The market freak-out over Japan today was premature

Japan’s major stock index, the Nikkei 225, plunged 7.3% today. For a country that’s supposedly growing at a rate of 3.5% per year, such a large one-day drop is out of character.

Japan’s major stock index, the Nikkei 225, plunged 7.3% today. For a country that’s supposedly growing at a rate of 3.5% per year, such a large one-day drop is out of character.

There are plenty of reasons to worry about Japan. The country’s central bank, under direction from prime minister Shinzo Abe, has embarked on its campaign of quantitative easing (QE) to purchase an unlimited number of Japanese securities in order to produce inflation. Abe and Japanese central bank chief Haruhiko Kuroda believe inflation will spur companies and individuals to invest rather than hold on to their money.

This is part of a three-step equation; Abe’s government is also advocating fiscal stimulus and a still-unclear structural reform plan. (For a more thorough description see our mega-graphic.)

But inflation also leads to higher interest rates. With already sky-high debt—nearing 245% of GDP—and more government spending on its way, critics worry that higher interest rates will make the cost of paying down the debt overwhelming.

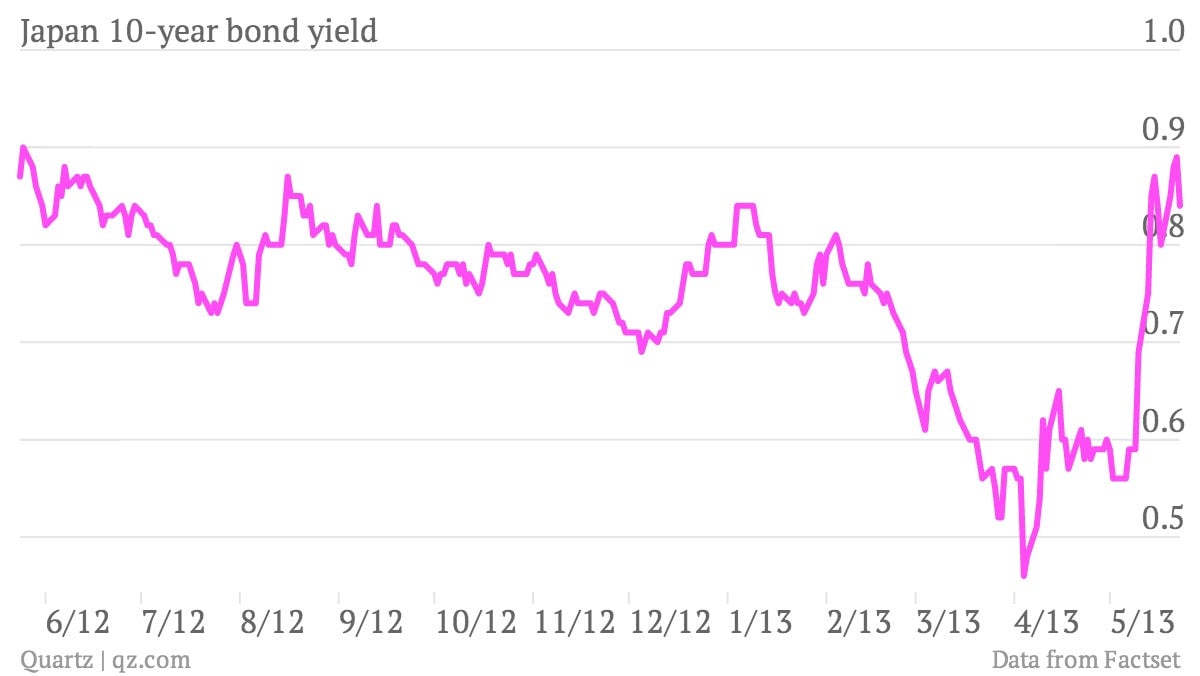

Indeed, despite the Bank of Japan’s bond-buying, the belief that inflation will eventually rise has pushed yields on Japanese government bonds (which, of course, represent the interest rate at which the government borrows) up—hitting 1% today. They fell to 0.84% only after the bank announced new plans to buy more of them because of “the unreasonable increase in the volatility of long-term rates.”

If debt-servicing costs go wild, Japan will have lost its chance to grow out of two lost decades. “There’s a window in time where there’s room to make the necessary adjustments [i.e. structural reforms],” said Ken Courtis, managing director of Starfort Holdings, at a World Economic Roundtable last month. By Courtis’s calculations (paywall), “with 2.5% interest rates on public-sector debt of 250% of GDP, Japan would have to grow nominal GDP by 6.25% per year simply to keep its debt level from increasing. In real terms (adjusting for 2% inflation), real annual growth would have to be 4.25%.” Courtis believes that’s just not possible for Japan right now.

So what could have made the stock market fall today? The recent rise in interest rates could have spooked it. “If [Japan] had to pay 2% (the same rate as its inflation target), the country would need to devote more than half of its tax revenue just to service its debt! Clearly this possibility is dawning on stock investors who pushed down the Nikkei by more 7% today,” Peter Schiff, the CEO of Euro Pacific Capital, wrote in a note.

At the same time, interest rates still aren’t that high and the central bank’s QE plans are just getting started. So unless the market’s fall was just a random moment of panic, wrote economist Paul Krugman, it might be an attack of doubt about whether the bank will really stay the course of QE for as long as it takes.

With only two-thirds of Abe’s plan in place, is this the moment to freak out? The Japanese program is based on the success of deep-seated structural reforms, which Abe has promised to announce before attending the G8 Summit on June 17-18. Either way, today’s tumble underscores the country’s financial vulnerability. “This is like crossing the Niagara falls on a tightrope on a rainy night in the mist,” says Courtis. It’s been done, but that doesn’t mean it isn’t very risky indeed.