China’s not letting up on its investment binge, as Chinese shoppers slow down

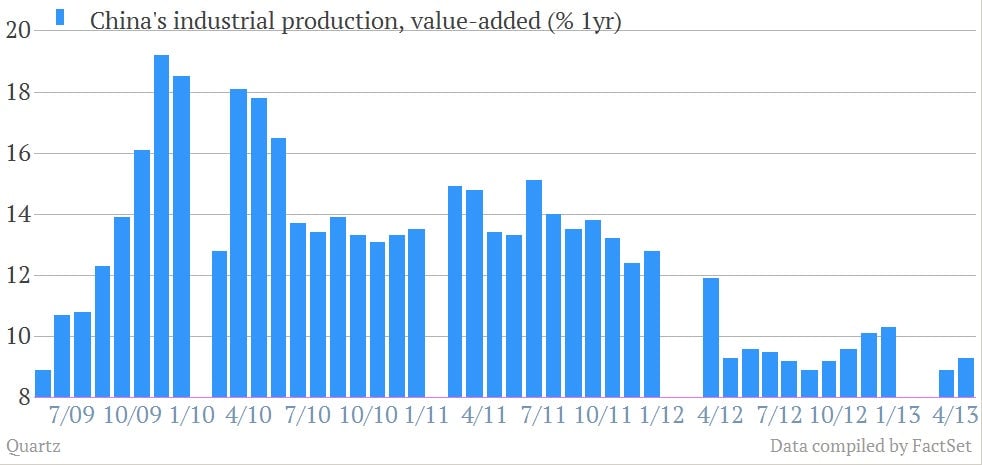

Industrial output, a key driver of Chinese economic growth, was up 9.3% in April, versus the same month of 2012—higher than the seven-month low of 8.9% seen in March, but slightly below expectations. The data suggests concerns about China’s slowdown will continue through the second quarter. Research firm IHS Global Insight emphasized that the data still look gloomy. ‘’This is not the start of a rally, it is a sputtering whimper as momentum continues to fade,’’ wrote IHS’s Xianfang Ren and Alistair Thornton. Here’s a look at the data. (Note: There are somewhat strange gaps in the data tied to Lunar New Year holiday. Those gaps drive drive economists nuts.

Industrial output, a key driver of Chinese economic growth, was up 9.3% in April, versus the same month of 2012—higher than the seven-month low of 8.9% seen in March, but slightly below expectations. The data suggests concerns about China’s slowdown will continue through the second quarter. Research firm IHS Global Insight emphasized that the data still look gloomy. ‘’This is not the start of a rally, it is a sputtering whimper as momentum continues to fade,’’ wrote IHS’s Xianfang Ren and Alistair Thornton. Here’s a look at the data. (Note: There are somewhat strange gaps in the data tied to Lunar New Year holiday. Those gaps drive drive economists nuts.

By tonnage, big growth drivers were production of non-ferrous metals, up 10.3% and automobile production, up 18.3% (link in Chinese). Despite rampant overcapacity problems, which we discussed in more detail last week, steel production was up 8.1%.

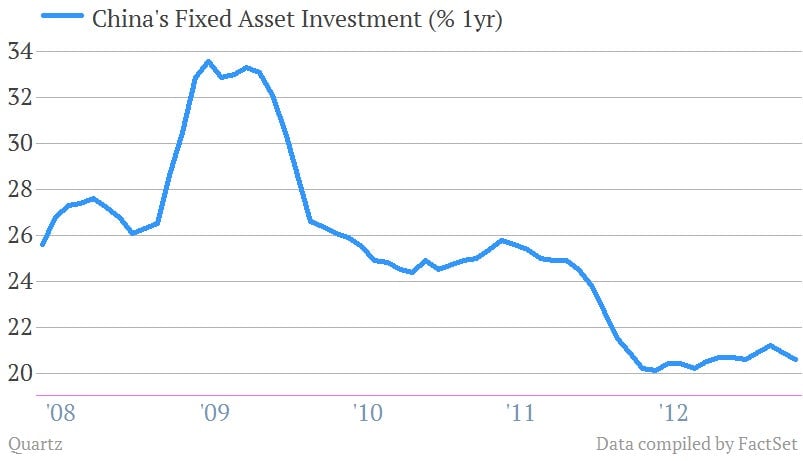

Meanwhile, investment in property and infrastructure continues to jump, even as the economy slows. Fixed-asset investment, which measures investment in things like property and infrastructure, rose 20.6% in April. That undershot analyst estimates of 21.0%, but it’s essentially in line with the 20% growth we’ve seen for a year now. Take a look.

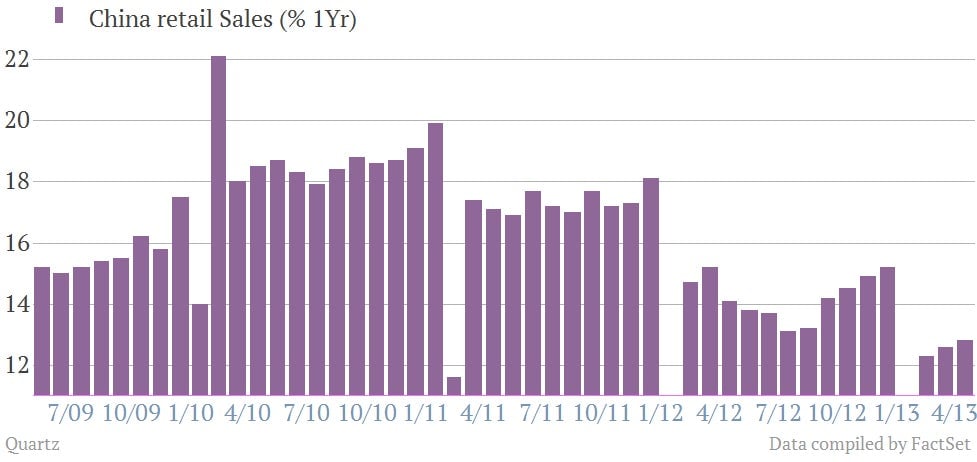

Elsewhere, retail spending picked up slightly, rising 12.8% from April 2012, compared with 12.6% gain in March. Though it’s picking up gradually, growth in retail sales has slowed a lot since last year. And that should concern anyone rooting Chinese consumers to rebalance the country’s economy away from manufacturing and capital investment.