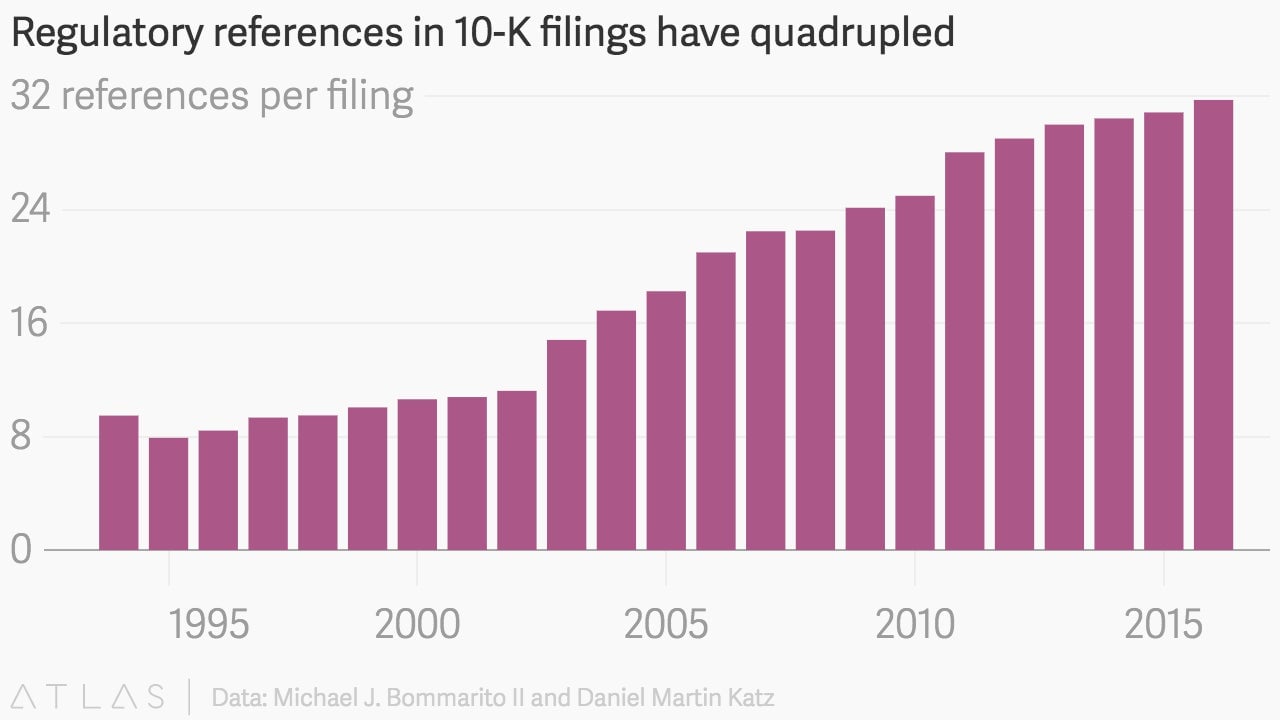

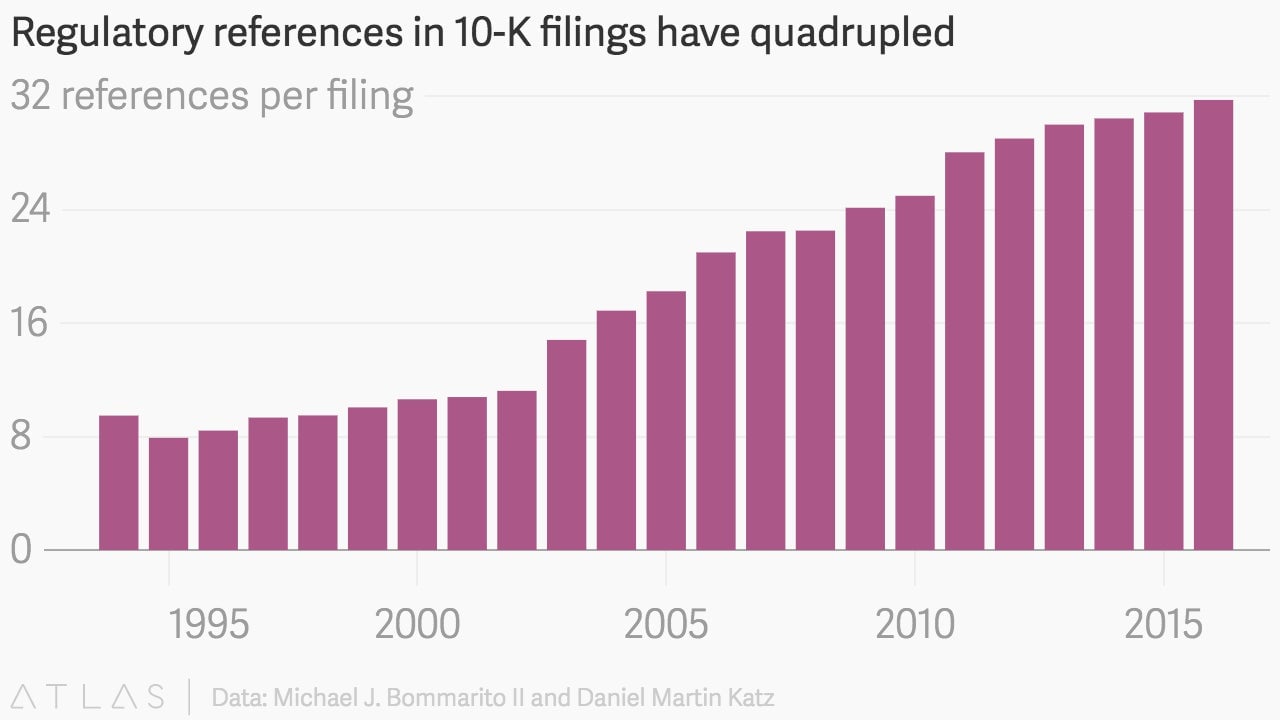

The rate at which US companies cite regulations as an obstacle has quadrupled over the last 20 years

There are few more rancorous political debates in business than the role of government regulation. Big regulatory shifts are often sparked by disasters: A mine caves in for lack of basic safety precautions, or, most recently, the over-leveraged finance industry takes down the global economy. Rarely does anyone measure the impact of new regulations on the companies they affect.

There are few more rancorous political debates in business than the role of government regulation. Big regulatory shifts are often sparked by disasters: A mine caves in for lack of basic safety precautions, or, most recently, the over-leveraged finance industry takes down the global economy. Rarely does anyone measure the impact of new regulations on the companies they affect.

Michael Bommarito II and Daniel Martin Katz, legal scholars at the Illinois Institute of Technology, have tried to measure the growth of regulation by analyzing more than 160,000 corporate annual reports, or 10-K filings, at the US Securities and Exchange Commission. In a pre-print paper released Dec. 29, the authors find that the average number of regulatory references in any one filing increased from fewer than eight in 1995 to almost 32 in 2016. The average number of different laws cited in each filing more than doubled over the same period.

The analysis is possible because companies often see regulations as a source of financial risk. For example, a development company building an office tower near dwindling wetlands might refer to the Endangered Species Act as a source of risk. A biotechnology company with a new drug on the horizon might bemoan fresh enforcement efforts from the Food and Drug Administration. Katz describes the filings as “a crowd-sourced description of the overall regulatory environment.”

