Mexico’s retail sector isn’t waking up from its siesta anytime soon

Mexican retail is reeling.

Mexican retail is reeling.

December marked the first month in over two years in which Mexico’s retail sector failed to report positive revenue growth from a year earlier. Sales plummeted again in February, falling 2.6% year-over-year. Few expected a contraction like this.

At fault: waning consumer spending and lackluster industrial production, both of which have taken a hit on the heels of the economic slowdown in the US. While neither bodes well for retail sector growth on its own, the combination of the two has been that much more troubling.

But there’s other factors at work. These three observations in particular paint a not-so-pretty picture of times to come:

Mexicans are either spending big, or skipping out and going home

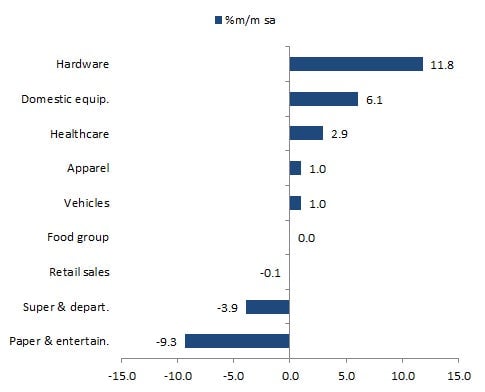

Weak apparel sales are leading the downward charge of retail sales. While hardware and domestic equipment climb—churning out month-to-month growth in February of 11.8% and 6.1%, respectively—Mexicans seem less inclined to spend money on cheaper objects such as clothing and footwear. The chart above, compiled in a report released by Barclays Capital yesterday morning, shows year-on-year growth numbers across eight different sales sub-sectors. Consumer confidence in Mexico fell in both January and February, and seems evident in Mexicans spending on cars and electronics, while holding back on less expensive goods such as apparel. Barclays’ chief economist for Mexico, Marco Oviedo, told Quartz he’s encouraged by the strong showing in durable sales, which bode well for consumer confidence. If only Mexican consumers were opening up their wallets for the smaller stuff.

Mexican retail market bellwether Walmart de Mexico isn’t doing too hot right now

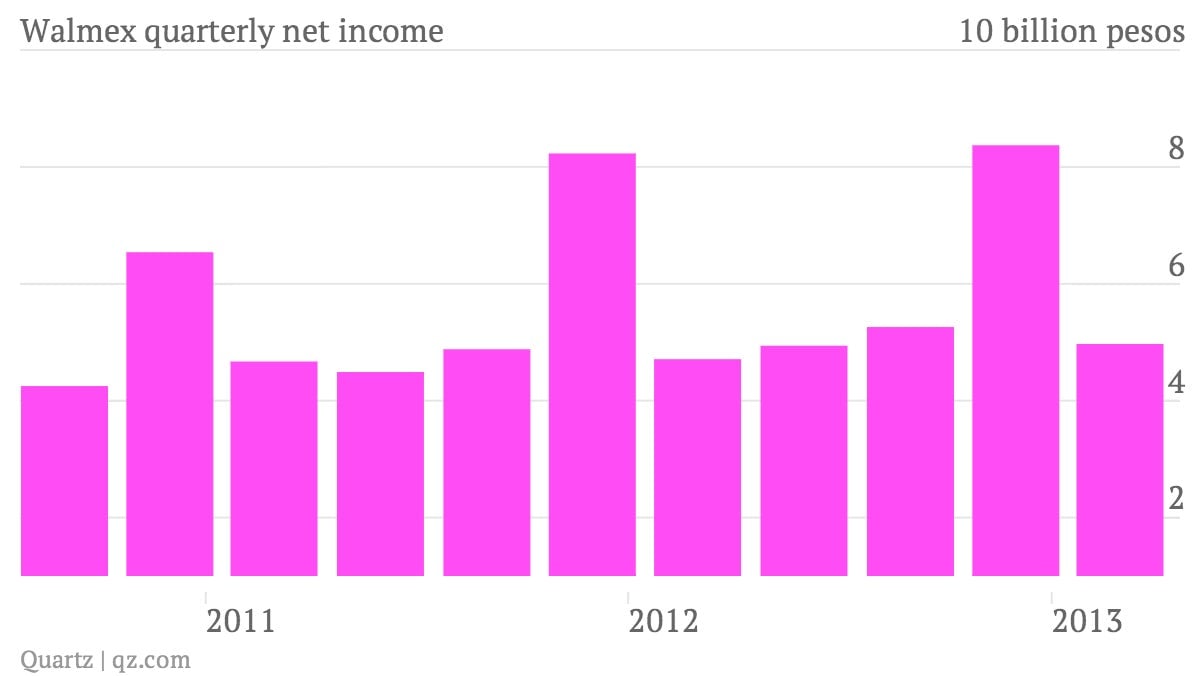

Wal-Mart de Mexico announced yesterday that it turned 4.97 billion pesos in first quarter profit, a 5.5% increase from last year. On the surface, the numbers don’t sound too bad, but Walmex is struggling. Much of its gain actually came from success outside Mexico, in the rest of Central America. Chief executive Scott Rank specifically blamed a lag in domestic consumer spending for Walmex’s lackluster performance in the country. But that’s not all; Ranks also warned that consumer spending isn’t going to improve anytime soon. Coming from an executive at a retail industry leader like Walmex, that’s pretty bad news for everyone else in the sector, too.

Industrial production went from bad to worse

So much for analyst expectations that industrial production in February was going to impress. February’s industrial output was supposed to grow year-over-year. Instead, it dropped 1.2%. Poor output for the month means the central bank’s decision to cut interest rates last month was probably justified. It also means worries about inflationary pressures continuing to push consumer prices higher will persist. Empty (or unwilling) wallets, higher prices and falling output: that’s hardly going to help the retail sector.