Stagnant wages in the US may be because we’re getting old

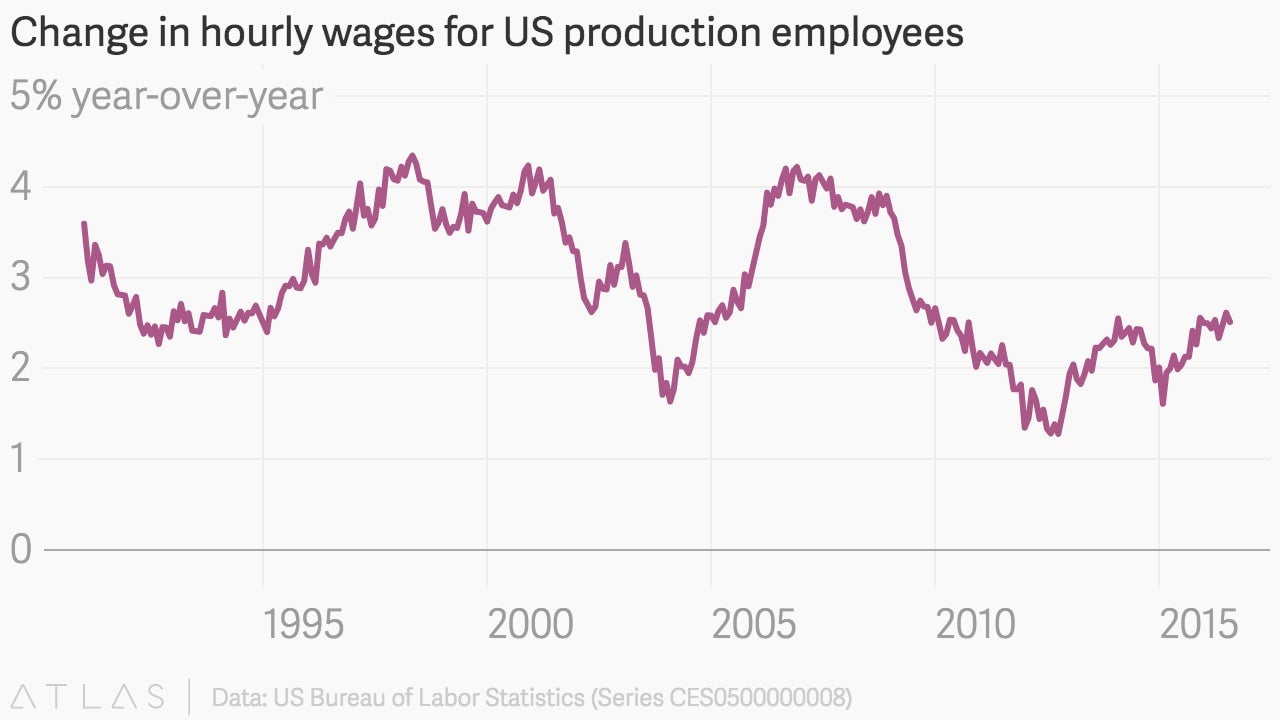

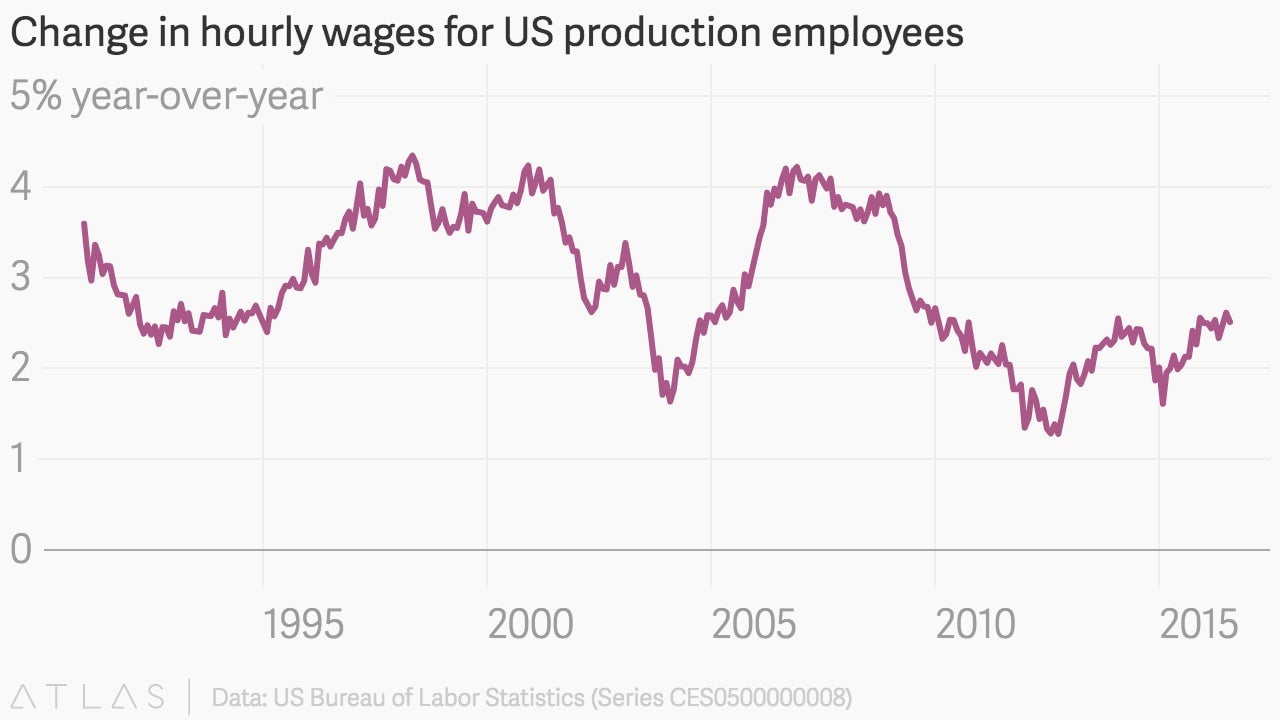

Sluggish wage growth in the US has been been a subject of much hand-wringing in recent years. Economists have suggested all manner of reasons for this slowdown, with the post-recession focus being on slack in the labor market—specifically an excess of part-time employees and gig workers. However, new analysis from the New York Fed suggests one more fundamental explanation: Americans are getting old, exiting the labor market, and dragging wage growth measures down for everyone.

Sluggish wage growth in the US has been been a subject of much hand-wringing in recent years. Economists have suggested all manner of reasons for this slowdown, with the post-recession focus being on slack in the labor market—specifically an excess of part-time employees and gig workers. However, new analysis from the New York Fed suggests one more fundamental explanation: Americans are getting old, exiting the labor market, and dragging wage growth measures down for everyone.

