The latest destination for all that money being printed? Asian bonds

Last week, we reported that African debt issuers were some of the biggest winners of global monetary easing policy—and that this “winning” also comes with risk. The same thing could also be happening in Asia, where businesses have flooded the corporate bond market. Companies, particularly in rapidly growing Southeast Asian economies, have been taking advantage of low interest rates to borrow on the cheap. Singaporean, Korean and Thai businesses have led the charge for new money in recent years.

Last week, we reported that African debt issuers were some of the biggest winners of global monetary easing policy—and that this “winning” also comes with risk. The same thing could also be happening in Asia, where businesses have flooded the corporate bond market. Companies, particularly in rapidly growing Southeast Asian economies, have been taking advantage of low interest rates to borrow on the cheap. Singaporean, Korean and Thai businesses have led the charge for new money in recent years.

Many companies and countries are issuing debt at record low rates, taking advantage of central banks’ monetary easing—in other words, the pumping of cheap money into the markets to spur economic growth. That in turn lowers the reward for holding the world’s safest assets and pushes investors toward riskier assets that boast higher yields.

Often, a sharp influx of foreign money into a country risks destabilizing the economy. But here’s why that’s less of a risk in Asia: Many bonds issued in Asian markets are local currency bonds (LCY). Although foreign-currency bonds are often easier to market to would-be investors, local-currency bonds don’t have exchange rate risk for the companies issuing them. In other words, the local currency won’t depreciate relative to the currency the company is using to borrow, which could make repayment more expensive.

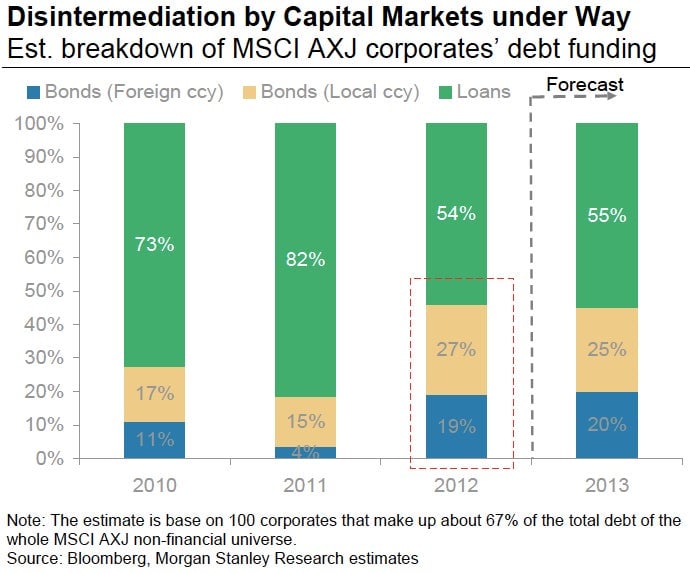

The trend could be part of the region’s natural progression toward complex capital markets. Morgan Stanley explains in a recent note that, because Asian consumers are saving less, banks have fewer assets to lend. That depresses traditional lending activity and encourages companies to look elsewhere for money, including in the bond markets. The upside? Capital markets spread out the risk of owning debt.

On the other hand, the influx of hot money could come back to bite foreign investors. Writes Lombard Street Research’s Freya Beamish in a note today (the emphasis is ours):

For the developing nations of Indonesia, Malaysia, the Philippines and Thailand, much of the increase in the size of the market has been pushed by foreign purchases. This is not a bad thing in itself as investment growth is warranted and deeper markets should help to improve the allocation of capital. But especially if capital inflows are driven by excess global liquidity they could increase the risk of default by driving overheating and currency appreciation. For the net exporters this would put pressure on margins. Meanwhile increased activity could also lead to a declining current account surplus or increasing deficit, leaving these economies vulnerable to a sudden reversal of funds and a sharp currency depreciation.

That makes the glut of easy money look less attractive—and less likely to fuel sustainable growth.