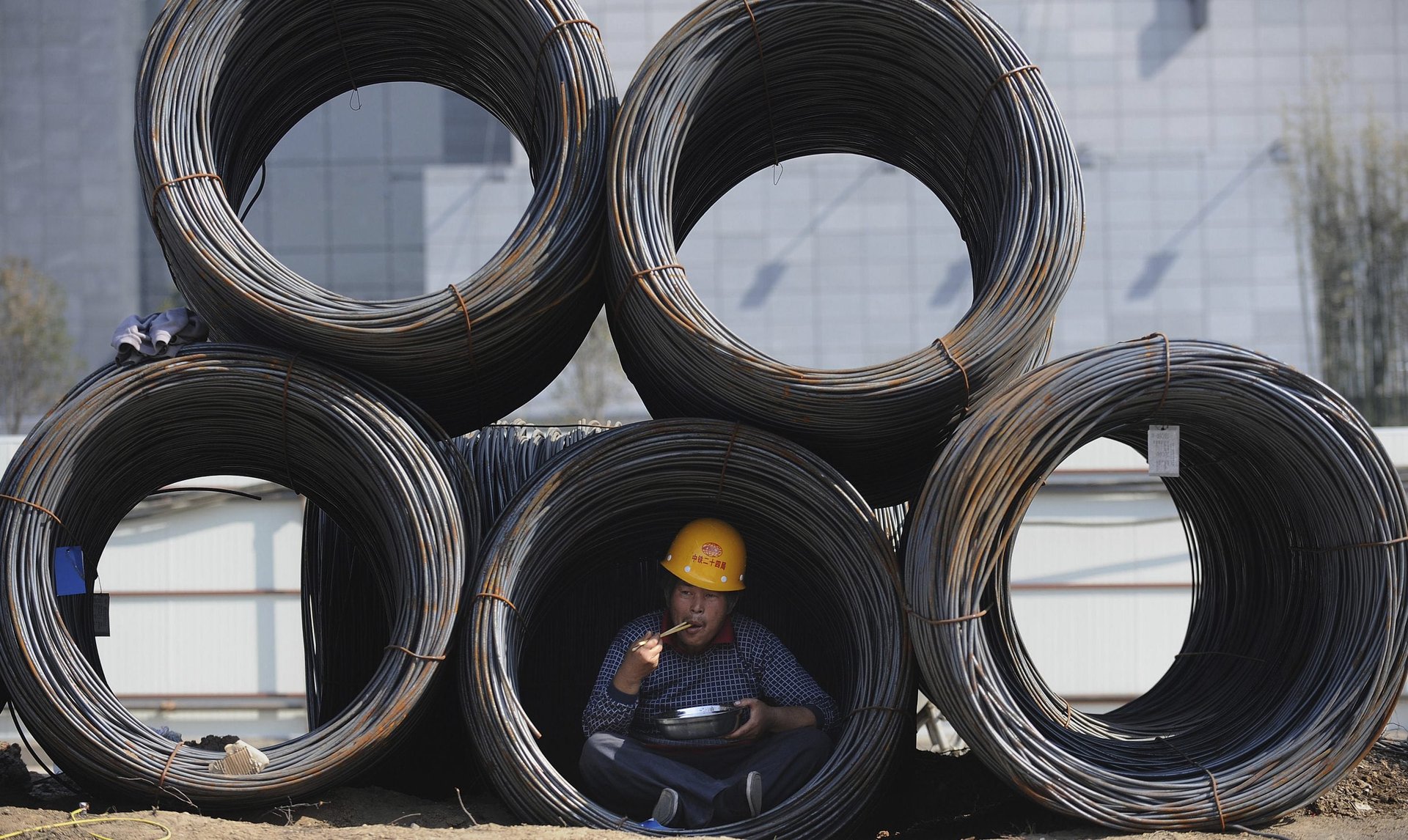

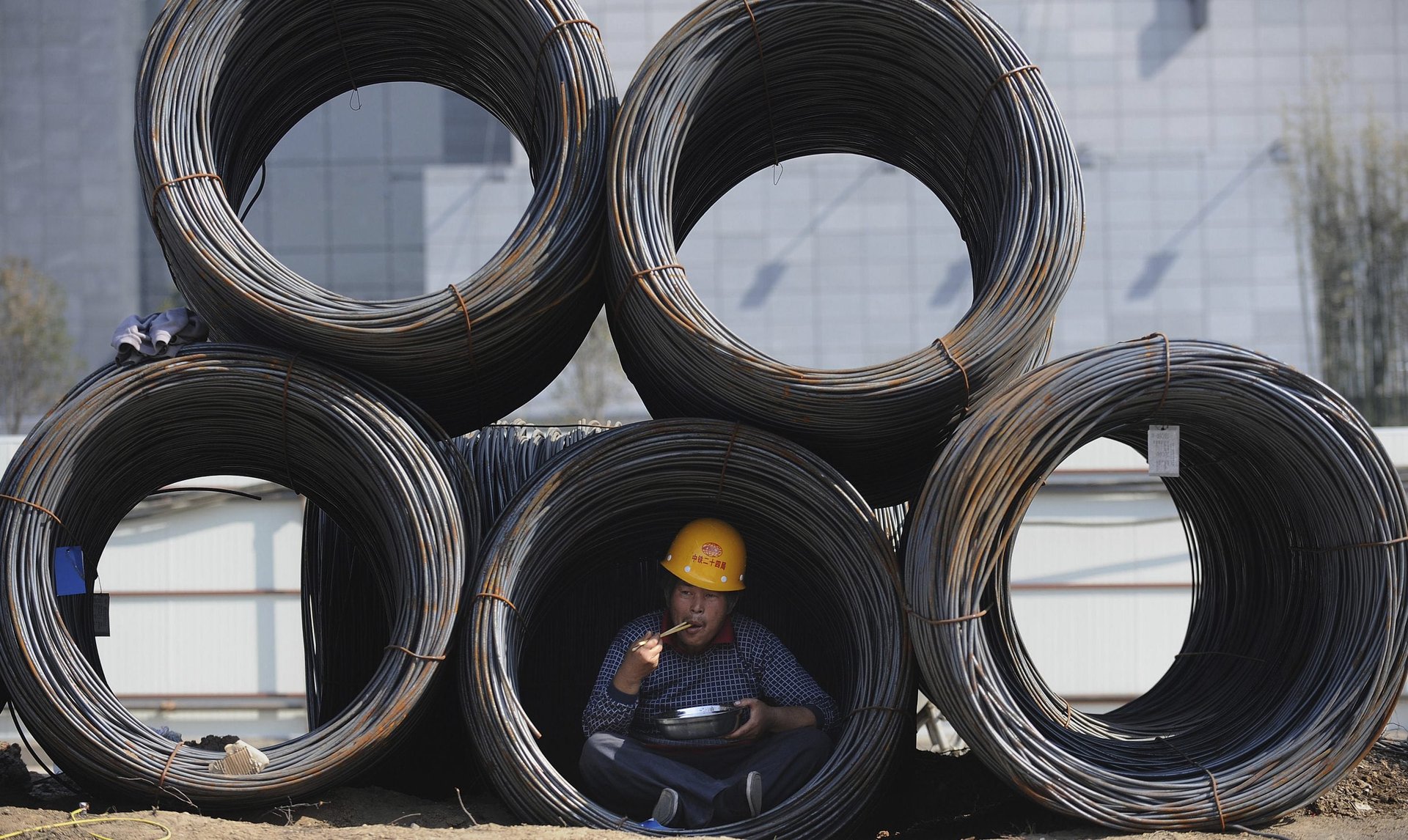

China’s private companies are not investing in future growth, leaving Beijing to pick up the slack

Despite concerns about slowing growth and rising debt levels, China’s economy looks to be on an upswing, a trove of official data released today (Sept. 13) show. Industrial production rose 6.3% in August from a year earlier, while retail sales gained 10.6% in August year-over-year. Both figures beat market expectations.

Despite concerns about slowing growth and rising debt levels, China’s economy looks to be on an upswing, a trove of official data released today (Sept. 13) show. Industrial production rose 6.3% in August from a year earlier, while retail sales gained 10.6% in August year-over-year. Both figures beat market expectations.

But there are worrying signs that the government is still doing a lot of the heavy lifting to keep China’s economy growing, despite ongoing attempts to reform the bloated, often heavily indebted state-owned sector.

Overall fixed-asset investment—which refers to money put toward longer term capital-intensive projects like building new factories or buying heavy machinery—rose at the slowest pace in 16 years, unchanged at 8.1% in the first eight months of the year from the same period a year ago, excluding rural households. Analysts had forecast investment growth of 7.9%.

Growth in government spending on fixed assets fell 0.4% to 21.4% in the January-August period. Growth in private sector investment, which accounts for 61.4% of all investments, was unchanged at 2.1% for the period.

In a separate data release, the Ministry of Finance said (link in Chinese) that spending in public sectors from education to healthcare increased 10.3% from a year earlier in August.

The continued discrepancy between government and private investment spending this year shows not only that China’s economy is still being heavily supported by state-owned companies, but also that owners of private firms are reluctant to spend their money, a sign that they are lacking confidence in the future.