Kinder Morgan is taking off on the momentum of last year’s merger

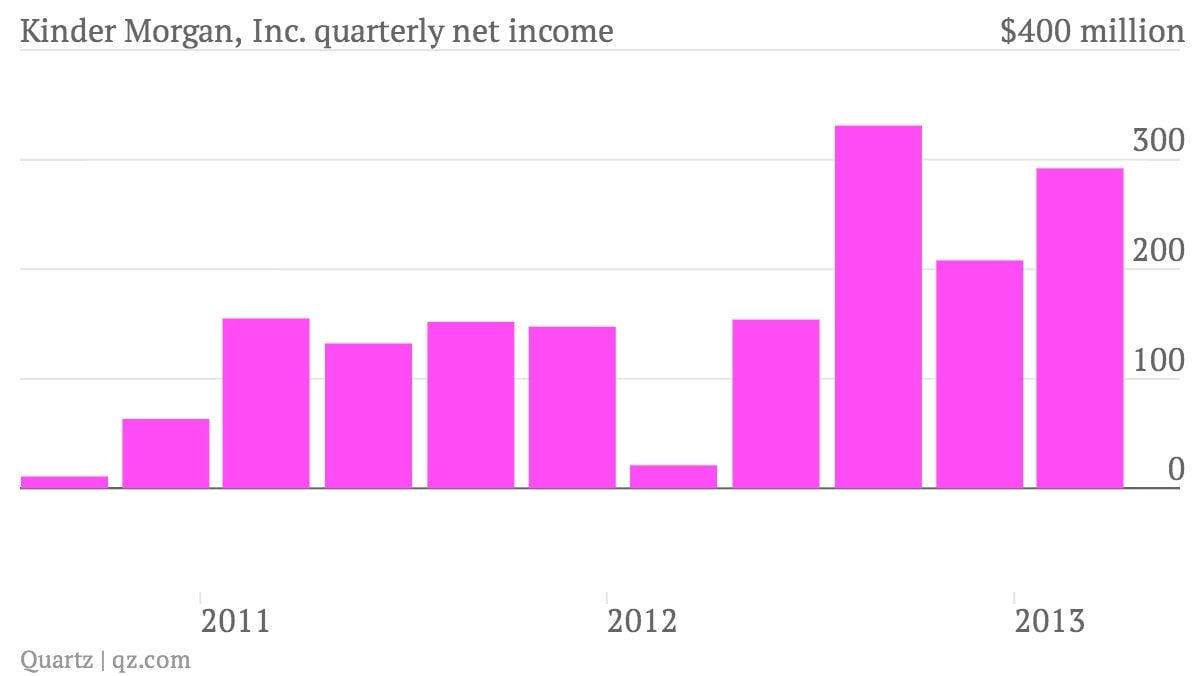

The numbers: US energy giant Kinder Morgan (KMI), which specializes in pipelines and energy storage, posted quarterly profit of $292 million, or $0.28 per share, slightly missing analyst expectations of $0.31 per share. Revenue leaped 65% from a year earlier, well above the expected 57.2%. KMI’s quarter rode strong numbers from its Kinder Morgan Energy Partners LP affiliates, for which profit nearly quadrupled, and El Paso Pipeline Partners LP, which reported a profit of $174 million.

- The numbers: US energy giant Kinder Morgan (KMI), which specializes in pipelines and energy storage, posted quarterly profit of $292 million, or $0.28 per share, slightly missing analyst expectations of $0.31 per share. Revenue leaped 65% from a year earlier, well above the expected 57.2%. KMI’s quarter rode strong numbers from its Kinder Morgan Energy Partners LP affiliates, for which profit nearly quadrupled, and El Paso Pipeline Partners LP, which reported a profit of $174 million.

- The takeaway: Revenues grew for the fourth consecutive quarter, and chairman and CEO Richard Kinder doesn’t expect that trend to break any time soon. Kinder said today that the company has “identified more than $12 billion in expansion and joint venture investments across the Kinder Morgan companies, and we are pursuing customer commitments for many more projects.”

- What’s interesting: KMI paid roughly $21 billion for El Paso Corp. last May. The acquisition was pretty unpopular among El Paso Corp. shareholders, who wondered why Goldman Sachs, which owns 19% of KMI, was allowed to advise on the merger. But that’s since been settled, and KMI appears to have emerged as the overwhelming victor. Not only did the merger turn KMI into the fourth-largest energy company in North America—and it says it’s since become third-largest—but the company has since posted consistent revenue growth and record profits. With Richard Kinder promising further expansion in the coming year, speculation has already begun to surface about his next move.