Everything you need to know about the student borrowing bubble in 17 charts

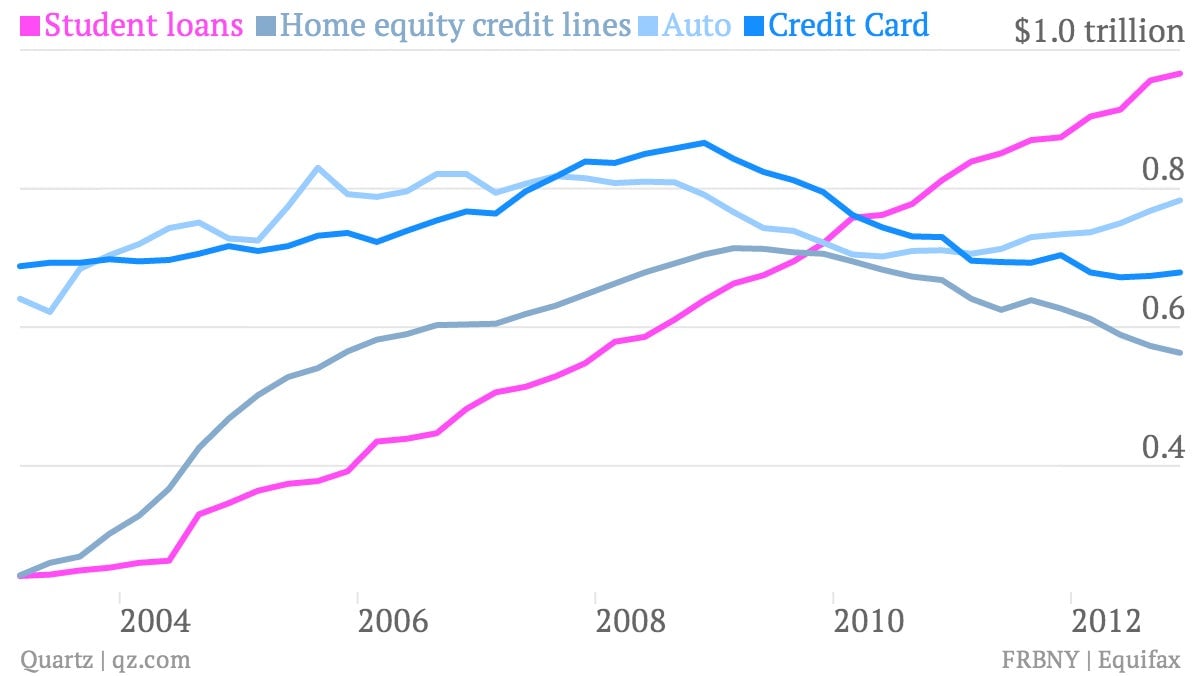

Americans have tempered their appetite for debt in the aftermath of the financial crisis, except when it comes to student debt. Over the last few years the outstanding amount of US student debt has surpassed the stock of automotive, home equity lines of credit and credit card debt. With just shy of $1 trillion in student loans outstanding, mortgages are the only form of debt Americans have more of.

1. What great de-leveraging?

- Americans have tempered their appetite for debt in the aftermath of the financial crisis, except when it comes to student debt. Over the last few years the outstanding amount of US student debt has surpassed the stock of automotive, home equity lines of credit and credit card debt. With just shy of $1 trillion in student loans outstanding, mortgages are the only form of debt Americans have more of.

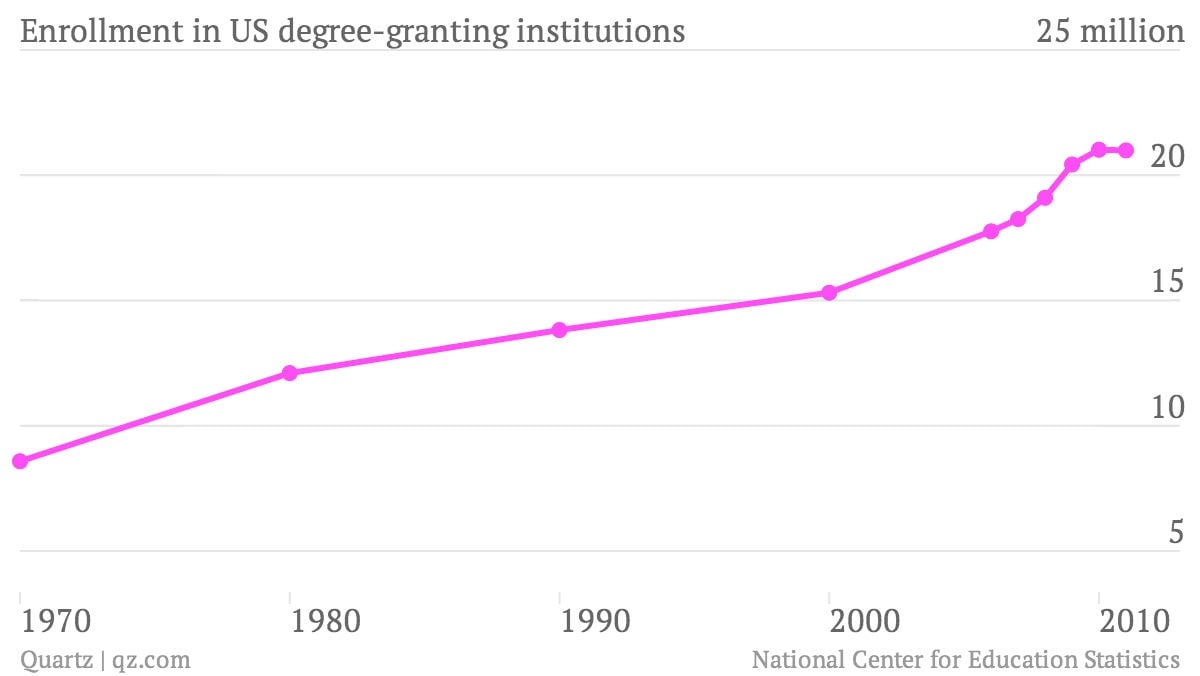

2. More students

- Part of that is simply because more people are going to college, a long-term trend in the US.

