The UK averted a triple-dip recession as service-sector boosts economy, though construction contracts again

The UK economy grew 0.3% in the first quarter of 2013 compared with Q4 2012, according to preliminary data. This suggests that the country avoided a triple-dip recession that was feared. Though data over the last month offered reason for hope that wouldn’t happen, the Q1 GDP data still came as a surprise, as economists had expected only 0.1% growth. Here’s a look at what happened instead:

The UK economy grew 0.3% in the first quarter of 2013 compared with Q4 2012, according to preliminary data. This suggests that the country avoided a triple-dip recession that was feared. Though data over the last month offered reason for hope that wouldn’t happen, the Q1 GDP data still came as a surprise, as economists had expected only 0.1% growth. Here’s a look at what happened instead:

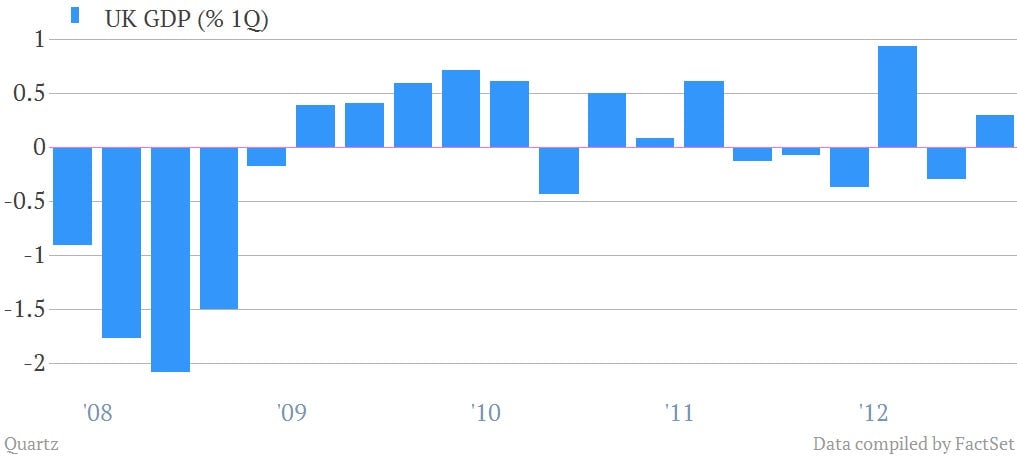

Still, 0.3% isn’t great. As the UK’s Office for National Statistics (ONS) put it, growth “has been broadly flat over the last 18 months.” Since the UK economy shrunk 0.3% in the last quarter of 2012, a second consecutive quarter of contraction would have meant a recession, the third to have hit the UK since the five-quarter recession in 2008-9 and the three-quarter recession in 2011-12.

That has to be a big consolation for George Osborne. Many suspect the Treasury head’s rigid deficit reduction plans to be draining the economy of the strength to recover. As the Guardian points out, a slide back into economic decline would have added ammunition to the IMF and the opposition Labour party in their fight to get Osborne to let up on austerity. (Note that today’s estimate is based on only around 44% of the information that the ONS uses, so the revised Q1 GDP figure that will come out in May could still change.) Here’s Osborne, being relieved:

