Mobile data is the new luxury good in southern Europe

Vodafone’s and Telefónica’s dismal results for the beginning of 2013 show serious weakness in southern Europe. Today, Vodafone reported its worst annual fall in service revenues in five years (paywall) in its fourth quarter, and blamed its problems (pdf) on “headwinds from a combination of continued tough economic conditions, particularly in Southern Europe, and an adverse European regulatory environment.”

Vodafone’s and Telefónica’s dismal results for the beginning of 2013 show serious weakness in southern Europe. Today, Vodafone reported its worst annual fall in service revenues in five years (paywall) in its fourth quarter, and blamed its problems (pdf) on “headwinds from a combination of continued tough economic conditions, particularly in Southern Europe, and an adverse European regulatory environment.”

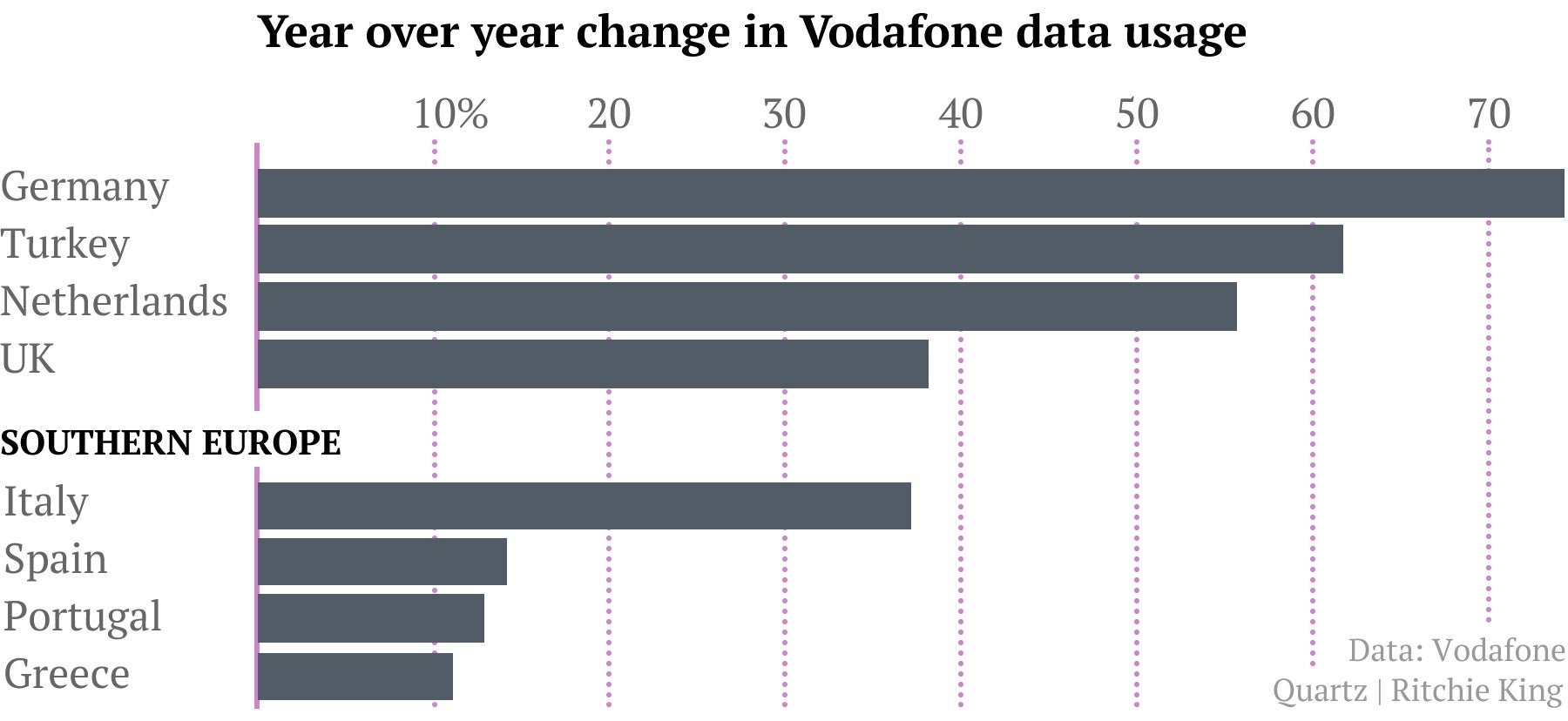

Smartphone penetration is similar in both southern and northern Europe, and data usage inevitably rises as more people get cell phones. However, the growth of data usage in Europe has slowed down in places where the economy has been hit by the euro crisis. Whereas it grew 74.3% year-on-year in Germany, in Spain the growth was just 14.1%.

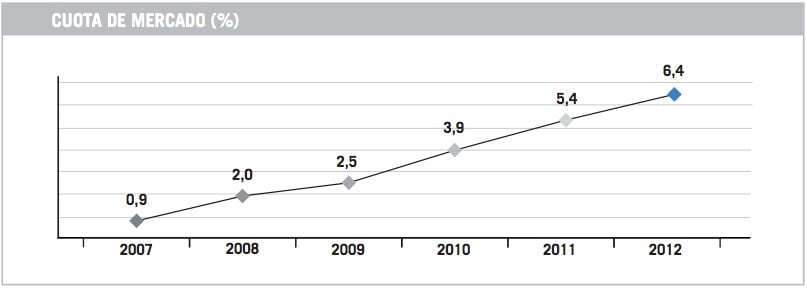

Hence the success of low-cost carriers like TeliaSonera’s Yoigo in Spain. In 2007, the provider had just 427,000 subscribers. At the end of 2012, it boasted 3.71 million. Yoigo’s plans offer fewer bells and whistles than those of its bigger competitors; its cheapest plan costs just €9 ($11.58) per month, plus €0.01 per minute before taxes for voice calls, and offers 1GB of data. In fact, only its most expensive plan offers more data: 2GB and unlimited national and international calls for €39.

Vodafone has been trying to break into the low-cost space, but doesn’t play up its cheapest plans and was the last major mobile carrier (link in Spanish) to go after that market in Spain. It tends to push Spanish customers instead towards its high-end “Vodafone Red” plans, with 10GB-60GB of data monthly. Though it says those plans have been successful, if data use is a luxury good they aren’t going to tempt most of southern Europe.