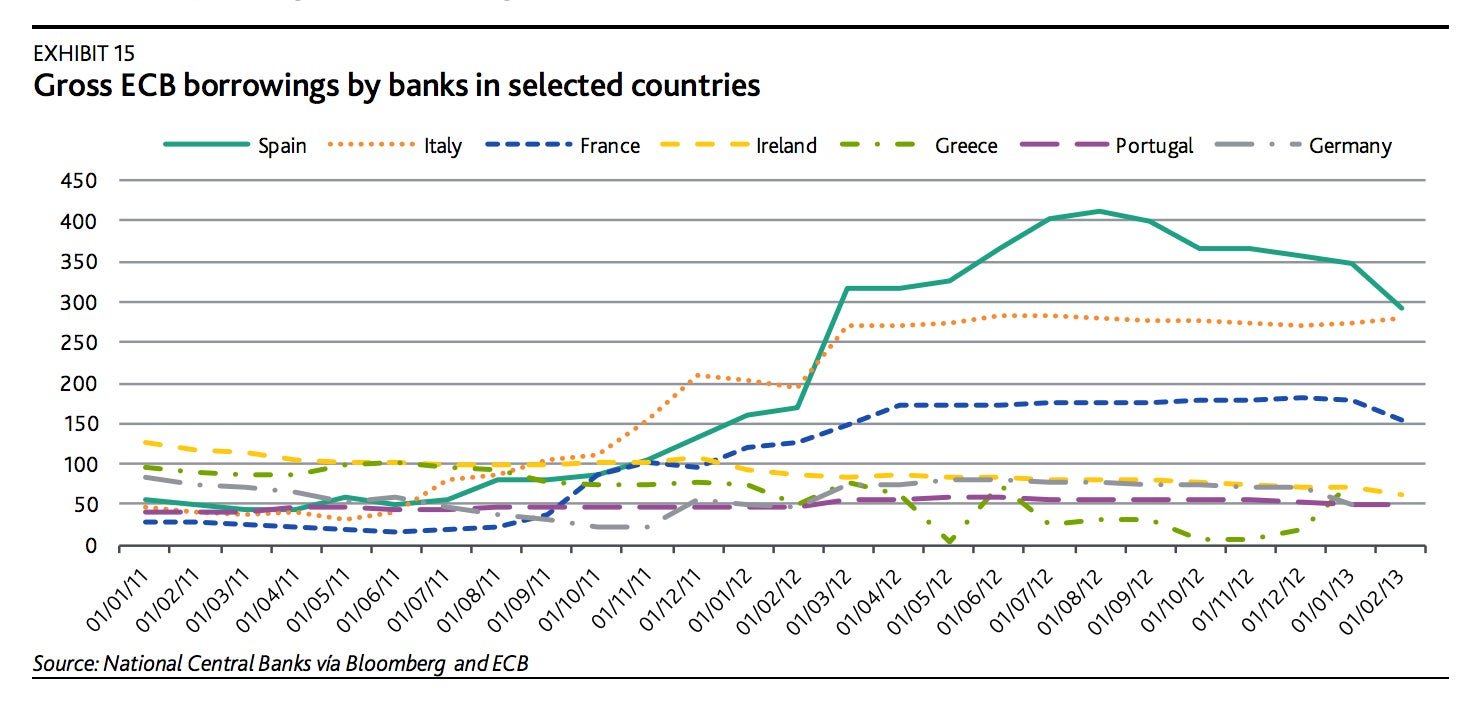

This lovely chart from the good people at Moody’s shows the result: Banks in large European countries such as Italy and Spain—and even France—are still far more reliant than they used to be on the European Central Bank as a source of that short-term cash. Now the ECB’s system of lending to banks definitely helped ease worries about a major European banking failure. Those cheap, long-term loans to banks, known as Long-Term Refinancing Operations, or LTROs, were introduced in late 2011 and early 2012 (paywall), when the European panic was cresting. But as you can see, more than a year later, banks have had trouble regaining the confidence of private-sector lenders.