Once again, investors are bracing for disappointing Twitter results

Investors waiting for good news from Twitter shouldn’t hold their breath. The company is set to report its earnings tomorrow (July 26) after US markets close, and indications are pointing to yet another weak quarter.

Investors waiting for good news from Twitter shouldn’t hold their breath. The company is set to report its earnings tomorrow (July 26) after US markets close, and indications are pointing to yet another weak quarter.

Even if Twitter met the top end of its sales guidance ($590 million to $610 million), it would be the slowest quarter of revenue growth (21%) since it’s gone public. So far this month, three firms have already downgraded the stock, and only six of 32 analysts polled by FactSet currently rate it as a buy.

Once optimistic of Twitter’s turnaround under CEO Jack Dorsey, SunTrust Robinson Humphrey’s Bob Peck lowered his rating from buy to neutral on July 8. In a research note, he said that user growth remains challenged and that recent products, such as Moments and Twitter’s logged-out interface, which were designed to simplify the product for new users, “have yet to reignite user growth.” Furthermore, those who have signed up for new accounts are checking Twitter less frequently than the rest of the network’s active users, he added.

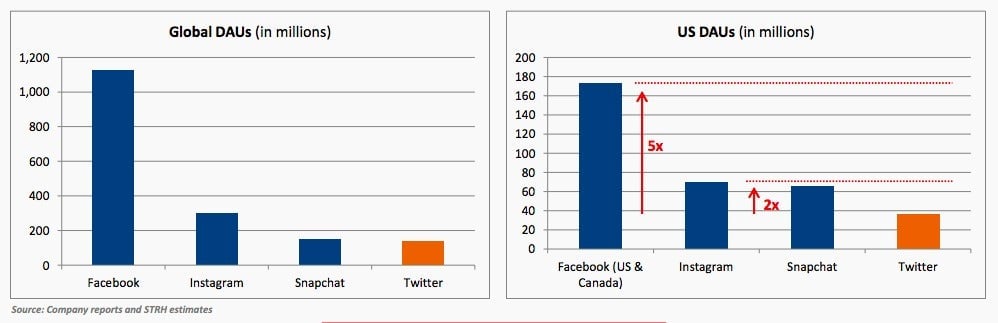

Twitter ended the first quarter with 310 million monthly active users. Its base is just a fraction of Facebook’s 1.65 billion users, and user growth has slowed to a crawl, even dipping into negative territory in the fourth quarter. On average, analysts are expecting Twitter added about 2 million new users in the second quarter, though Peck is less optimistic, forecasting an addition of 1 million users.

Still, with the Rio Olympics and US elections on the horizon, there are many opportunities to capture new users in the second half of 2016.

If, however, Twitter is unable to get out of its slump, Peck believes that a merger or acquisition will be “inevitable.” That might not be what the company wants, but it could be good news for investors. Deutsche Bank is one of the few firms that say Twitter’s stock is worth buying, in part because of its M&A potential.