This is why the market loves LinkedIn more than Facebook

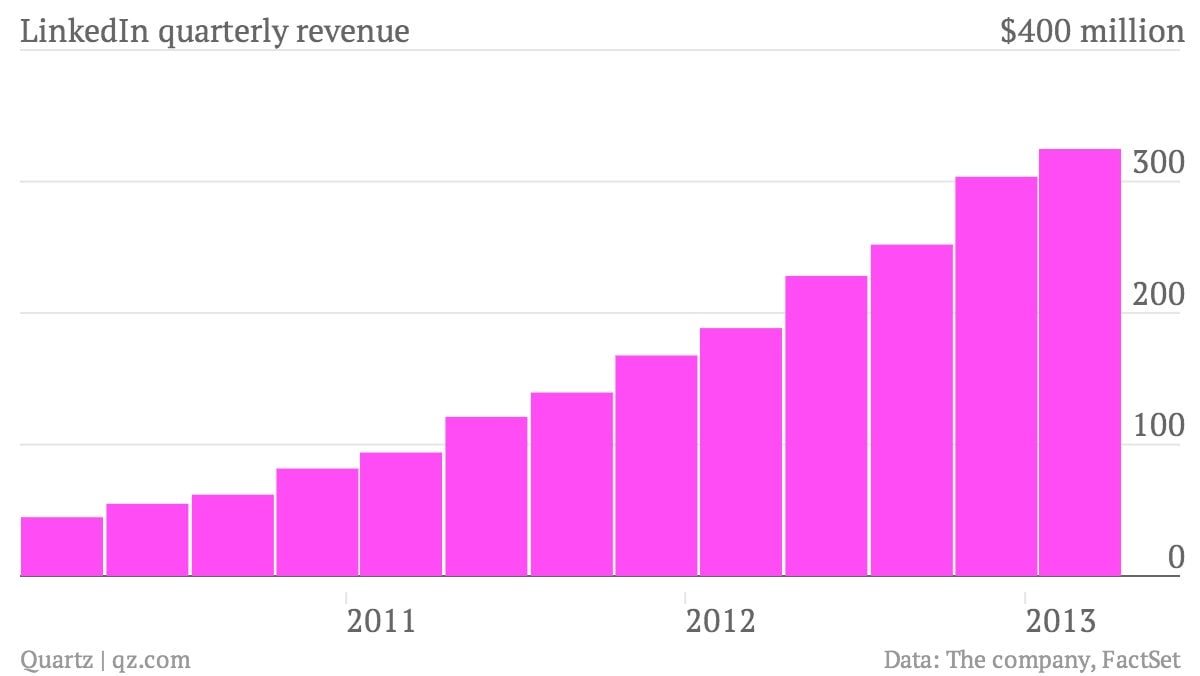

The numbers: Pretty good. Sales rose 72% over the same period of the prior year to $324.7 million. Profits rose to $22.6 million, up from the $5 million the company earned during the first quarter of 2012. But shares fell sharply, likely because the company’s forecasts for sales and profits in the coming quarters weren’t as high as some investors hoped.

- The numbers: Pretty good. Sales rose 72% over the same period of the prior year to $324.7 million. Profits rose to $22.6 million, up from the $5 million the company earned during the first quarter of 2012. But shares fell sharply, likely because the company’s forecasts for sales and profits in the coming quarters weren’t as high as some investors hoped.

- The takeaway: LinkedIn has become something of a social media darling of the stock market. Before the after-hours decline today, the stock was up about 76% this year alone. (For comparison, Facebook is up about 9%.) Why? LinkedIn has been able to deliver growth from three separate revenue streams: subscriptions from users, fees from corporate headhunters and recruiters and online advertising. The corporate business has been growing especially fast, with revenue up 80% during the first quarter. And that’s after 90% growth in the fourth quarter of 2012. The corporate recruitment business now accounts for 57% of LinkedIn revenue.

- What’s interesting: Advertising accounted for just 23% of LinkedIn revenues during the most-recent quarter. At Facebook, advertising is 85% of revenue. Oh, and LinkedIn generates a higher percentage of profit for shareholders than Facebook, in part, because it issued a much smaller number of shares than Mark Zuckerberg’s social networking behemoth.