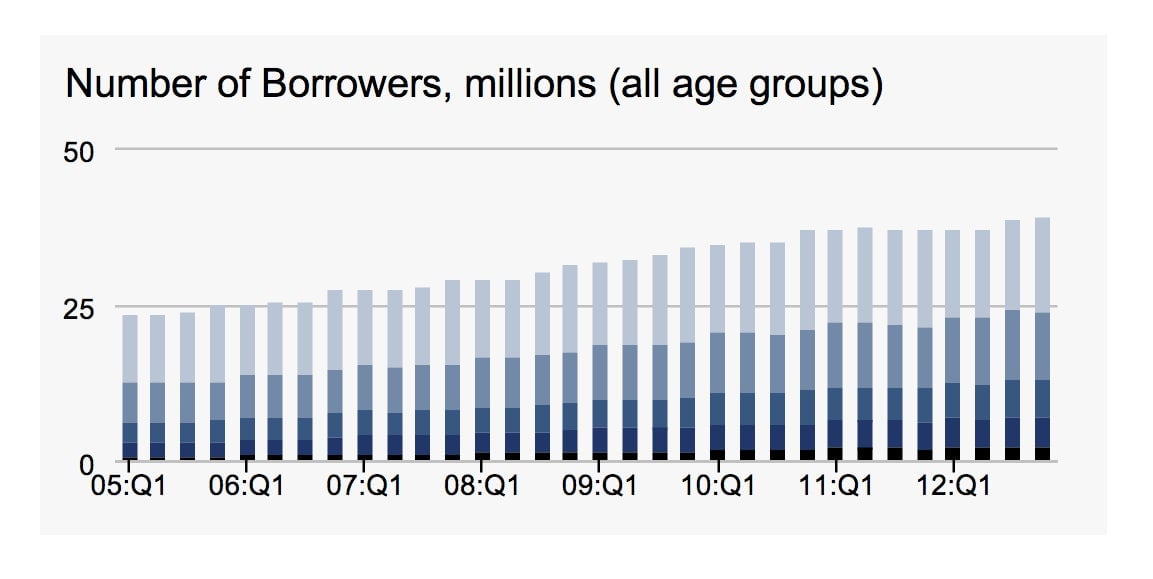

3. More debt

- On top of that long-term trend, when the great recession hit, many had difficultly finding work and instead returned to school to burnish their skills and wait out the worst of the downturn. And plenty took on debt to do it. As a result, the number of people carrying student debt has been moving steadily higher, the New York Fed reports.

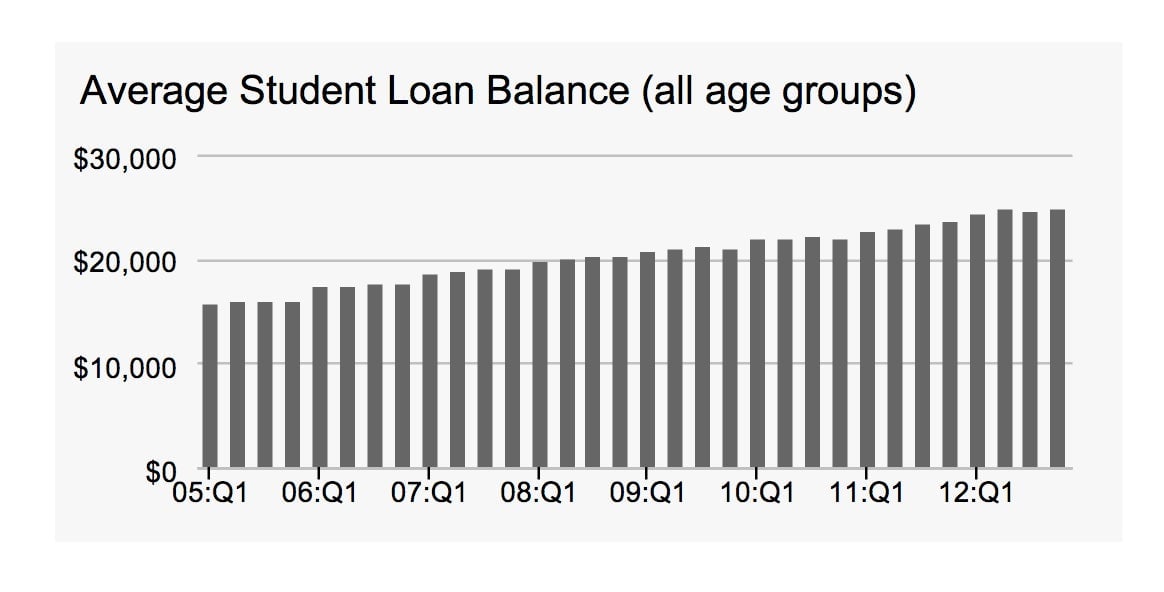

4. More money

- But it’s not just numbers of people that’s pushing student debt higher. The average amount of student debt these people are taking on is growing too.