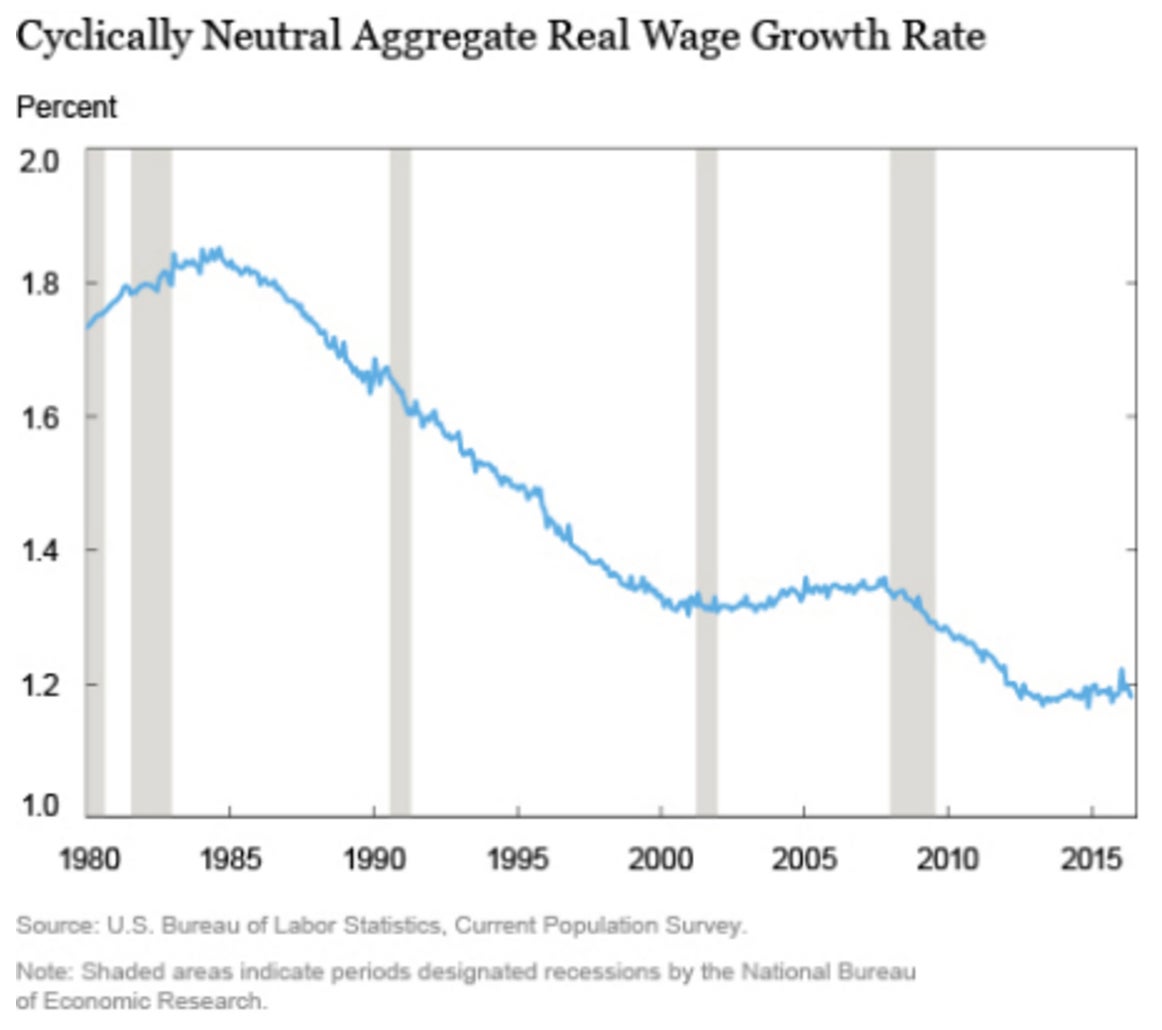

This is certainly not a new idea, but it’s a difficult thing to measure. In an post published on Liberty Street Economics, the blog of the New York Fed, three Fed researchers attempt to extract the the impacts of aging from all the other economic factors affecting wages. They conclude that in the 1980’s wage growth from aging peaked above 1.8%. Over the past thirty years that contribution has fallen by a third, to nearly 1.2%.

