US pay growth is pathetic and expected to stay that way

American paychecks continue to look skimpy, according to the latest report on incomes and spending, which the US Commerce Department just shoved out the door.

American paychecks continue to look skimpy, according to the latest report on incomes and spending, which the US Commerce Department just shoved out the door.

The headline figure

Incomes rose 0.2% in March. That’s slightly better than forecast, according to Bloomberg. And it’s fair to say incomes are stabilizing after being whipsawed around in recent months by wrangling about the US deficit in Washington. That prompted a flood of special dividends and cash payments from corporations late last year. And because of that, those payments collapsed early this year, driving incomes sharply lower. But as you can see, things are getting back to normal.

Sub-2% raises

Adjusted for inflation, American wage growth still looks pretty weak. In March it clocked in at 1.9%. That’s better than the decreases seen during the worst of the recession and its aftermath. But it sure ain’t great. During the housing boom years, wage growth spent plenty of time above 3.5%. And during the 1990s, it was ridiculous, topping out above 8% in June of 1998.

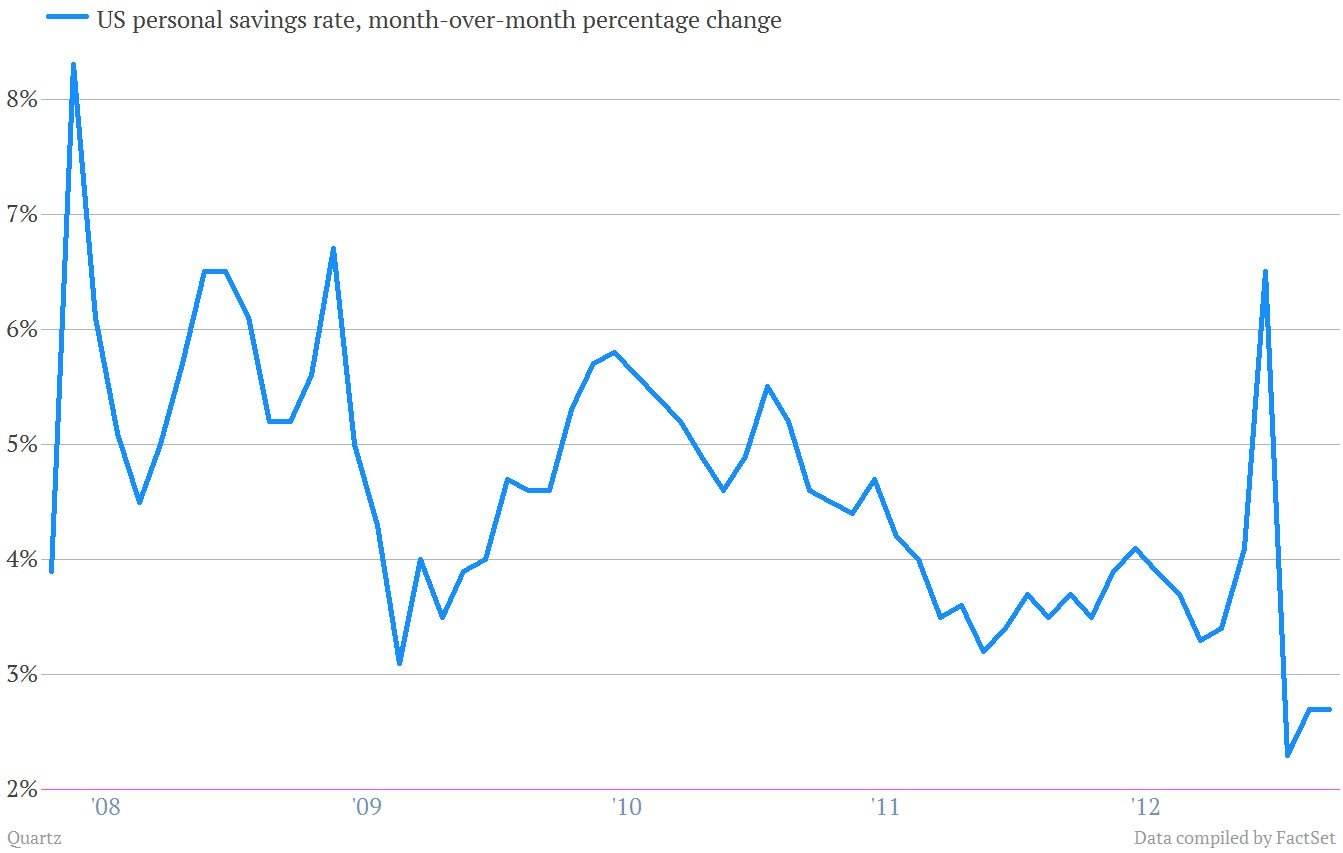

Savings? Hah!

