Soros and other top hedgies now love Google more than Apple

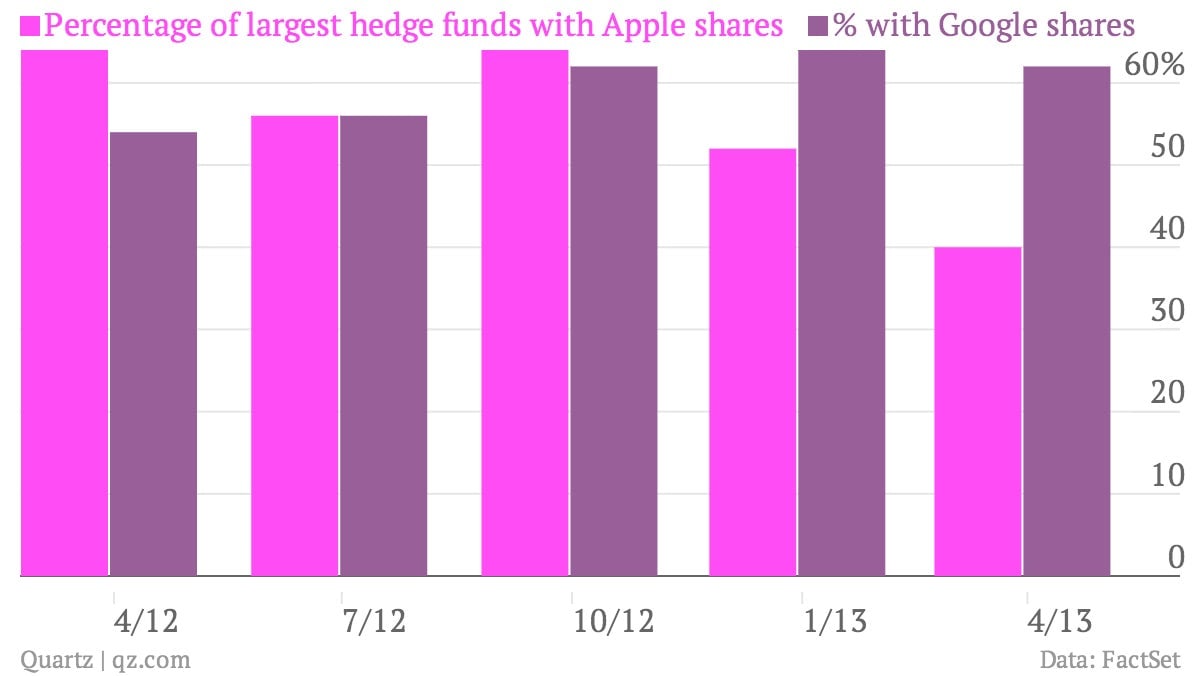

For a long time, hedge funds roped themselves to Apple and rode its remarkable rise higher. It was almost like they had to own it. The stock had such a large weight in stock market indexes, the so-called smart money risked severe under-performance by opting not to own the electronics giant. But as Apple’s shares have stalled, so has hedge fund enthusiasm for them.

For a long time, hedge funds roped themselves to Apple and rode its remarkable rise higher. It was almost like they had to own it. The stock had such a large weight in stock market indexes, the so-called smart money risked severe under-performance by opting not to own the electronics giant. But as Apple’s shares have stalled, so has hedge fund enthusiasm for them.

The stock has been a terrible under-performer this year, down more than 18%, even as the broader S&P 500 stock market index is having something like a career year, rising nearly 16% so far. Meanwhile, Google’s up roughly 28% year-to-date, with shares recently hopping to more than $900.

One of the funds lightening up on Apple and loading up on Google belongs to speculator par excellence George Soros, who remains very much alive, and has had a pretty nice run lately. Besides getting on board the Google train, Soros’ fund reportedly made a killing shorting the Australian dollar as well as the Japanese yen and lightened up on gold holdings ahead of the yellow metal’s plunge.