A day of reckoning is coming for the global commodities glut

The best investment idea at Ira Sohn 2013 could be all about shorting everything that’s associated with the voracious Chinese demand for commodities, a symptom of policies that attempted to quell–but really just put on hold–the effects of the financial crisis.

The best investment idea at Ira Sohn 2013 could be all about shorting everything that’s associated with the voracious Chinese demand for commodities, a symptom of policies that attempted to quell–but really just put on hold–the effects of the financial crisis.

Stanley Druckenmiller, former managing director of Soros Fund Management, said commodity producers were fooled in 2008, when the Chinese government injected 4 trillion yuan (at the time, $586 billion) in stimulus into the Chinese economy. That created a false demand for goods and for the raw materials to make them.

But the effects of expanding credit have only been skin deep. “It’s taking a greater amount of credit growth to generate an extra point of GDP,” Druckenmiller explained. A decline in efficiency is coupled with changing government policy. “2008 was the last gasp of an old regime…the new regime is all about eliminating imbalances,” like excessive and unsustainable bank debt.

Commodities producers ramped up production, believing that the global economy was in full-blown recovery mode and that the sudden demand from China was certain to last. Now, with growth slowing in China and demand sluggish in the rest of the world, too many commodities are being produced for the amount of goods the global economy can handle.

That has a negative effect both on commodity prices and on the valuation of companies and countries that produce them. “We think the supply-demand combination for commodities is deadly,” Bruckenmiller said.

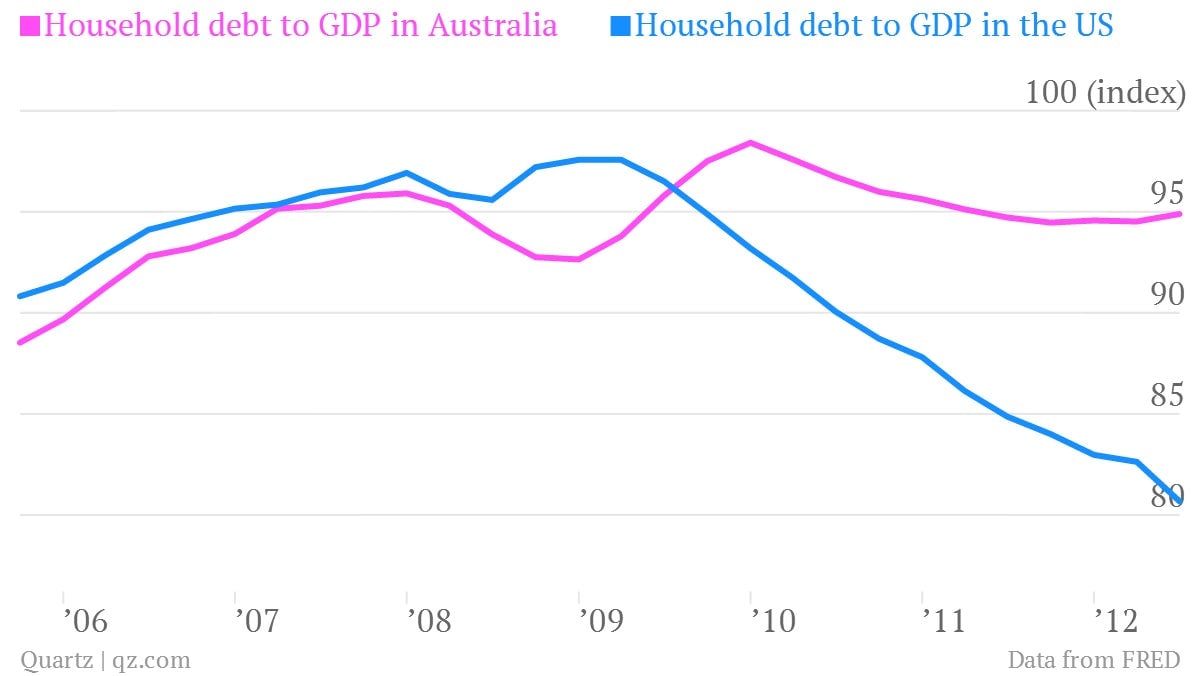

Just take Australia, which is highly dependent upon commodity demand, particularly in regards to China. The Australian economy grew through the financial crisis, and markets didn’t impose some of the same discipline there as they did in other markets. But that’s created asset bubbles and a currency so strong it’s been damaging to the economy.

It’s no surprise, then, that Australia’s central bank has begun to shadow the moves of its Western peers. On May 7 the central bank cut rates in an attempt to weaken the strong Australian dollar, and is likely to cut interest rates further. “We think the Australian dollar, which you saw was hanging up relative to the commodity index, will come down and come down hard,” Druckenmiller told investors.

In essence, the shake-out Druckenmiller is predicting is just a delayed reaction to the global financial crisis. Commodity producers, Australian consumers and China may have escaped the immediate effects of the downturn, but according to Druckenmiller, the global reckoning is right around the corner.