5. So why is that?

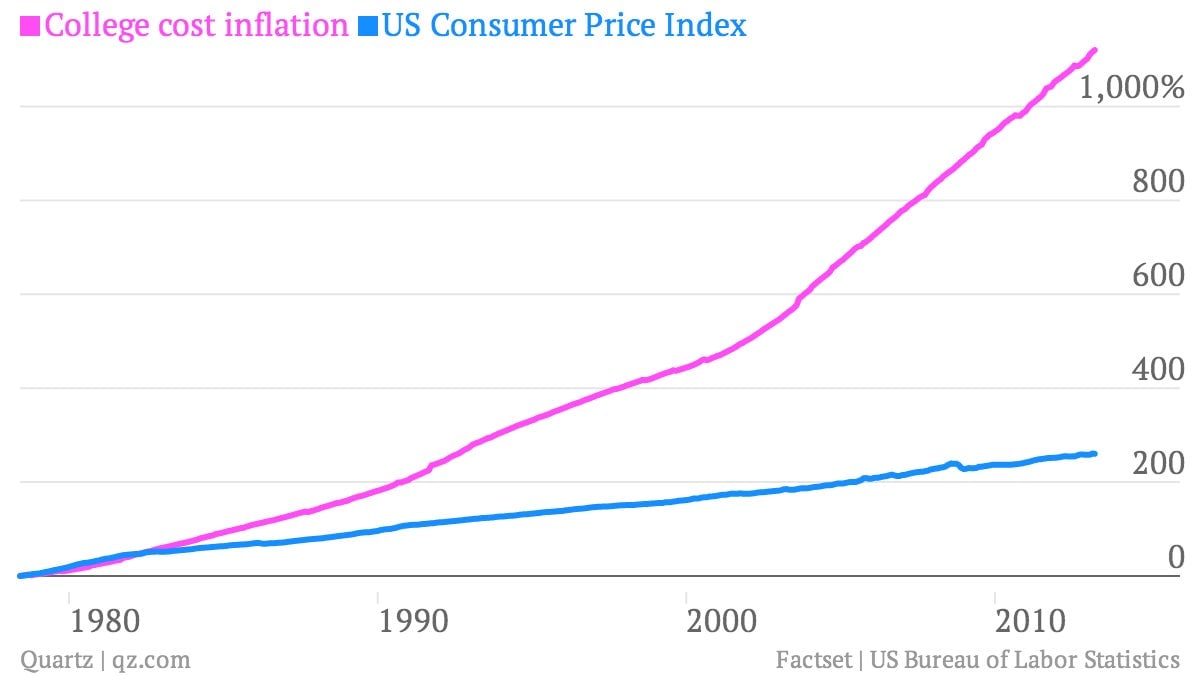

- The cost of college tuition has been rising stupidly fast in the US. Over the last 35 years, it’s up more than 1,100%. During the same period, the Consumer Price Index—a broad gauge of the level of prices in the US—is up about 260%.

6. A new reality

- So, student debt is becoming a much more common fact of life for young Americans, with some 43% of all 25-year-olds carrying student debt at the end of 2012. Just eight years ago it was 27%.