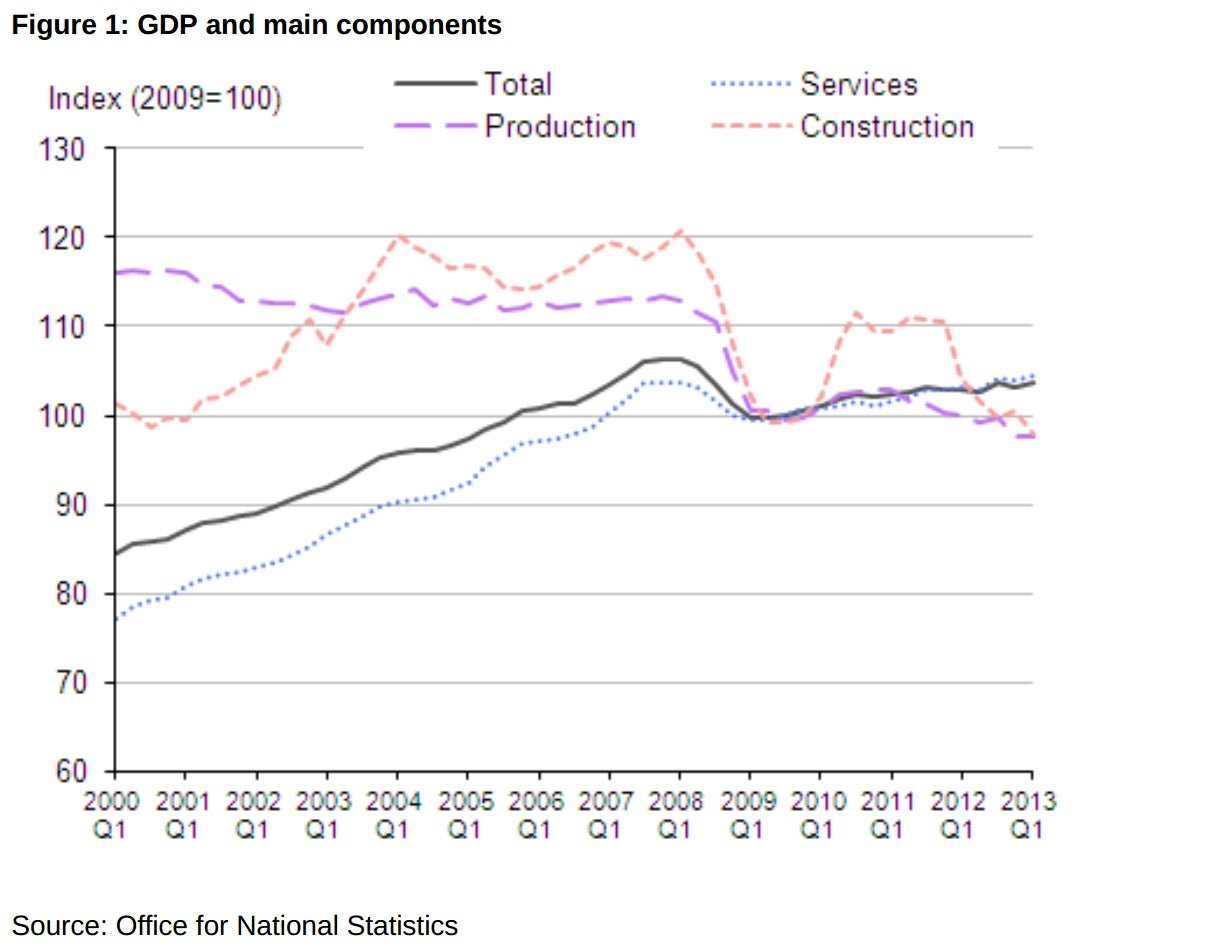

Beyond the headline figure, the good news here is the UK’s service sector, which grew 0.6%. That’s important because services contribute around 75% of the UK economy, so when they tank, the country goes with them. And vice-versa, of course—services generated around 0.5 percentage points of Q1 GDP (pdf), said the ONS. Here’s a look at that:

However, government spending contributed 0.1 percentage points of Q1 GDP growth, after having shaved 0.2 percentage points off growth in Q4 2012; meanwhile, business services and finance generated only 0.1 percentage points to GDP last quarter, down from 0.2 in the prior quarter. And as you can see in the chart above, even as the UK’s service sector outperformed, production is still struggling—it grew at only 0.03% on the quarter. The remaining drag on GDP growth comes from construction, which shrunk by 2.5%, even amid more signs that the housing market has been on the mend. Construction activity fell for five consecutive quarters in 2011 and 2012, with slight growth in Q4 2012 arresting this trend. That should make Q1’s return to contraction disheartening.

