You can do it America! Seven charts that explain why you can handle the payroll tax hike

As we said earlier today, lackluster sales at Wal-Mart look to some like evidence that the US’s payroll tax increase at the start of this year is, as predicted, pinching less-affluent Americans. And all else equal, raising taxes in a weak economy is probably not the best move. But we don’t think American consumption is going to collapse. Let us walk you through our thinking.

As we said earlier today, lackluster sales at Wal-Mart look to some like evidence that the US’s payroll tax increase at the start of this year is, as predicted, pinching less-affluent Americans. And all else equal, raising taxes in a weak economy is probably not the best move. But we don’t think American consumption is going to collapse. Let us walk you through our thinking.

True. The payroll tax increase (a 2% increase in the Social Security payroll tax) will take a bite out of consumer incomes this year. It’s reflected in a giant increase in payments to government insurance programs like social security in January:

But we think that the cash Uncle Sam is taking out of the wallets of consumers could be offset by other developments elsewhere in the economy, which isn’t as weak as it once was. For instance…

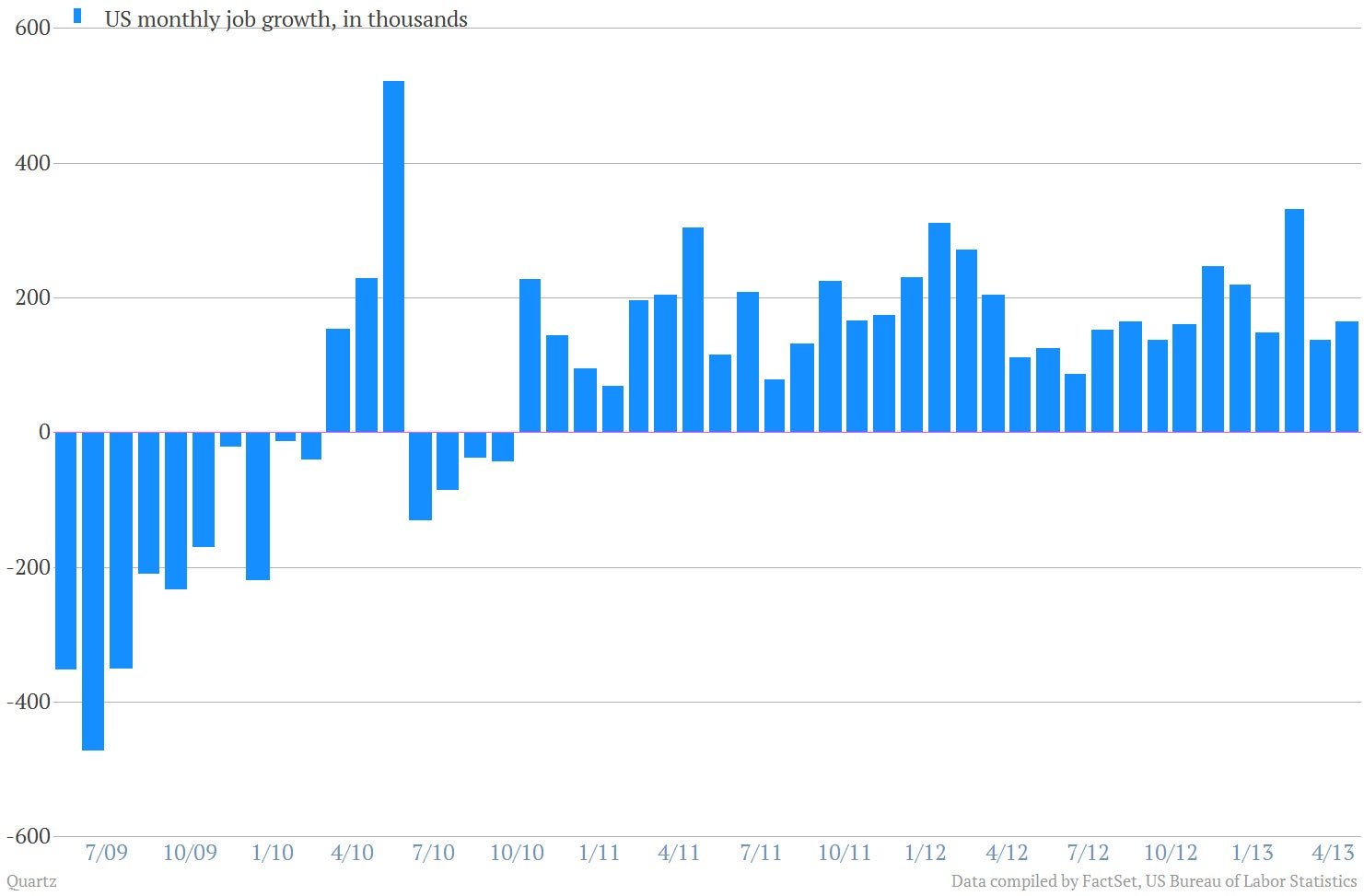

More jobs. Job growth has been steady for a while now. And we’ve even had some especially good months lately. Fore example, more than 330,000 jobs that popped up in February, after revisions. Even if you’re paying higher taxes, it’s probably better than being unemployed.

People are working longer hours. It’s not exactly a good time, but it reflects the slowly improving US economy and should put more money in consumers’ pockets.

