Germany’s industrial output was surprisingly solid, but it’s too early to hail it as a sign of recovery

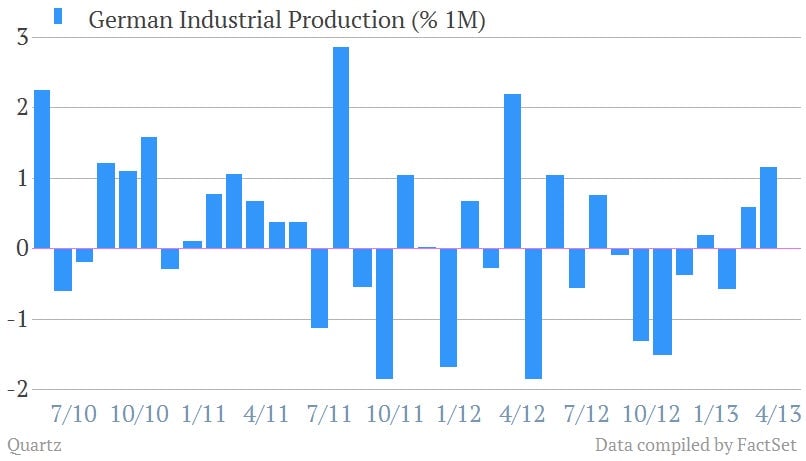

Germany may be on the mend. Industrial production grew 1.2% month-on-month in March; analysts had expected a contraction. Energy output drove a lot of this: It was 4.0% higher than in February, which itself had been 0.8% up on January. And that’s after inclement weather in March suppressed construction activity, which should therefore make up ground in April. Here’s a look at the month-on-month trend:

Germany may be on the mend. Industrial production grew 1.2% month-on-month in March; analysts had expected a contraction. Energy output drove a lot of this: It was 4.0% higher than in February, which itself had been 0.8% up on January. And that’s after inclement weather in March suppressed construction activity, which should therefore make up ground in April. Here’s a look at the month-on-month trend:

However, look at the same trend year-on-year, and the comparison suddenly looks rather less fantastic:

That’s why some analysts think Germany’s recovery is still in “maybe” territory. Other annual comparisons look grim as well. For instance, domestic orders for machinery and equipment plummeted 15% year-on-year in March. That’s the biggest decline since August. And that points to the corrosion of domestic demand that, while way worse in other euro zone countries, is starting to eat away at Germany’s economic fundamentals now too.

Another cause for a cautious reading of March industrial production is the figures that have come out so far for April. Even as export demand has stayed relatively firm, domestic demand continues to drag on growth. And the preliminary Markit purchasing managers’ index for April suggests a contraction in industry for the first time in five months (pdf, link in German). Put that all together, and the outlook on Germany’s recovery looks hazy indeed.