7. Don’t freak out

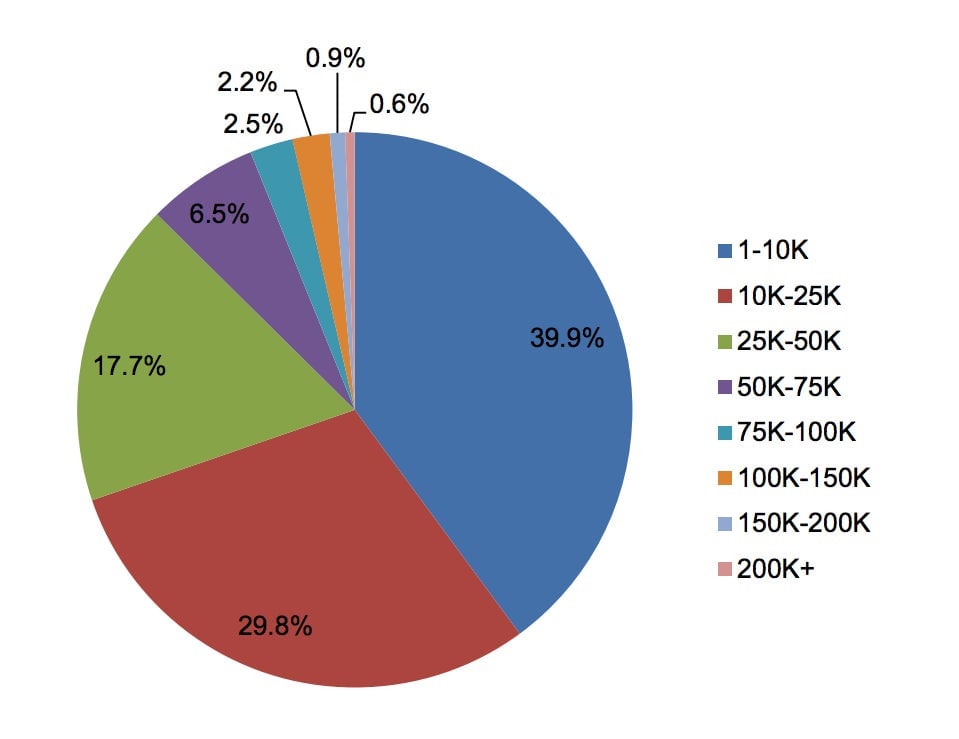

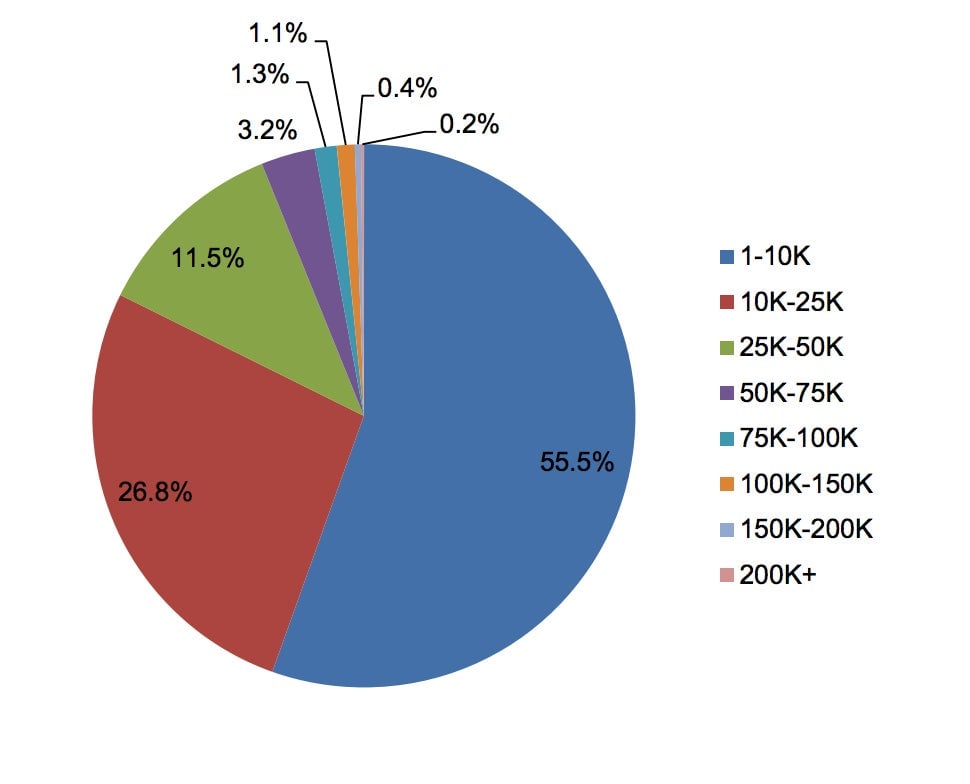

- It’s true that more people have student debt. And it’s also true that the average debt load has been moving higher. But it’s important to keep in mind that the vast majority of those with student debt don’t have tons of it. Here’s a look at the breakdown at the end of last year, from the Federal Reserve Bank of New York.

8. That said…

- Larger chunks of debt are clearly becoming more common. Here’s a look at the same chart, from back at the end of 2005. You can see that a lot more people have debt loads of $10,000 or more now, with a lot of growth in those with debt between $25,000-$50,000.

