At last, Japan’s government gains confidence in its economy—and so do its consumers

The Japanese economy is on the mend, said the Cabinet Office earlier today, in its first upgrade of the economic assessment in two months. Specifically, private consumption, exports, industrial production and corporate profits among large firms are all “picking up.”

The Japanese economy is on the mend, said the Cabinet Office earlier today, in its first upgrade of the economic assessment in two months. Specifically, private consumption, exports, industrial production and corporate profits among large firms are all “picking up.”

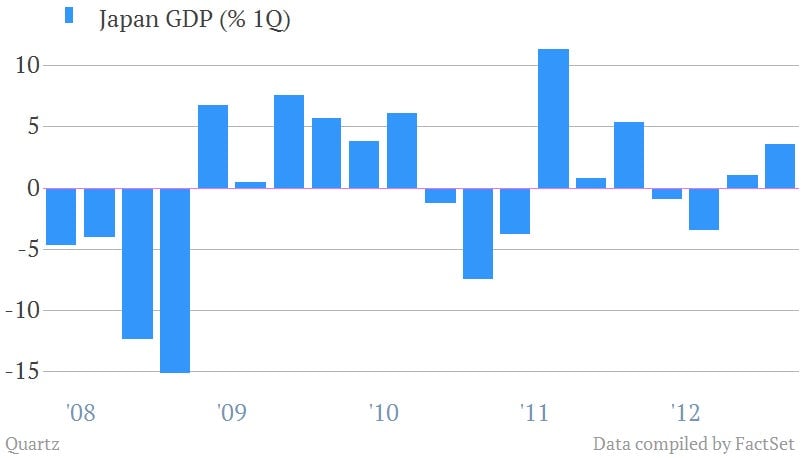

The unusually upbeat report comes on the heels of the May 15 announcement that Japan’s economy grew at an annualized rate of 3.5% in the first quarter of 2013.

Around 2.3 percentage points of the growth came from private consumption, which typically contributes around 60% of the country’s GDP. This suggests that in the first quarter—well before the Bank of Japan’s monetary stimulus was announced—consumers had already started spending again. This is important because consumers and businesses must expect inflation in order for it to happen—and to trigger the most critical part the Abenomics plan to reinflate the economy. Today’s report indicates that household consumption continues to rise.

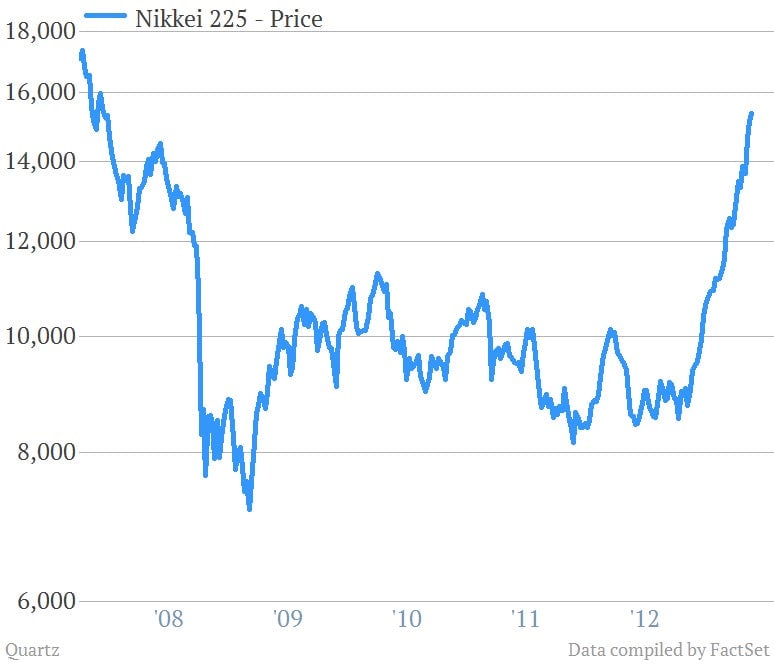

Rising consumer confidence is partly related to the stock market; the Nikkei gained 1.47% today, hitting highs not seen since December 2007:

Meanwhile, the Tankan survey—a measure of sentiment among manufacturing businesses—climbed 11 points in May so far and entered positive territory for the first time since May 2012, said Reuters.

The government said it expects the economic recovery to “resume gradually supported by the improvement of confidence, the improvement of export conditions and the effect of the policy package and monetary policy.” It also cautioned that erosion of overseas demand still posed a big risk to the economy, and that employment and wage growth were still shaky. This is potentially worrisome given the economy’s continued “mild deflationary phase.”

Here’s the problem with flat wage growth: If inflation kicks in, that will be great for the Japanese economy, at least for a while. But if Japanese households are going to keep spending, they need to feel secure. Stagnant wage growth coupled with rising prices doesn’t breed confidence in personal wealth.

Another concern: Akira Amari today warned that if the yen continued to weaken, ”people’s lives will be negatively affected.” That’s because the flip side of cheap exports—and booming corporate profits—is expensive imports, of which Japan has a lot.

But those are longer-term worries. For the moment, the government’s announcement hints that the Bank of Japan’s uniquely aggressive monetary program, announced in early April and launched this month, is working. That means the BoJ is likely to maintain the policy when it meets for two days starting on Tuesday of this week.