The leading scholar of income inequality died the same week Exxon awarded Rex Tillerson $180 million

Anthony Atkinson, an Oxford economist who died Jan. 1 at age 72, spent his life studying income equality, a field he virtually invented (paywall).

Anthony Atkinson, an Oxford economist who died Jan. 1 at age 72, spent his life studying income equality, a field he virtually invented (paywall).

Among other things, Atkinson proposed raising the top tax rate to 65%, providing minimum-wage government jobs for anyone who wants one, and asking companies to cap CEO pay at 75 times the average pay in the firm (it’s now about 276 times), all to help address structural imbalances that allow the rich to hoard their wealth.

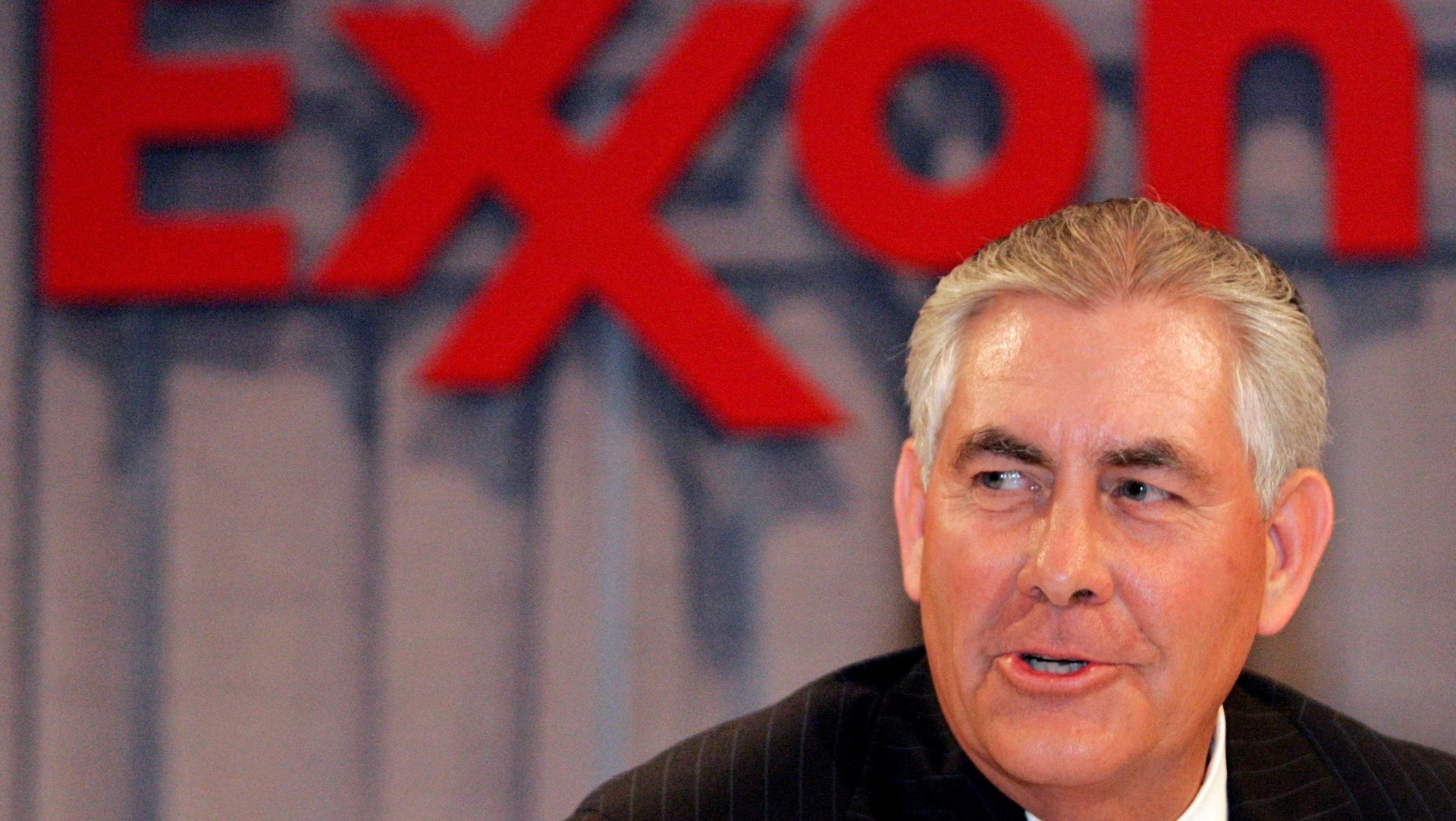

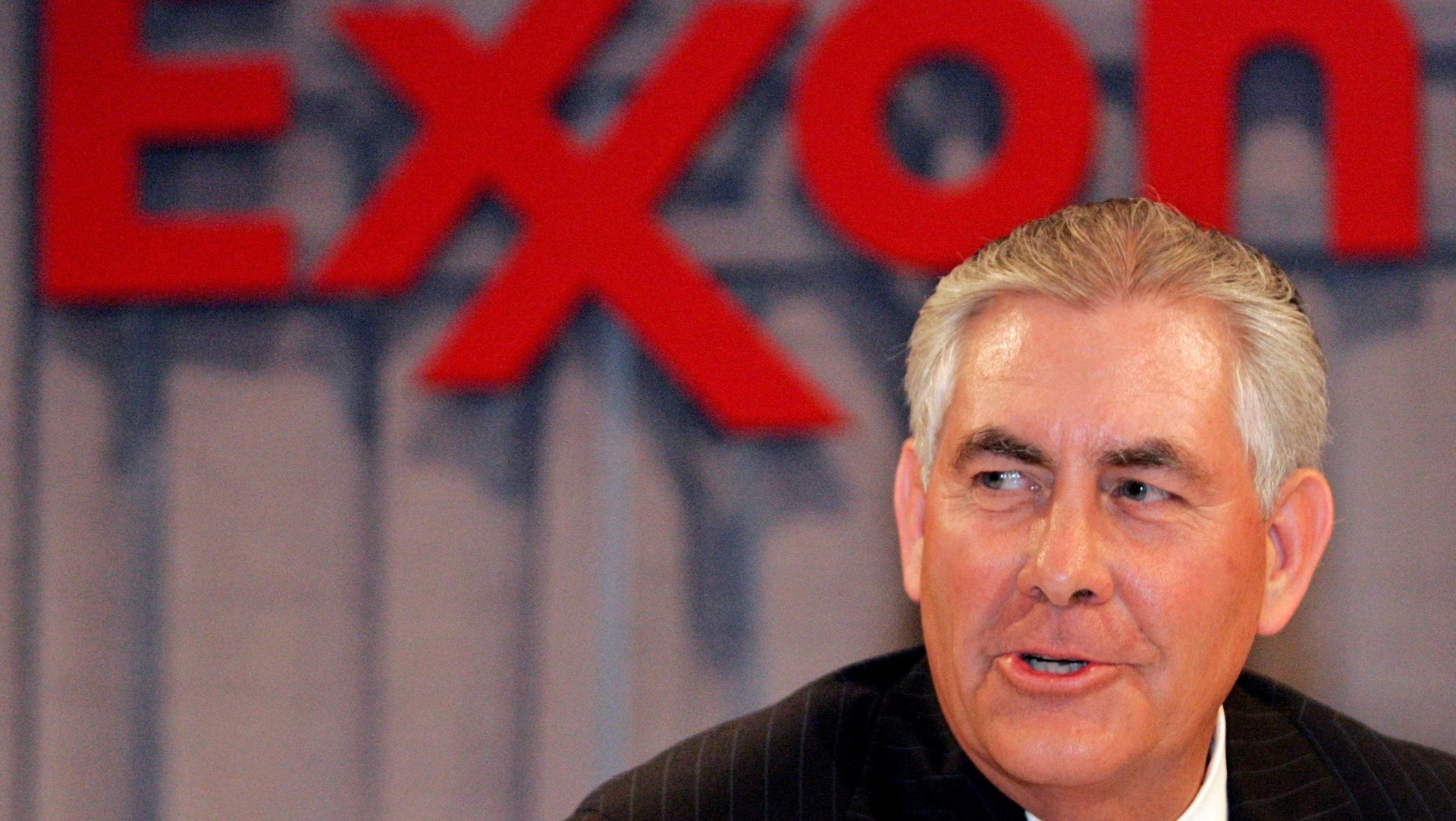

So what would Atkinson make of the news that Exxon Mobil CEO Rex Tillerson, who is stepping down to become US Secretary of State, was awarded a $180 million retirement package?

The award, which is contingent on Tillerson’s conformation by the US Senate, is meant to help the nominee comply with ethics rules and sever his ties with the company. Instead of receiving 2 million Exxon Mobil shares over 10 years, as called for in his retirement agreement, Tillerson will get the cash equivalent deposited into an independently managed trust account.

Tillerson, 64, spent 41 years at Exxon Mobil, and since taking over as CEO in 2006, helped secure its place as one of the world’s biggest and most valuable corporations, with annual revenue of $246 billion.

Tillerson’s award is lavish in the context of the average CEO, although it’s smaller than that of the man he replaced at Exxon. According to a 2015 Reuters analysis, the average Fortune 500 CEO retirement account is valued at $17.7 million. At the time of the study, David Novak, CEO of YUM Brands, which owns Taco Bell, KFC and Pizza Hut, had the largest retirement package, valued at $234 million. Tillerson’s exit package is less than half the $400 million that his predecessor, Lee Raymond, walked out with in 2006 .

Most Americans, of course, have no such security, and the poorest fifth of Americans near retirement age—those between ages 55 and 64, and making less than $39,000 a year—had savings of just $13,000 as of 2013.

Atkinson, whose research influenced Thomas Piketty, believed that advantages of wealth buy not just goods, but peace of mind. As the Economist wrote in discussing Atkinsons’ work: “Wealth generates comfort even when it isn’t being spent.”

In his 2015 book, Inequality: What Can Be Done?, Atkinson describes how wealth perpetuates itself, by influencing government policies that favor low inflation over full employment, or low taxes over spending on education. Even government policies that encourage R&D spending on new technologies can serve to widen income gaps, as more and more low-wage jobs are lost to automation. Government must act where the private sectors fails, and Atkinson offered 15 concrete proposals, including the creation of a minimum inheritance, payable to all citizens upon reaching adulthood, and rewriting the tax code in ways to redistribute wealth.

If he’s confirmed, Tillerson will join a cabinet believed to be the wealthiest ever, whose combined fortune of $9.5 billion is equal to the wealth of the lowest third of Americans. Given President-elect Trump’s declared priorities of lowering taxes and reducing regulations, using the power of government to tackle inequality seems like a distant wish.