Disclosing regulatory risks protects companies from accusations of securities fraud in the event regulations damage their business. However, companies also want to appear strong to investors. If they air a laundry list of theoretical dangers they may see their stock price collapse. These balancing incentives encourage honest disclosure and, as a byproduct, ensure the Bommarito and Katz’s results can’t easily be dismissed as companies just griping about the government.

On the surface the analysis seems to lend weight to criticisms that “big government” is squelching business. Previous research from the Mercatus Center at George Mason University has documented a massive increase in the sheer amount of regulation. According to the Mercatus analysis the boom in regulation is responsible for a 0.8% reduction in annual GDP growth since 1980—leading to a national loss of nearly $13,000 per capita in 2012 alone.

However, the new data isn’t quite a slam dunk for regulation-haters. References to laws are a fairly coarse way of measuring their importance and there are still other factors that need to be accounted for. One major issue: Reporting requirements have also increased over time, which probably accounts for some of the increase. There are also certain regulations which have appeared in the last 20 years that nearly every company references in their filings, such as Sarbanes-Oxley.

It’s also not certain that the growth in the number of regulations cited necessarily means companies are under a greater burden. One hypothesis, says Katz, is that “the economy got really specialized, so there’s a lot of rules, but a lot of them don’t apply to […] individual companies.” Another possibility is that today’s more consolidated companies sprawl across a wider range of industries, and thus appear to be subject to greater regulatory pressure then they would if each business unit operated independently.

And then, of course, there is the big question: Even if the regulations are onerous, do the societal benefits outweigh any economic losses?

Bommarito and Katz don’t answer that question, but research like theirs presents some basic information to inform a discussion. Their paper has been submitted for peer review and they have two others planned. They also plan to release the full dataset later this year. Perhaps that will spur policymakers to approach the political questions with more science, and less emotion.