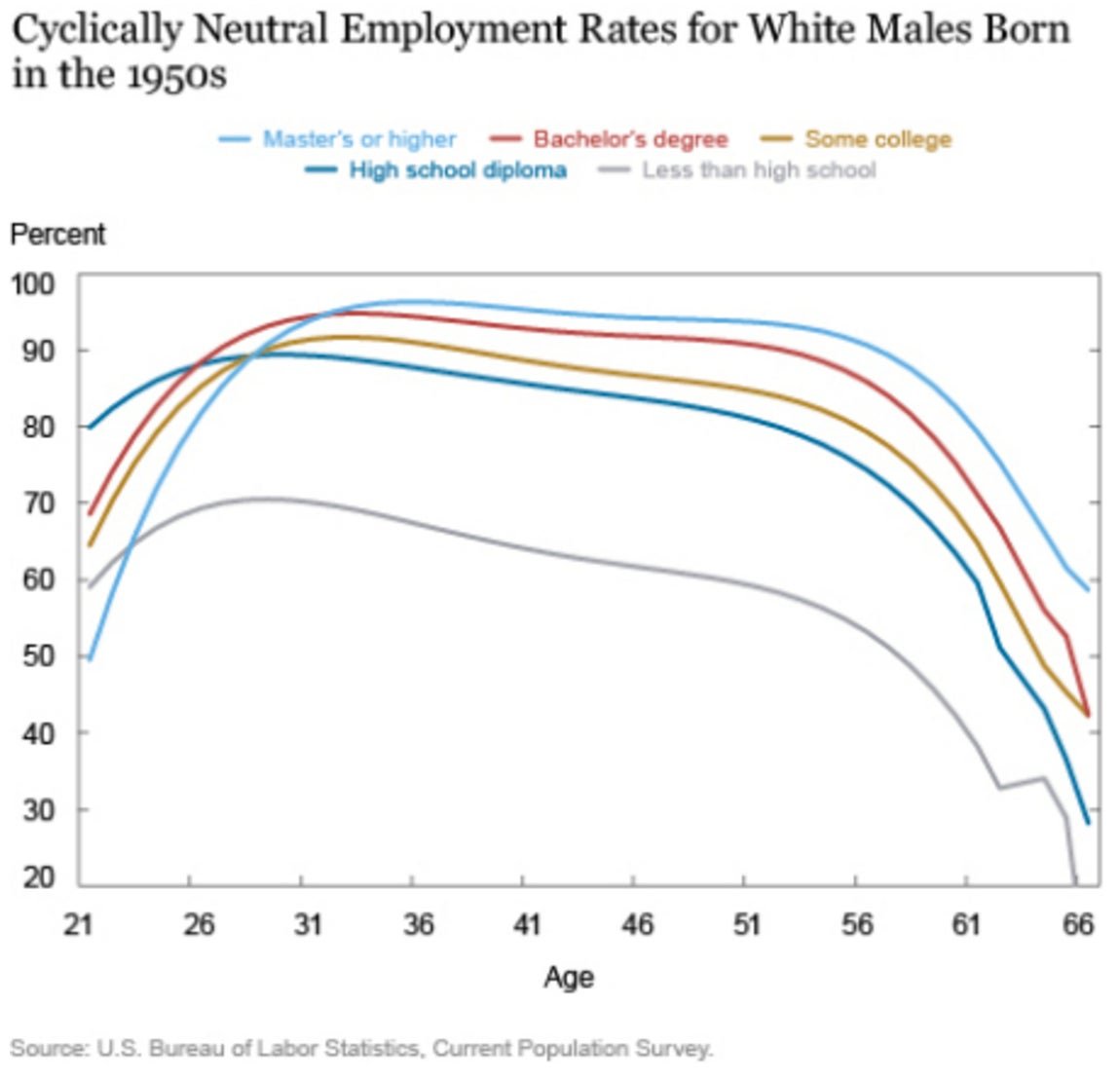

People who are born in the same year tend to enter and exit the workforce at approximately the same time. Those who are exiting tend to leave near the peak of their earnings. The precise arc of employment varies by race and education, but the trend is universal. The authors use white men—the most economically influential demographic group—as an example.

As the US population gets older, a huge number of high-earning workers are retiring—and being replaced by much lower paid entry-level, or part-time, workers. The authors conclude “the aging of the U.S. population will continue to act as a headwind to labor productivity and wage growth.” That may be a significant understatement: The U.S. Census Bureau projects that the median age of the US population will continue to rise through at least 2065.