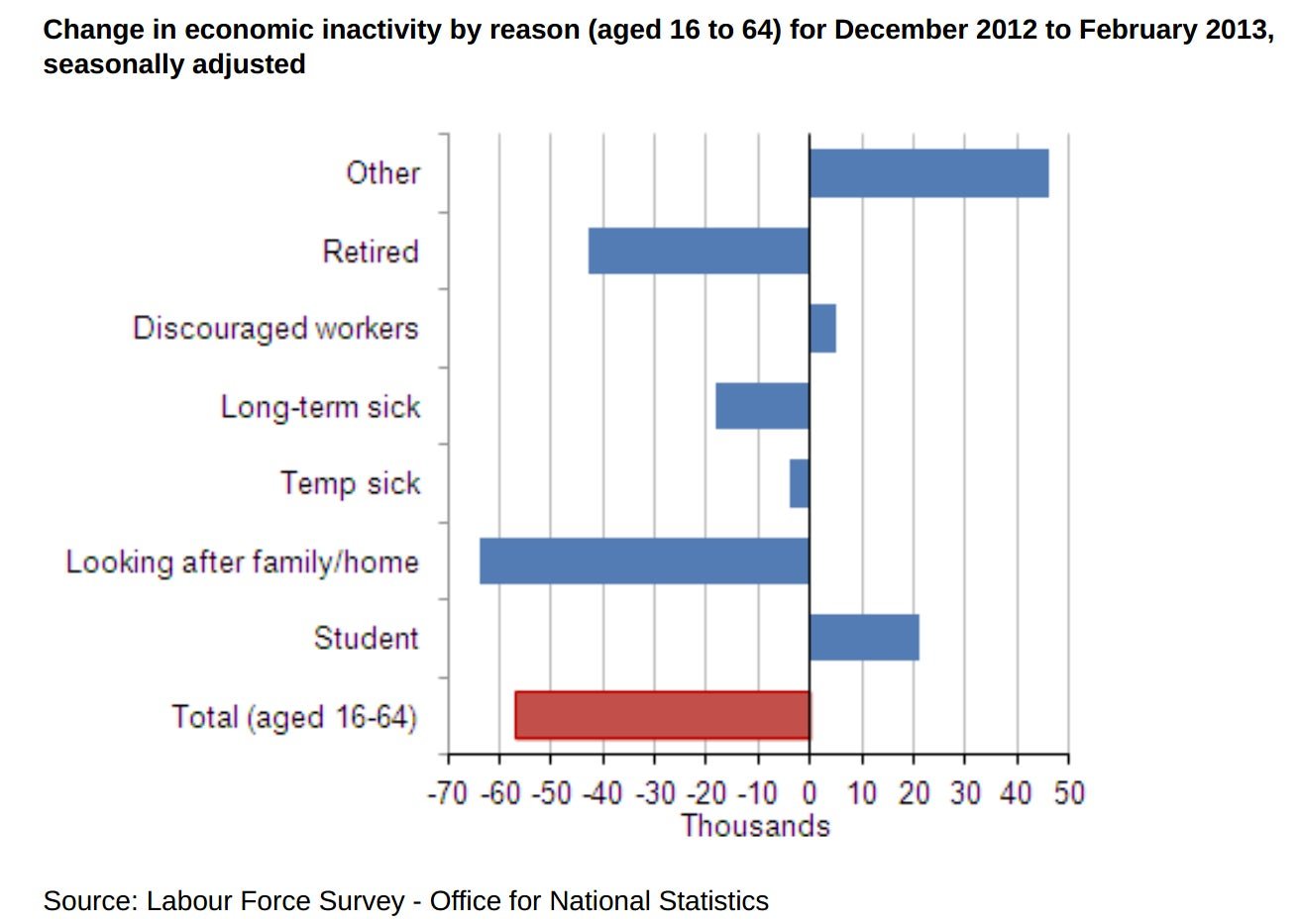

Another mixed signal comes in the labor market data out today (which covers January and February, but not March), which show a small uptick in the unemployment rate, putting it at 7.9%. That sounds potentially bad, but it might not be. The ONS attributes this to more people rejoining the workforce (pdf), as 57,000 fewer people were declared “economically inactive” in the three months that ended in February, compared with the prior three months. At 8.95 million, the number of economically inactive Brits is at its lowest since 2006. Here’s how those changes look: