BP is raking in roughly $7.7 million a day from its new stake in Rosneft

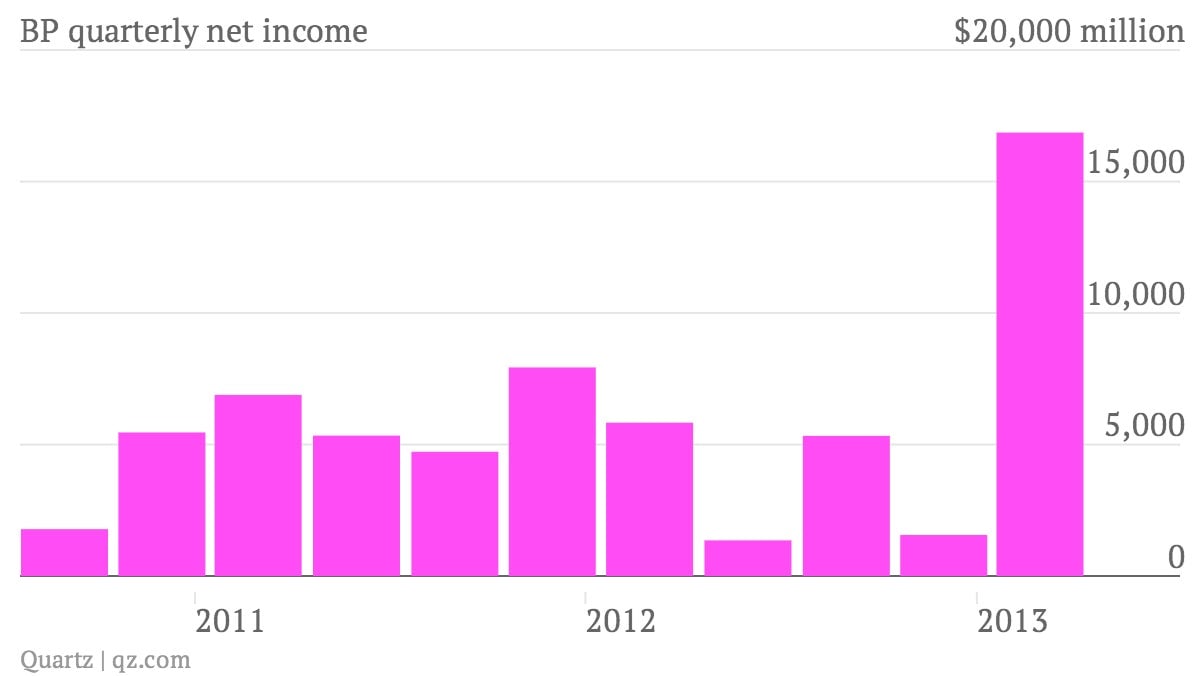

The numbers: Impressive. The British energy powerhouse rode last month’s sale of Russian oil company TNK BP to $16.86 billion in profit in its second quarter, nearly tripling from the same period a year ago. Revenue jumped 16% from last year to $107.21 billion. Gas production fell year-on-year, however, due in part to BP’s asset sell-off.

- The numbers: Impressive. The British energy powerhouse rode last month’s sale of Russian oil company TNK BP to $16.86 billion in profit in its second quarter, nearly tripling from the same period a year ago. Revenue jumped 16% from last year to $107.21 billion. Gas production fell year-on-year, however, due in part to BP’s asset sell-off.

- The takeaway: BP is making money, and lots of it. By selling its stake in TNK BP to Russian state-owned oil company Rosneft, BP earned $12.5 billion this past quarter alone. And there’s more still to come: As part of last month’s deal, BP also boosted its stake in Rosneft to 19.75%. BP is currently earning about $7.7 million a day from its nearly 20% ownership of the Russian oil giant, or $2.8 billion a year. Not a bad investment.

- What’s interesting: BP is on a diet. Selling its non-essential assets and amassing a nearly 20% stake in Russian state oil giant Rosneft has left the company with mounds of cold cash, but it’s also setting BP up for a leaner and more productive future. Could this be the new Big Oil model? ConocoPhillips spun off a handful of its assets last year, and has raked in a cool $12 billion in asset sales since the beginning of 2012. With two of world’s largest energy companies moving away from the traditional integrated approach in hopes of beefing up production and profitability, ExxonMobil could be left behind if it doesn’t follow suit.