Ignore the sketchy official data, here’s the real metric to watch on Chinese manufacturing

Reading the tea leaves of Chinese economic data is one of the great frustrations of the modern day macroeconomists. For instance, how much weight should one put on today’s private sector survey data which showed a softer-than-expected Chinese manufacturing outlook? The government numbers are often equally opaque, with the ridiculous recent read on imports and exports merely the latest example. So what should you look at? How about this:

Reading the tea leaves of Chinese economic data is one of the great frustrations of the modern day macroeconomists. For instance, how much weight should one put on today’s private sector survey data which showed a softer-than-expected Chinese manufacturing outlook? The government numbers are often equally opaque, with the ridiculous recent read on imports and exports merely the latest example. So what should you look at? How about this:

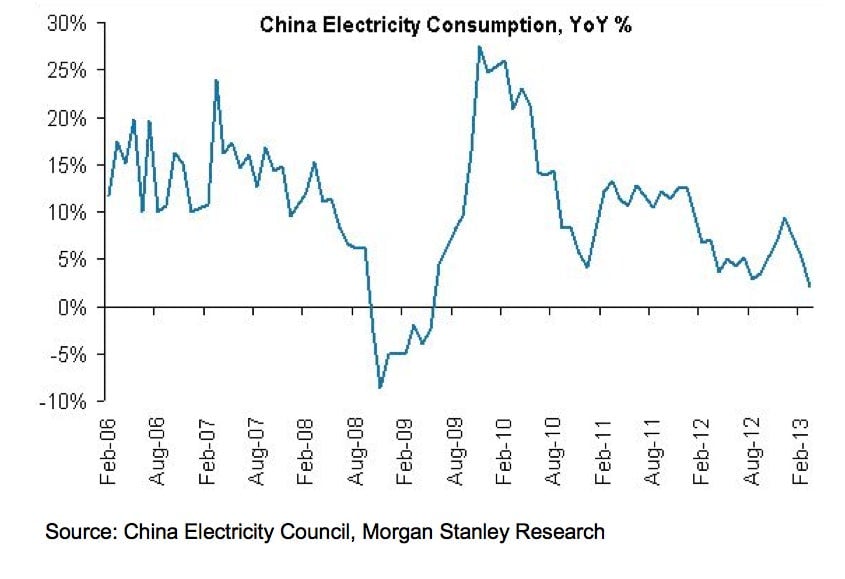

Chinese manufacturers are voracious consumers of energy. So, for awhile now economists have taken to looking at electricity consumption for a ricochet reading on Chinese manufacturing. And demand seems to be softening quickly. This has knock-on implications for a whole host of countries that base their economies around digging stuff up, such as coal to supply power plants, and selling it to China. (We’re looking at you Australia.) ”The coal market seems to face a supply glut at present, as Chinese buyers were reportedly being flooded with offers for various grades of thermal coal from other regions apart from Australia, South Africa and Indonesia,” wrote Citigroup commodities analysts, in a note yesterday. “Some utilities have decided to lower their purchase prices of domestic thermal coal as consumption has remained below normal levels.” In a world of squishy Chinese data, that’s a data point worth paying attention to.