9. And …

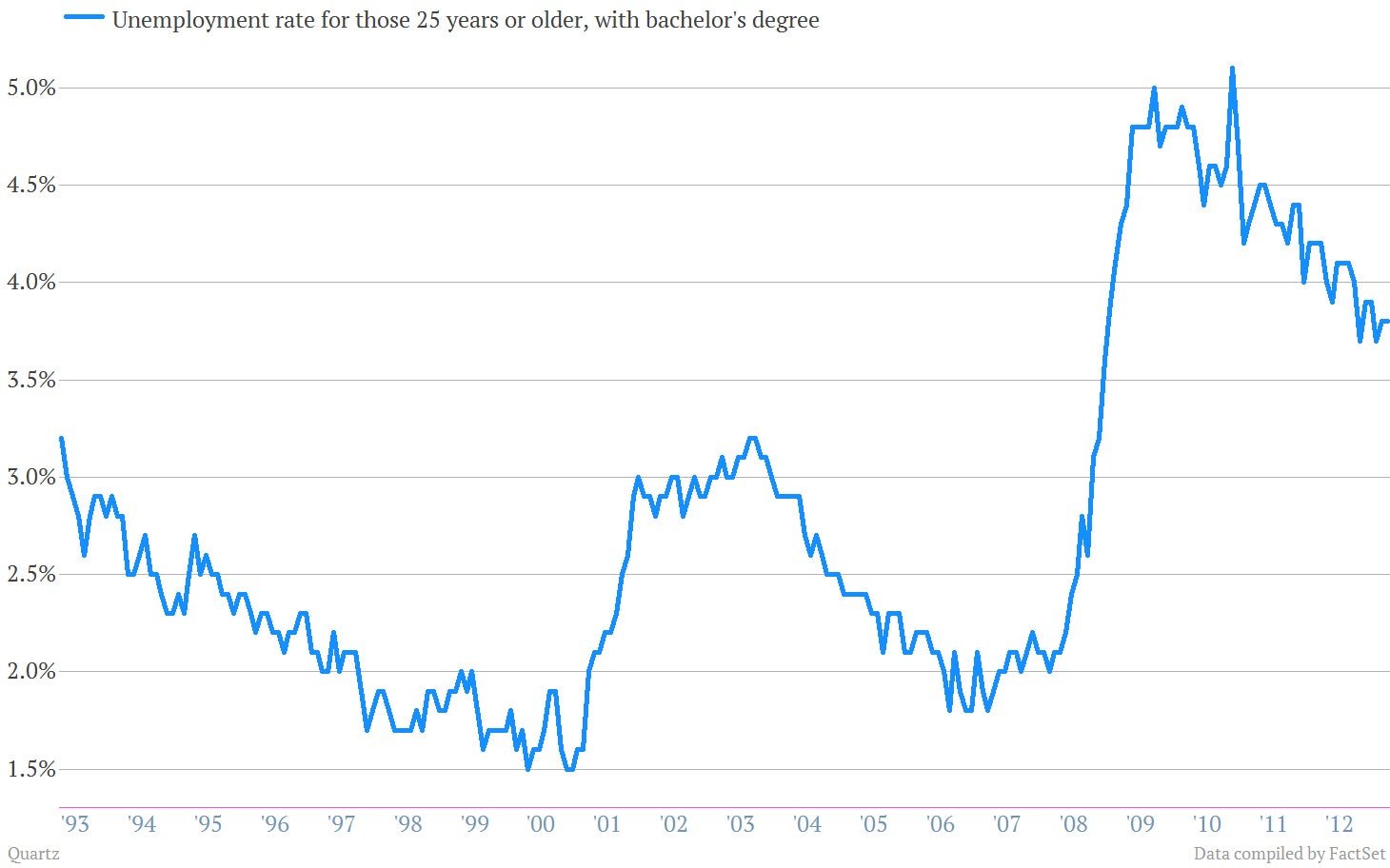

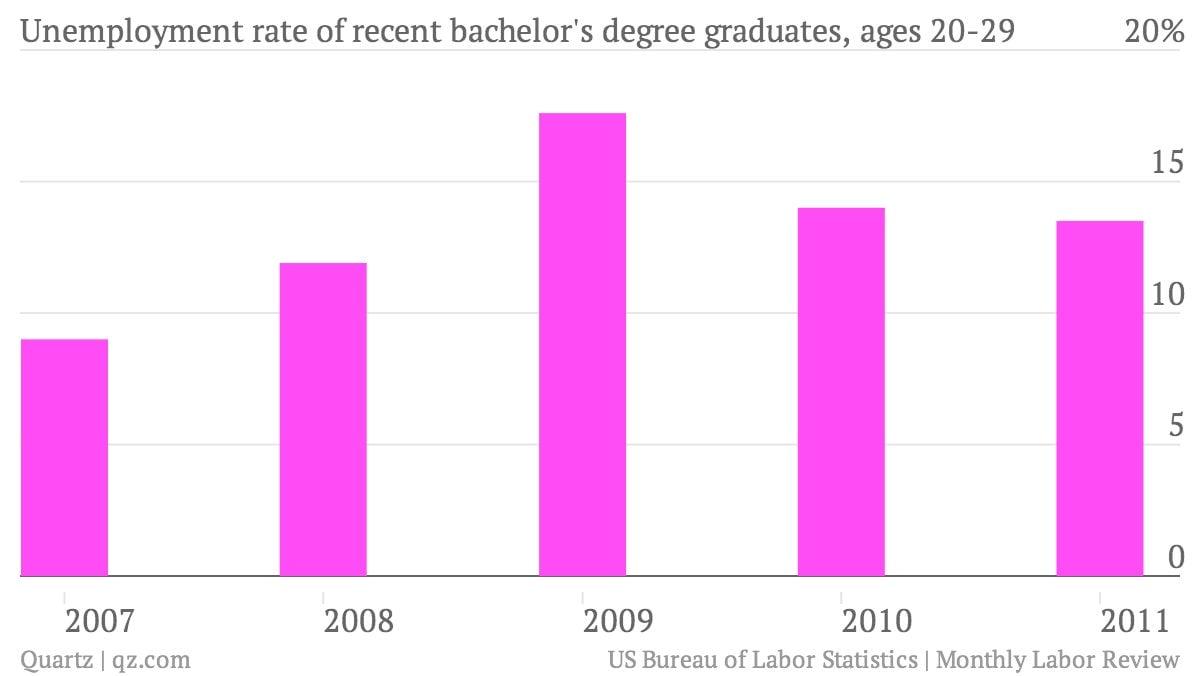

- Even a modest amount of debt can be too much if you can’t make the payment. For students leaving college during and after the great recession, things have been especially tough. For example, unemployment for college grads is still quite high by historical standards. (Although it’s much lower than unemployment for those without a college degree.)

10. But…

- That figure includes everybody over the age of 25. A February report on the job prospects of recent graduates showed higher rates of unemployment for those between ages 20 and 29. Researchers found that the cohort of people who graduated in 2011—either from graduate and undergraduate programs—had an unemployment rate of 12.6%. If you just look at those with bachelor’s degrees, it’s 13.5%.

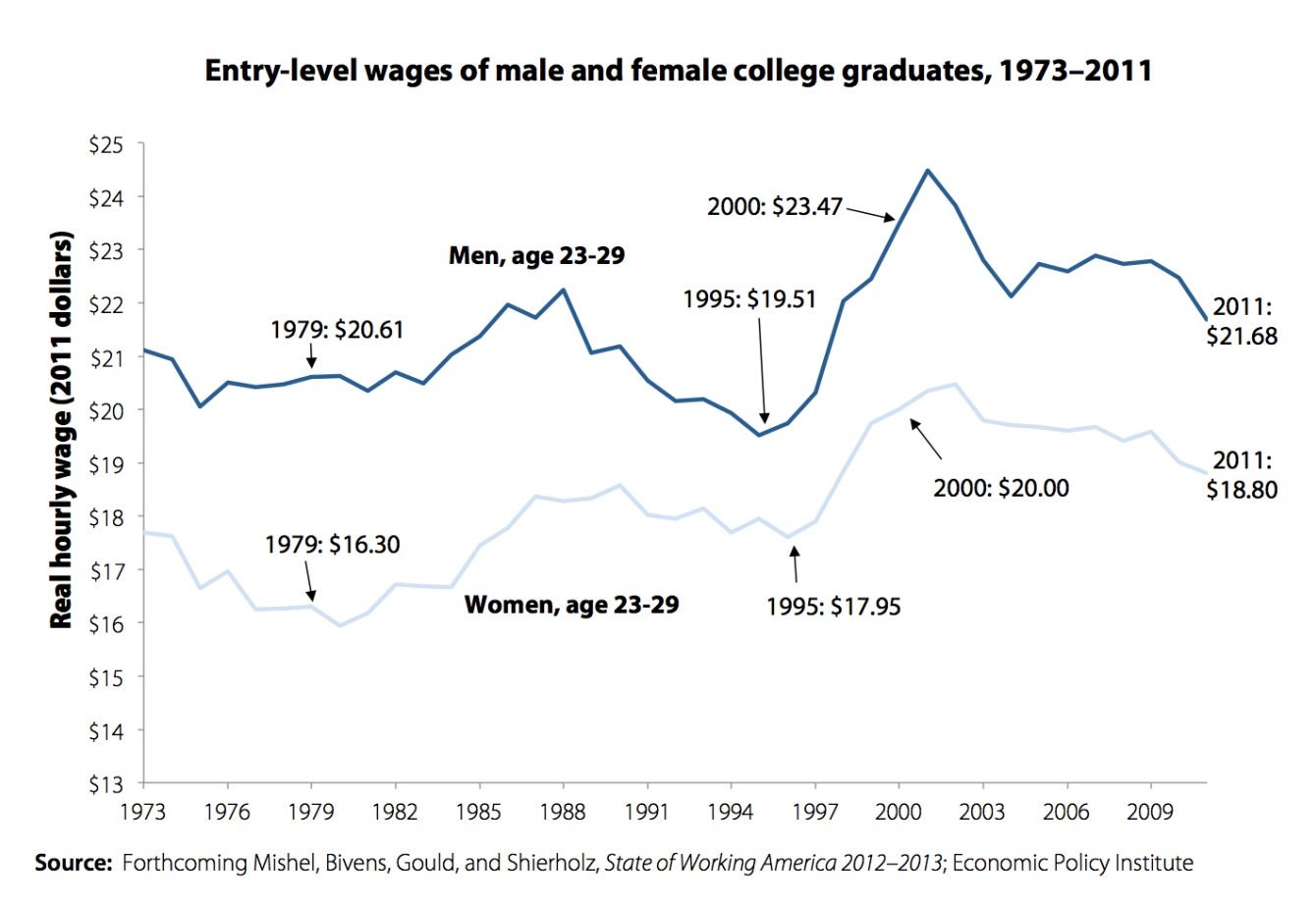

11. Not to mention…

- The ones who have jobs are earning less. Check out this chart, from a recent Economic Policy Institute report. (HT: Jordan Weissmann)

12. As a result, more student loans are starting to sour

- Here’s a look at the percentage of the outstanding balance of different types of consumer debt that are 90 days delinquent. You can see that student debt has ticked higher in recent months. And by the way, these numbers likely understate the extent of the problem since more than 40% of borrowers are estimated to be currently in a forbearance, grace or deferment period when payments don’t have to be made. In fact, researchers at the New York Fed say that the true rate of borrowers at least 90 days behind on their student loan payments is over 30%.