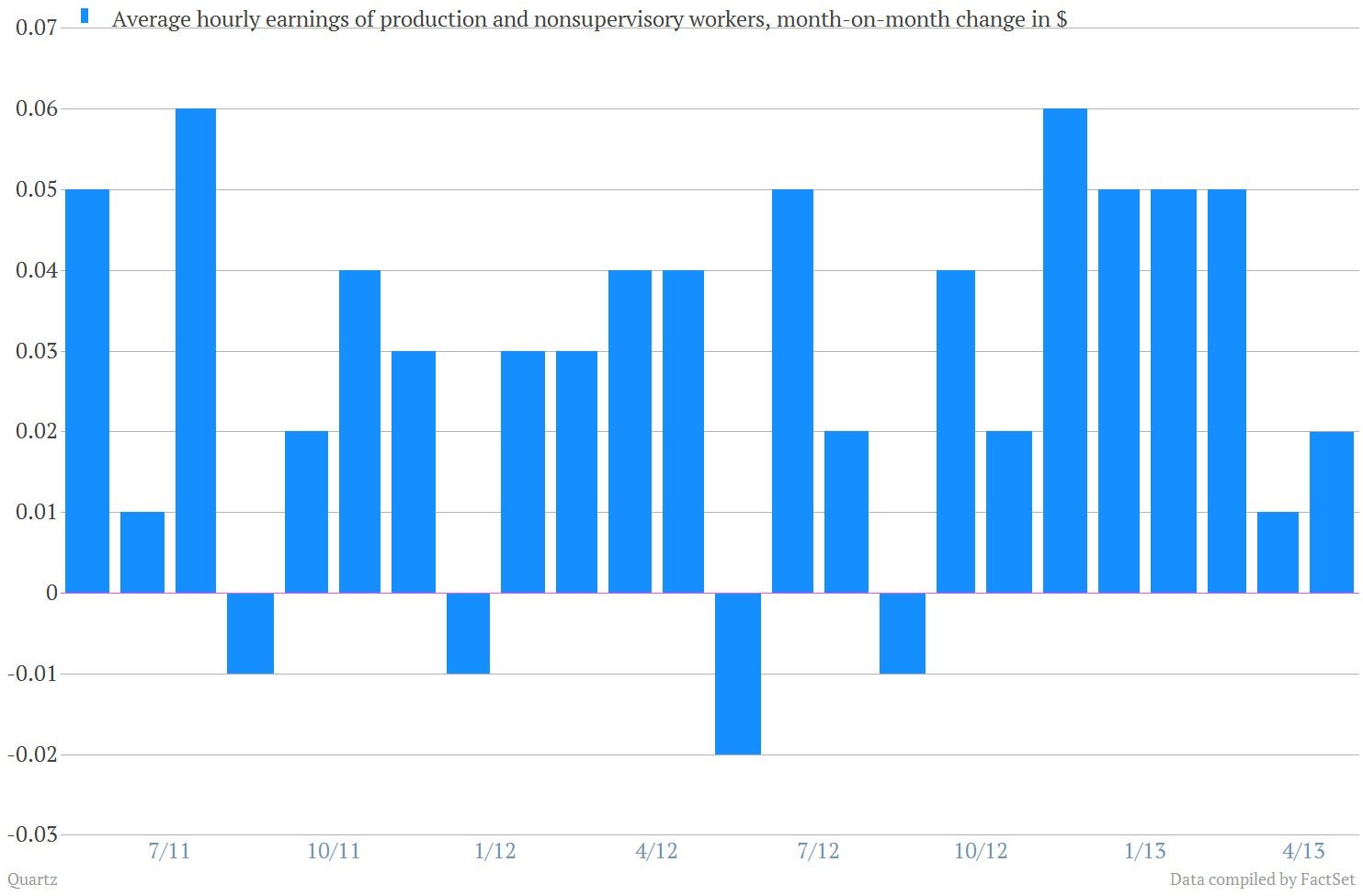

Pay has been perking up, ever so slightly. Again, we’re far from a golden age for wage-earners, but rising is better than falling. Here’s a look at the month-on-month increase in average hourly earnings. Again, we’re talking about pennies here. But in this indicator, it’s always pennies. And you can see that we’ve strung together a few decent months of increases going back to September of 2012.

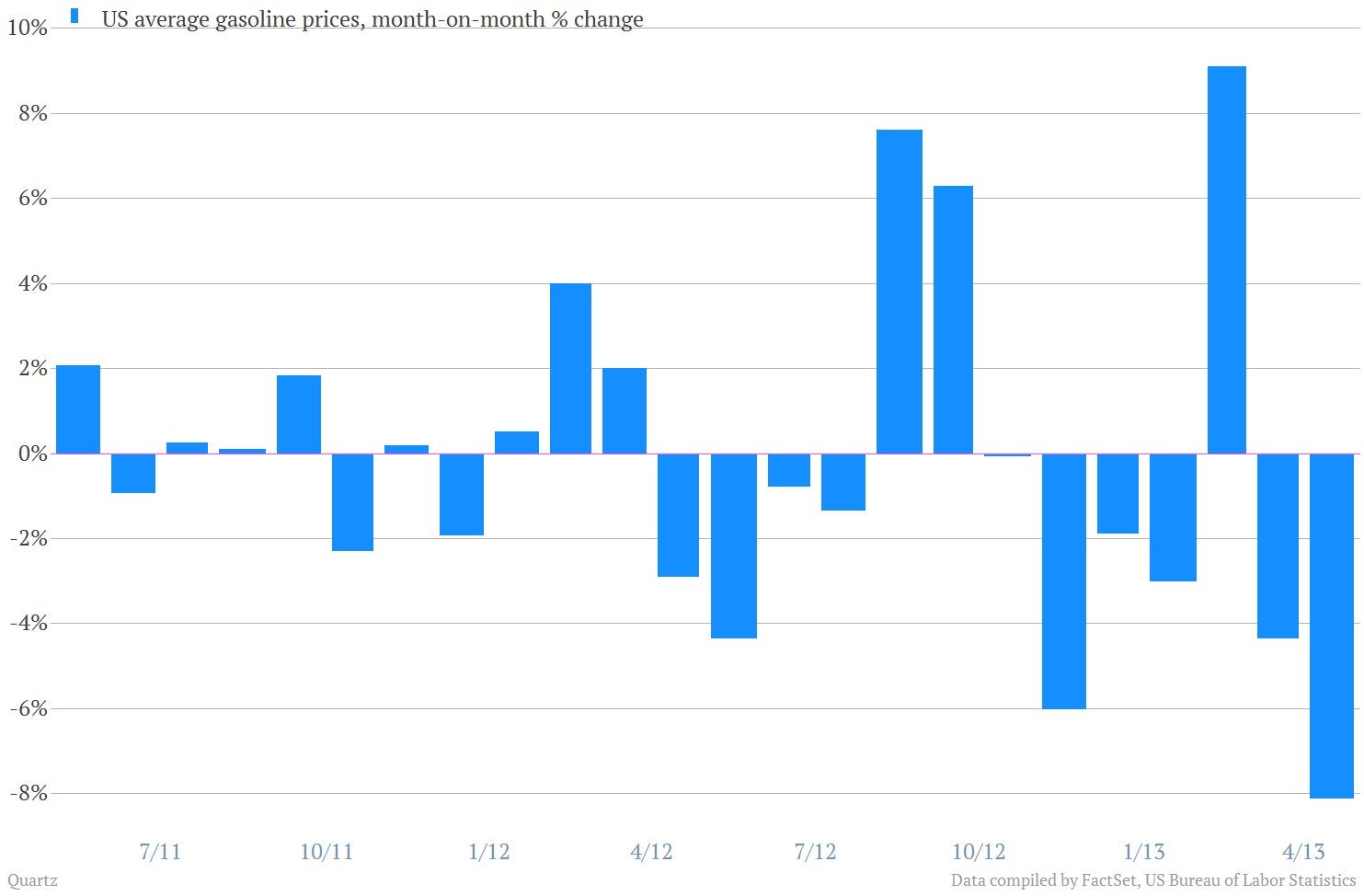

Gas prices have been (mostly) falling. The decline in this key input of the American lifestyle frees up cash to be spent elsewhere.

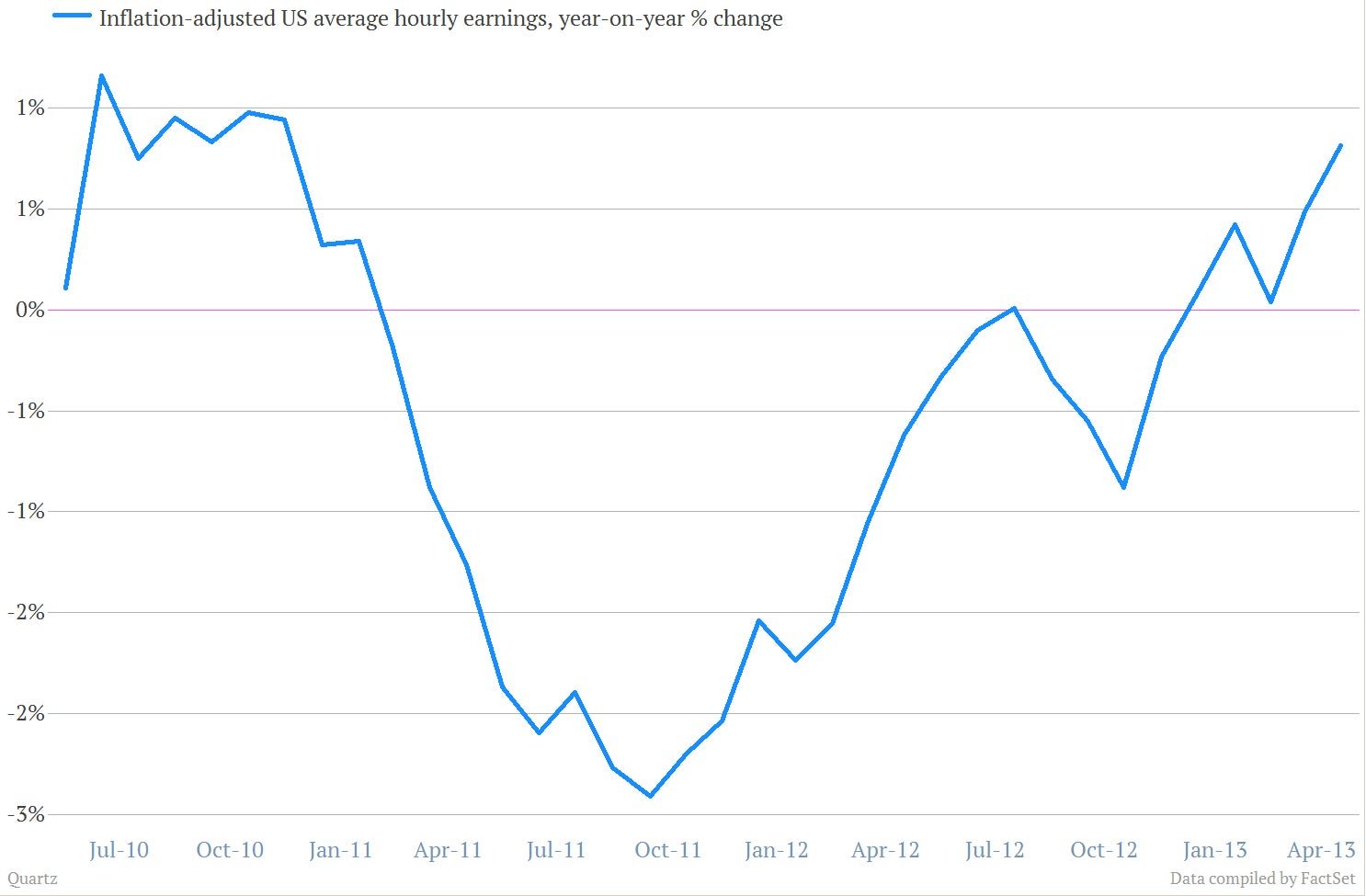

Real wages are rising. Inflation-adjusted US wage increases are hitting some of their highest gains in recent years.

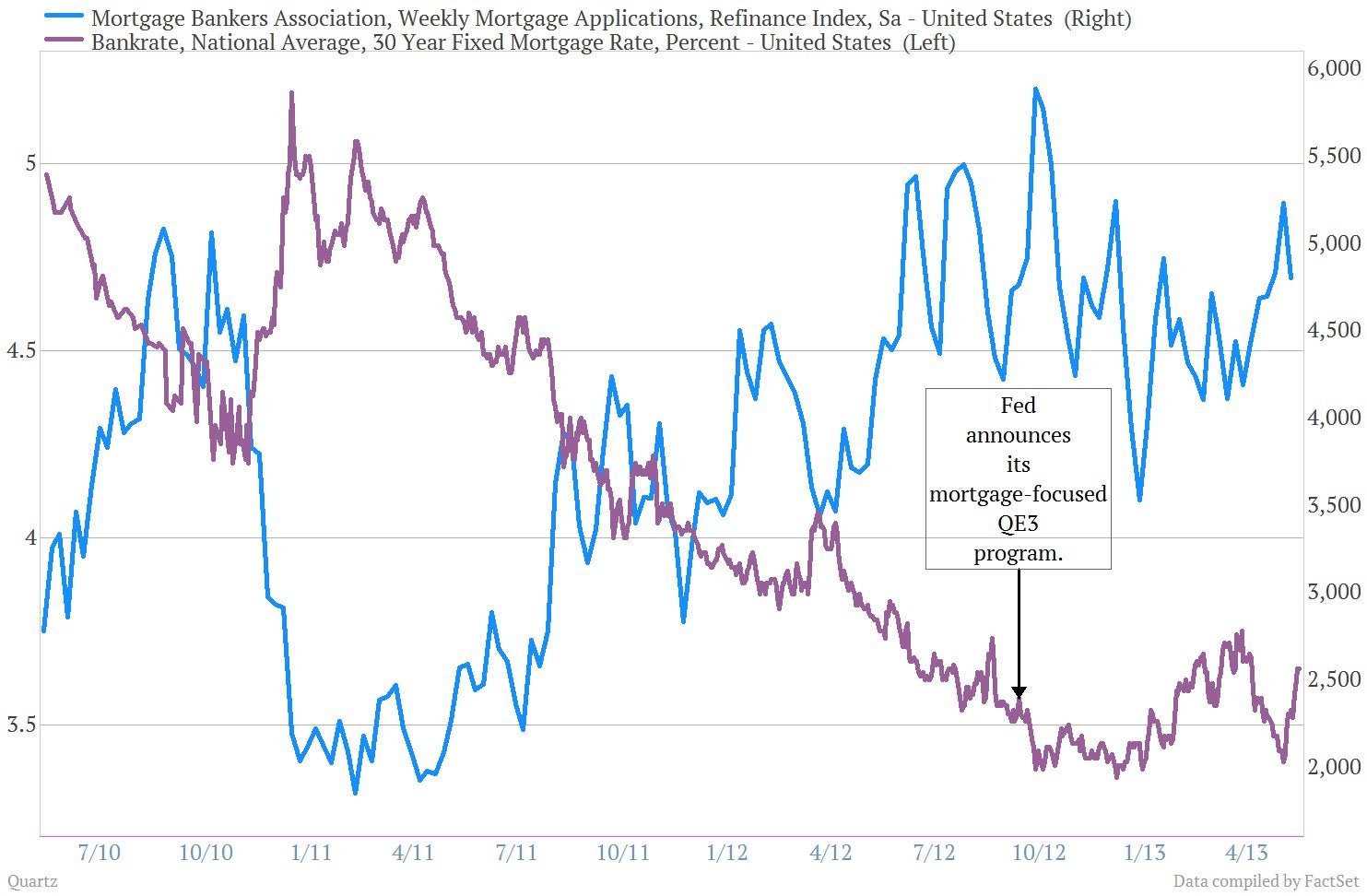

Plus, the refinancing boomlet is still rolling. The Federal Reserve’s super-low-interest-rate policy continues to encourage homeowners to restructure their mortgages at lower rates. Remember, the whole reason that the Fed wants people to refinance is that it cuts down on the amount consumers have to spend on housing, and frees cash up to be spent elsewhere.

So does this mean that consumer spending is going to go through the roof? No. But it does mean that Americans may have enough extra cushion in their wallet to keep the payroll tax cut from bringing the US consumer to a screeching halt.