Nigeria has tried a range of strategies to stem a trouble currency slide as well as manage its mounting economic crisis. The latest strategy could see it jail its own citizens.

The Central Bank of Nigeria (CBN) is looking to amend laws that regulate the local foreign exchange market. As part of its proposals (pdf), CBN is seeking extra powers to allow it “seize” foreign currencies in instances “where money is imported to sponsor terrorist activities or any other subversion activities to undermine the security of Nigeria.” But that request could be viewed as a cynical move to allow the bank, and the government, access funds in domiciliary accounts of private citizens in the name of national security.

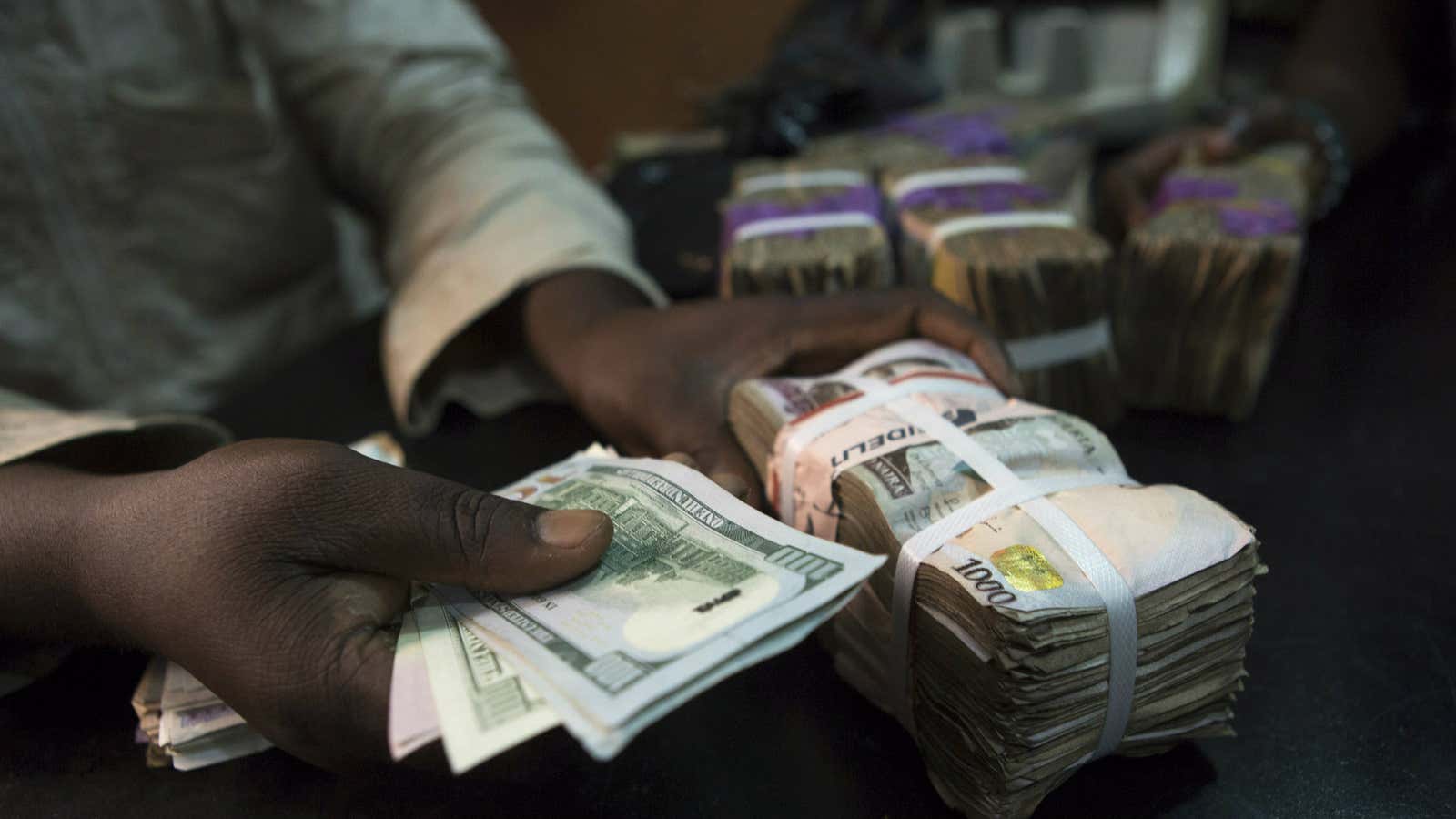

The key challenge for the Nigerian regulators is there continues to be a wide gap between CBN’s official exchange rate of around 305 naira to the dollar and the parallel markets’ street value of between 390 naira to 410 naira. It has created both uncertainty and a shortage of dollars in the system as investors and individuals sit on the sidelines to see how far the naira will fall.

Should this amendment bill be passed, a likely outcome will be Nigerians with domiciliary accounts will withdraw and hold foreign currencies in cash, rather than risk being forced to change money at government rates with better prices available on the parallel market. To discourage that outcome, the Central Bank has proposed a two-year jail term or fine for anyone in “possession” of foreign currency “without depositing same in a domiciliary account within 30 days of its acquisition.”

Been here before

This isn’t the Central Bank’s first tactic to attempt to control the forex market. A year ago, with oil prices down and government earnings slowing, the apex bank adopted a fixed exchange rate as local banks put limits on spending on debit cards outside the country. In June, after several months of criticism of its currency policies, the Central Bank agreed to float the naira and allow the value of the currency be determined by market forces. But given the stability in the currency’s official value despite the devaluation, the Central Bank’s move was described as a “managed float.”

Despite its stated goal of trying to stabilize the foreign exchange market and resolve the persistent dollar shortage, the Central Bank has curiously made several moves that have worsened the crisis. It has barred banks from forex trading and cracked down on money transfer operators, an important source of forex for the local market through remittances from the diaspora (both bans were later lifted).

The bank’s unorthodox moves are believed to be backed by government which has also played its part in worsening an already bad situation. Last week, state security agents raided bureau de change operators accused of “unnecessarily hiking rates“, a move which has only worsened the dollar scarcity.