That surge of dividends at the end of 2013 also briefly pushed up the US consumer savings rate, which has been moving steadily lower since the Great Recession gave Americans the financial scare of a generation back in 2008. But skimpy raises—and increased confidence to spend—have reasserted themselves in recent months, pushing US savings rates down to the lowest levels since back in 2007.

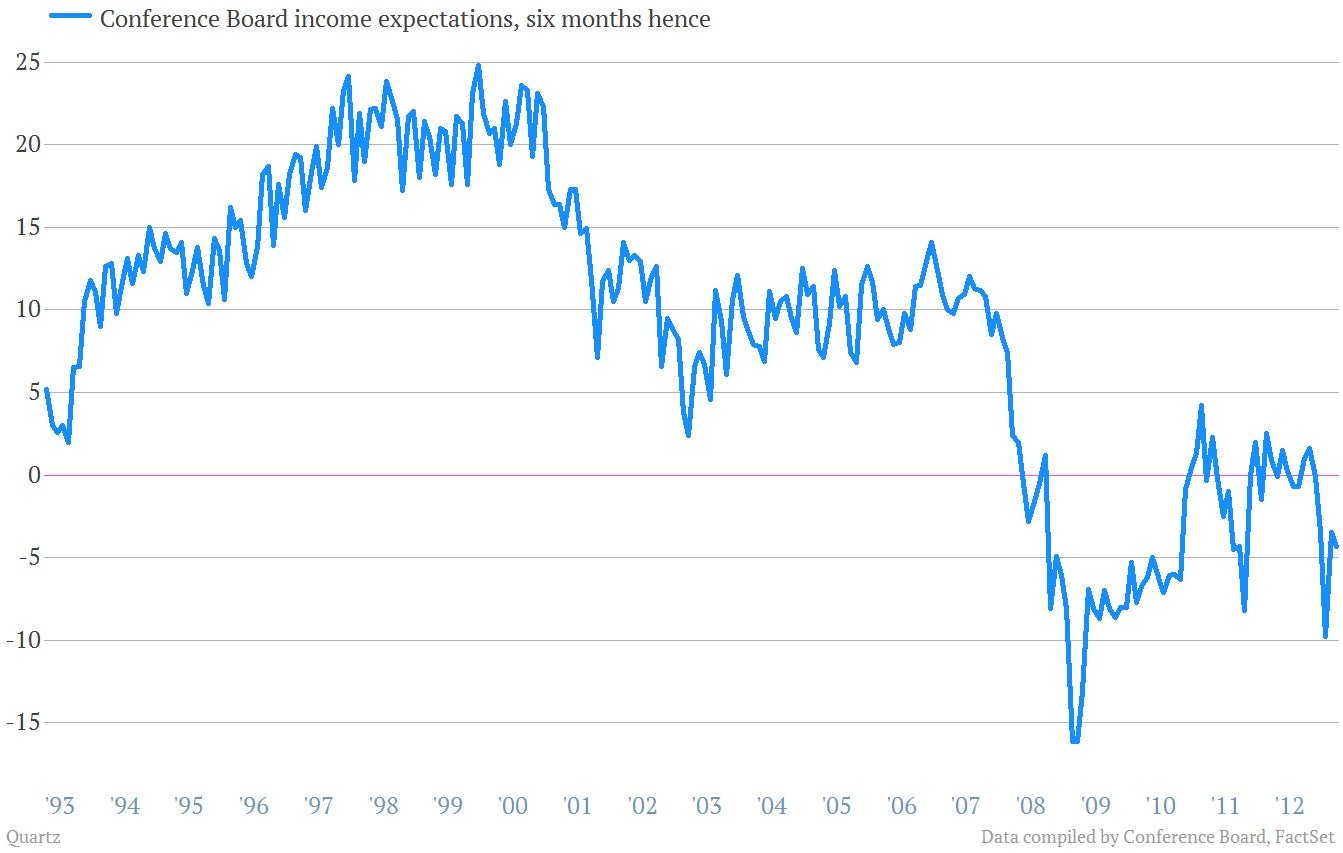

Little hope

And from the look of things, Americans aren’t especially optimistic about the prospects for higher pay anytime soon. Here’s a look at the Conference Board’s consumer confidence survey data on expectations for incomes. The percentage of respondents expecting their incomes to decrease in six months continues to exceed those expecting pay raises. Here’s a longer term look at how things have changed since the recession hit. It’s pretty striking.