Investors just gave Galaxy Securities $1 billion to make China’s bad debt problem worse

China Galaxy Securities Co., which is majority owned by one of China’s sovereign wealth funds, raised $1.07 billion in its Hong Kong IPO today—capital that will go toward building up its margin financing and securities lending businesses, its core money-spinners.

China Galaxy Securities Co., which is majority owned by one of China’s sovereign wealth funds, raised $1.07 billion in its Hong Kong IPO today—capital that will go toward building up its margin financing and securities lending businesses, its core money-spinners.

Many are hailing the event as a revival of Hong Kong’s moribund IPO market, and that may be. But Galaxy’s prospectus tells another story too: Over-regulation of China’s stock market is warping incentives for its brokerages.

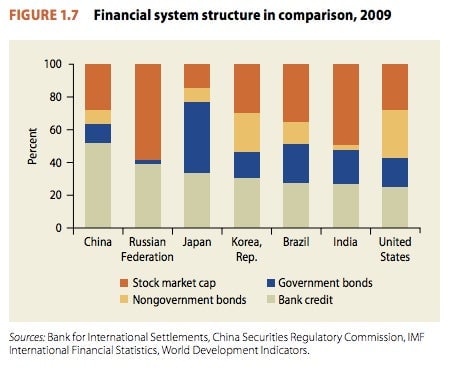

The Wall Street Journal argues (paywall) that there are growth opportunities in China’s underdeveloped capital markets. For instance, as of 2010 Chinese households had only 13% of their savings sitting in equities, with the vast majority in deposits. Also, China’s corporate bond issuance is relatively immature relative to equities:

But that’s likely because the government controls who can invest and which companies can list. Essentially, China’s banking system is more of an ATM for state-owned enterprises (SOEs), not an efficient allocator of capital. Smaller companies are desperate for funding. The best companies have fled to international exchanges (ie, what Galaxy just did). Meanwhile, many SOEs are barely profitable and seldom pay dividends.

That’s all bad news for Galaxy. Its business is closely tied to the performance of China’s capital markets, which have foundered in recent years. The Shanghai-Shenzhen 300 index rose only around 8% in 2012, compared with the S&P 500’s 13% increase. Meanwhile, China’s markets regulator has been sitting on IPOs, causing a backlog of more than 800 companies that are waiting to list.

Those factors likely contributed to the 10% nosedive in Galaxy’s earnings last year, according to its prospectus. Its earlier performance was even worse. Between 2010 and 2012, Galaxy’s profits dropped 49%, even as it slashed 60% of its workforce. The company has also had a hard time boosting its market share above 5%. The industry has so many small players vying for business that the top 10 brokerages claim only 40% market share (link in Chinese). And that doesn’t include the state-owned banks, which are currently banned from the brokerage businesses.

The situation isn’t likely to improve until the government institutes major reform—including liberalizing both the yuan and interest rates. And that’s not going to happen anytime soon. As a result, Galaxy and other brokerages are looking to make money through less regulated endeavors like wealth management and trust products, which appeal to investors looking for higher yields (to compensate for artificially low deposit rates).

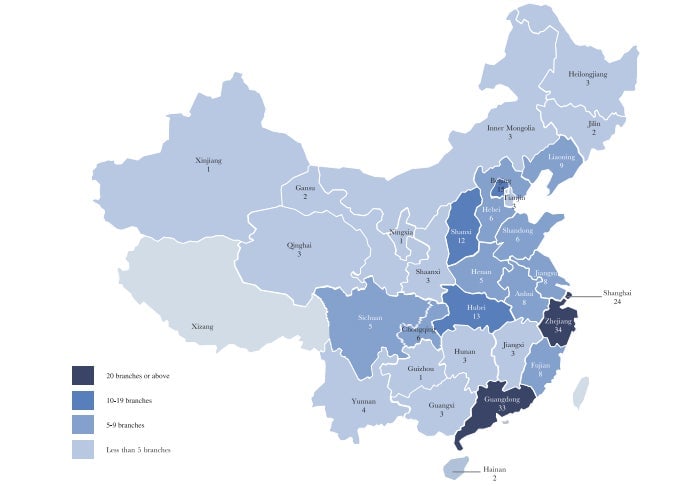

Here’s a look at the reach of Galaxy’s retail business, which—flush with funding from its IPO—is presumably expanding:

But that expansion comes at a price. Take, for instance, its dodgy 3 billion yuan in financing for Guilin Investment Corporation’s “urban improvement” (link in Chinese). Still, package and selling these dodgy products has its advantages: it provides the capital needed for securities-backed lending, as China Real Time reports. Just what China’s financial sector needs: more risk.