13. So is this the subprime crisis part II?

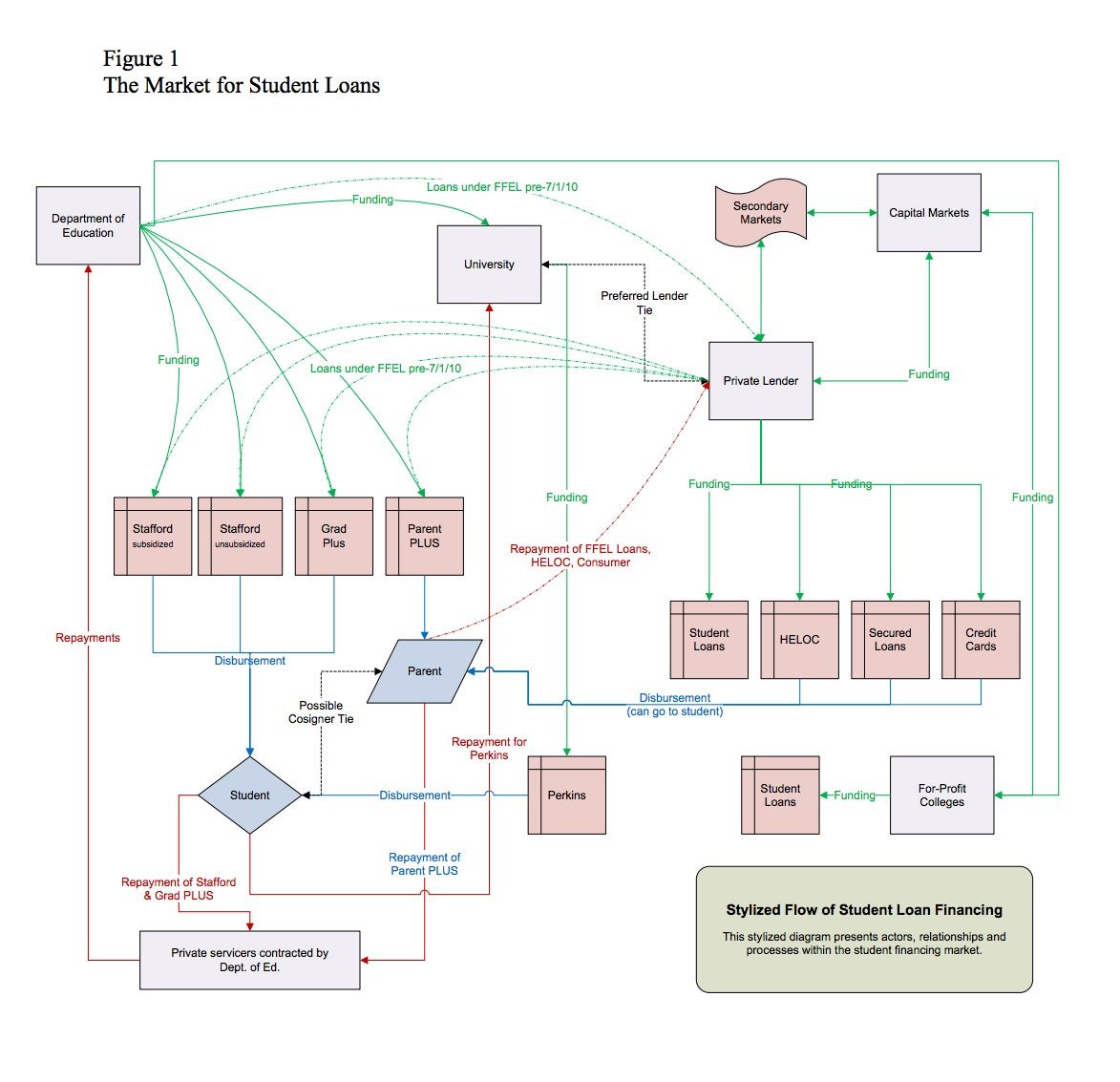

- No. It is true that the US student lending market looks complicated. And investors do buy packages of student loans that are somewhat similar to the mortgage-backed securities that nearly brought down the financial system.

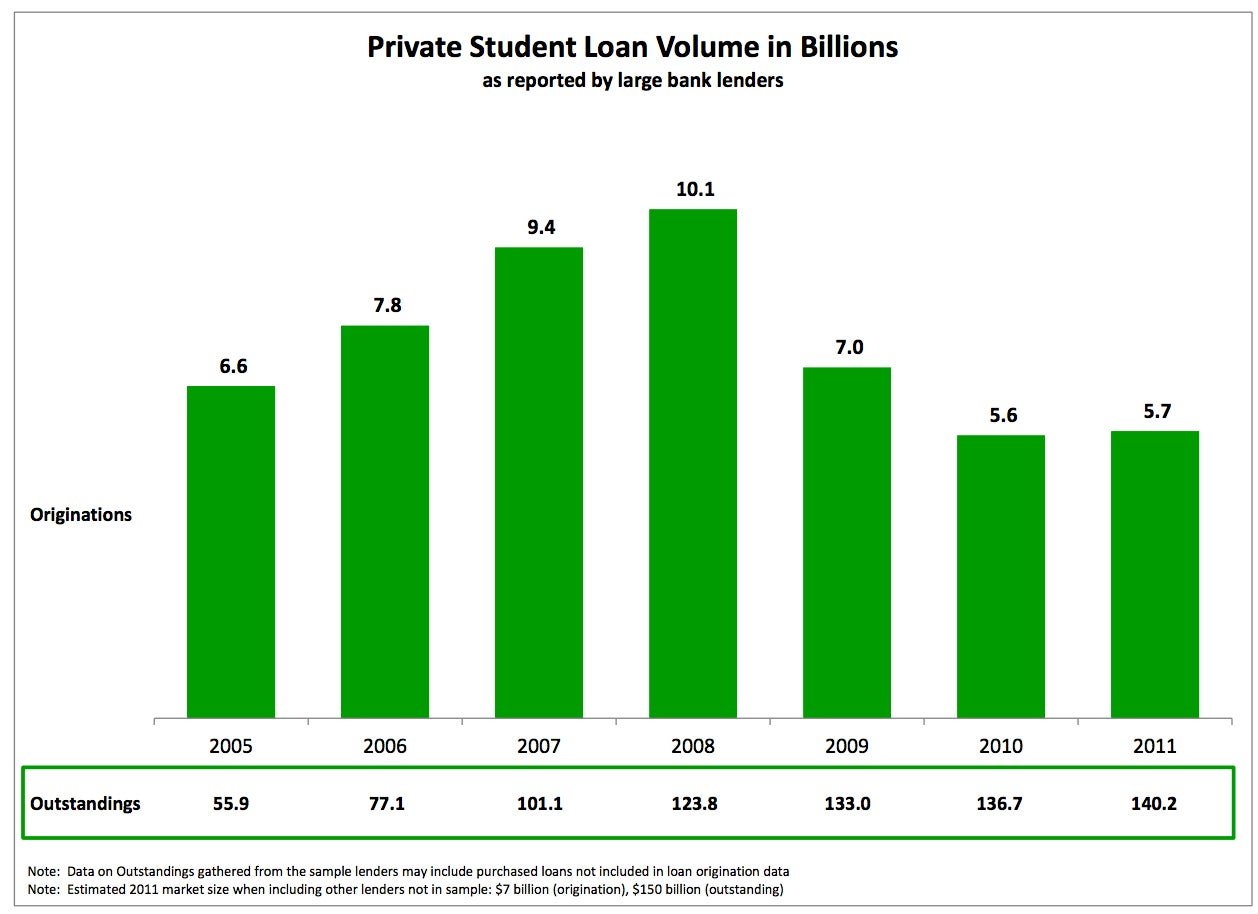

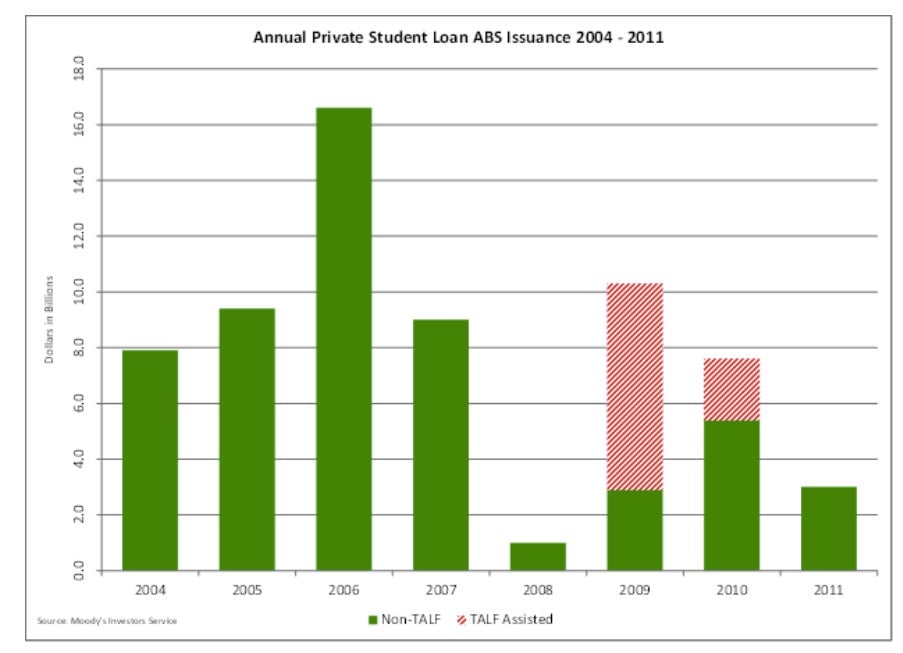

14. No Lehman

- But here’s the thing. The student loan market is tiny compared to the mortgage markets. Oh, and the US private student lending market kind of already did collapse—or at least contract sharply—during the financial crisis.

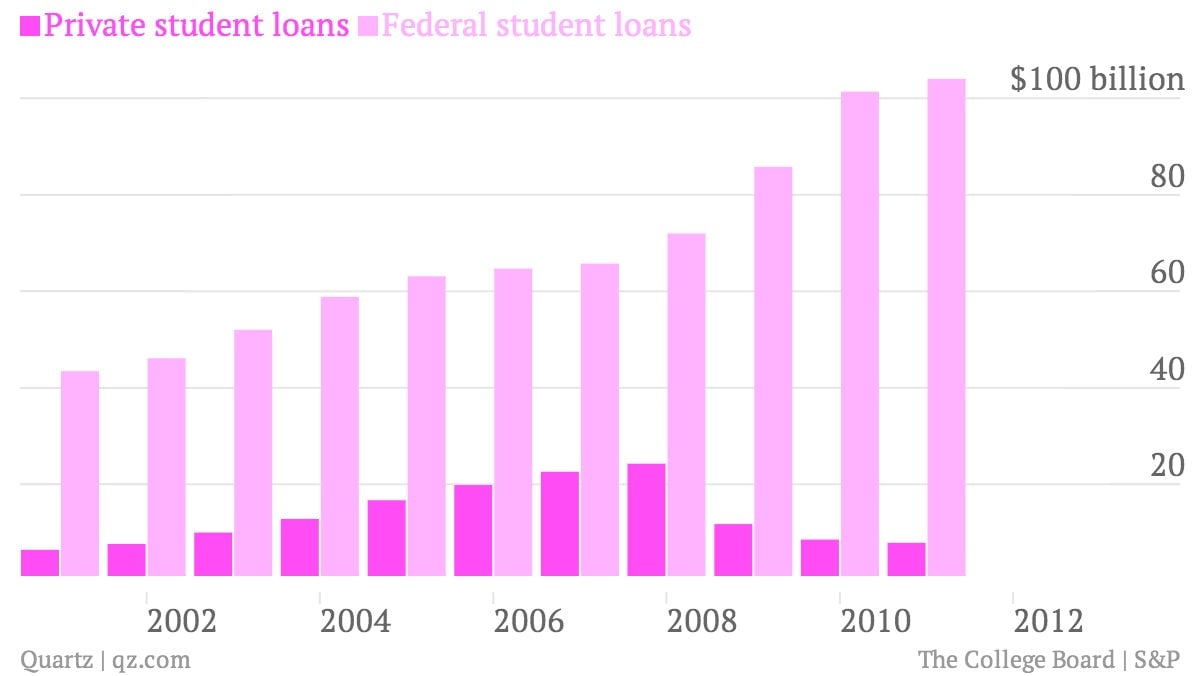

15. Uncle Sam steps in

- As a result, the US government now plays a larger role in student lending.

16. Seal of Approval

- Either by slapping government guarantees on packages of student loans made by private lenders.. That’s the red stuff in the chart below.

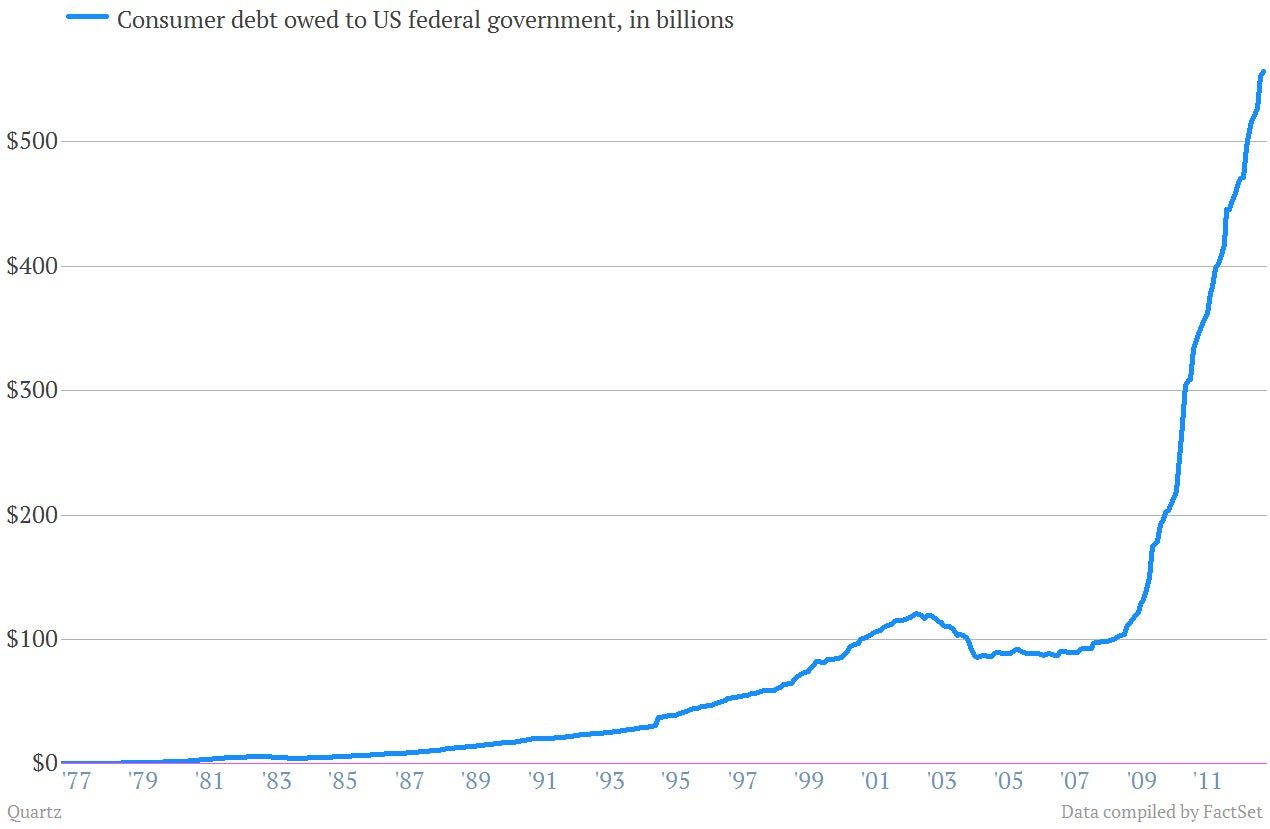

17. Cut out the middle man

- Or by lending directly to students. That’s the vast majority of the consumer debt that’s now owed to the US government, which has been skyrocketing lately. It may not be great for the US debt load. But it means there’s not going to be any unforeseen crisis that will swoop in and force Uncle Sam to shore up the market, because—well—he’s already done it.

So if it’s not going to cause another crisis, why should I care?

- You should care because the US economy runs on debt. And debt is a way of pulling future consumption into the present. Put simply, the insane cost of going to US colleges and universities is gobbling up too much of future spending power of college graduates, before they even get their first job. And that leaves less to be spent throughout their lives on things like cars, houses and vacations. In fact, we’re already seeing young student borrowers retreating from two cornerstones of the US economy—the home and car markets—according to researchers from the Federal Reserve Bank of New York. “While highly skilled young workers have traditionally provided a vital influx of new, affluent consumers to US housing and auto markets, unprecedented student debt may dampen their influence in today’s marketplace,” they wrote. The bottom line is that college graduates are supposed to the bright spot of the US economy, but runaway college costs are turning even them into a potential liability.