Today’s earnings will tell whether Amazon will still be more expensive than Netflix

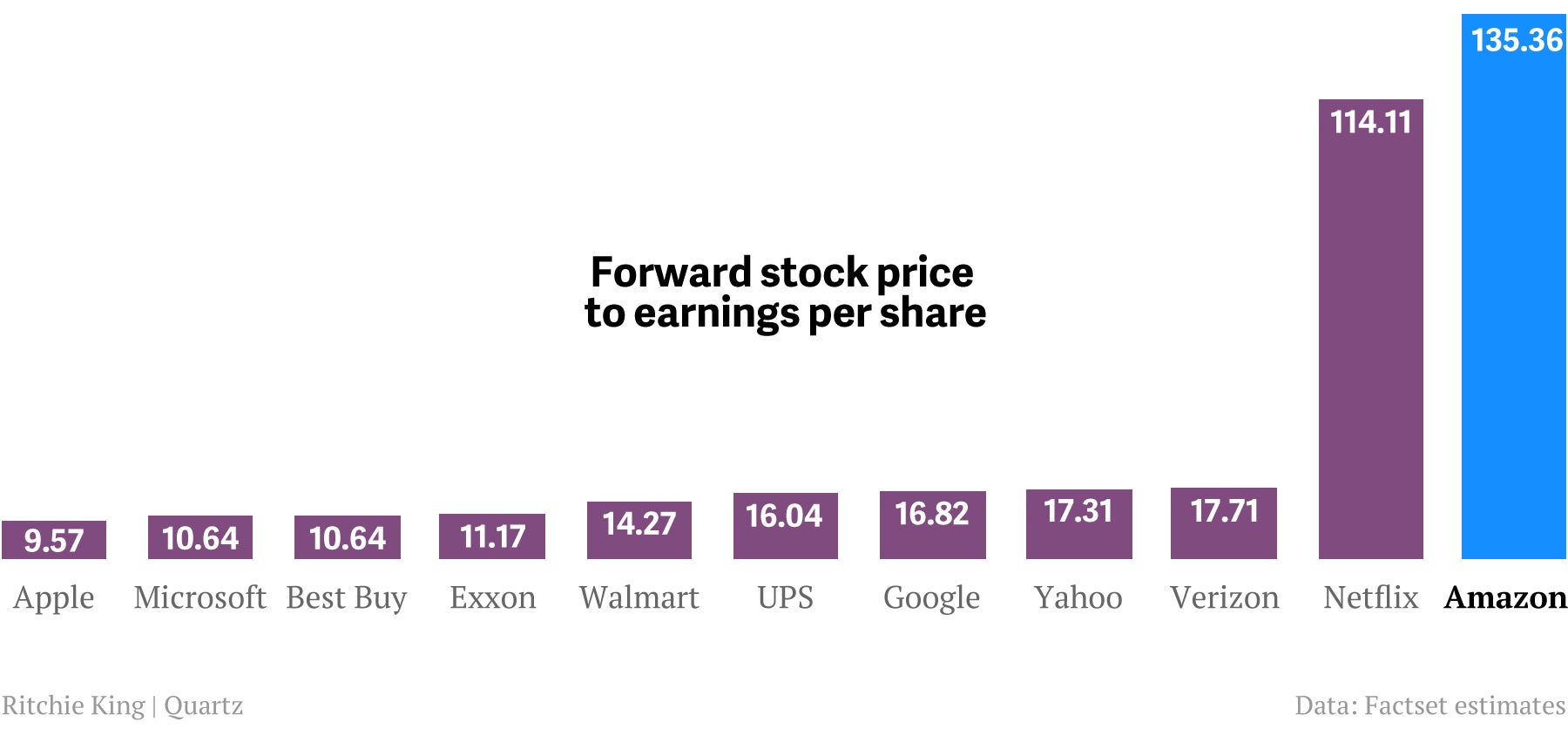

With traditional Wall Street favorites like Apple falling on hard times, Amazon is one of the darlings du jour for investors. It also looks like it will continue to be one of the most expensive stocks on the S&P 500, according to its ratio of forward stock price to earnings per share as calculated by FactSet. The guidance Amazon provides later today when it reports its earnings will show whether that will hold true. A big ratio means investors expect higher earnings growth in the future. It’s also a measure of how richly or cheaply a company is valued.

With traditional Wall Street favorites like Apple falling on hard times, Amazon is one of the darlings du jour for investors. It also looks like it will continue to be one of the most expensive stocks on the S&P 500, according to its ratio of forward stock price to earnings per share as calculated by FactSet. The guidance Amazon provides later today when it reports its earnings will show whether that will hold true. A big ratio means investors expect higher earnings growth in the future. It’s also a measure of how richly or cheaply a company is valued.

According to the current figures, Amazon will be slightly more pricey than Netflix and salesforce.com. And Amazon is expected to be way more expensive than other behemoths like Apple, Google and Walmart. Some of these companies are trying to hone in on Amazon’s turf, with same-day deliveries and other services. In the meantime, the online retail giant is also looking to expand its offerings, including a television set-top box that will allow customers to stream video over the Internet onto their TV.

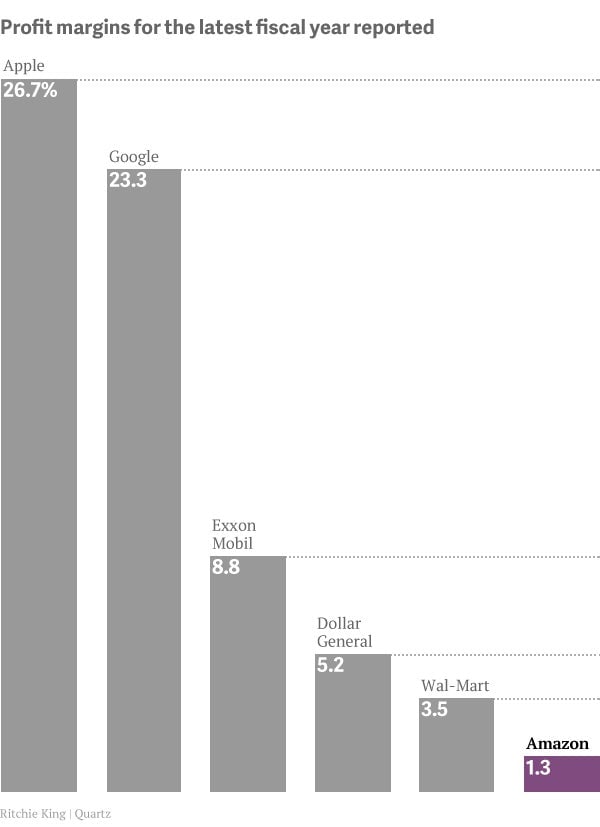

Amazon’s P/E ratio is all the more striking when you look at its profit margin compared to some of these same companies, as we did in January based on its full-year 2012 results: