The Gap is back in fashion but it sees the weakening yen as a problem

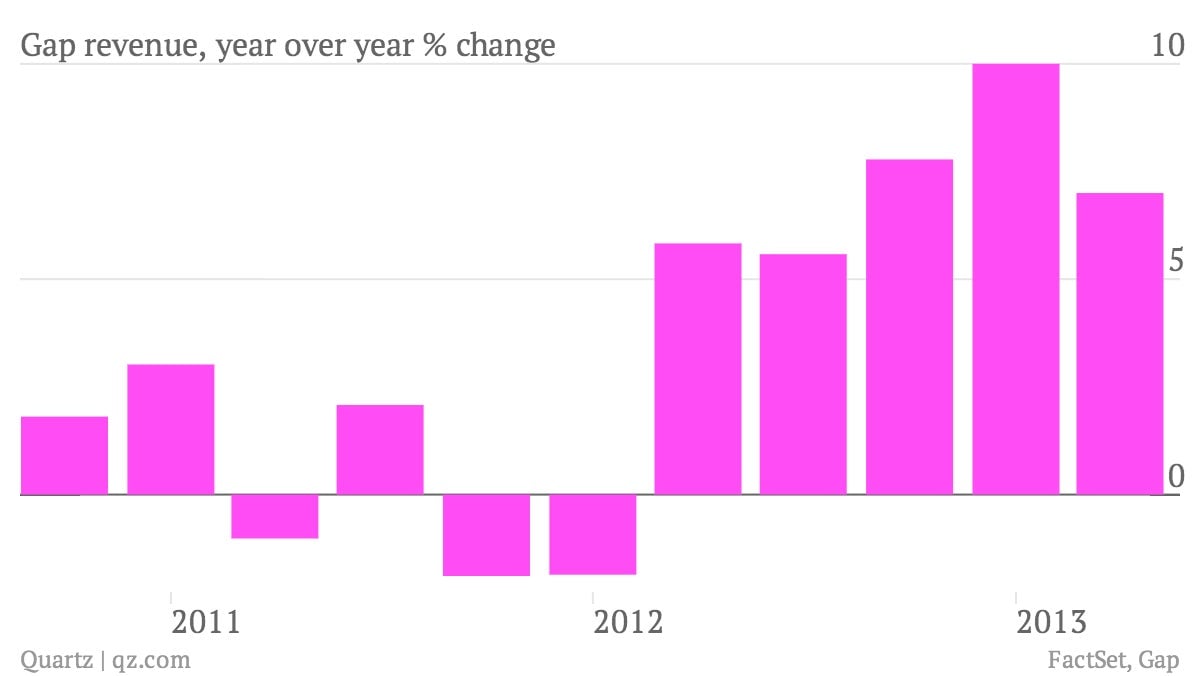

The numbers: Good. Clothing retailer Gap reported a 43% jump in net income, beating expectations. Net sales increased by 7% to $3.7 billion. But analysts had forecast higher annual profits than Gap’s estimate of at least $2.52 in earnings per share. Gap blamed the weakening yen for its conservative forecast, since that decreases the profitability of its Japanese sales in dollar terms. As a result, the stock dropped in after-hours trading.

The numbers: Good. Clothing retailer Gap reported a 43% jump in net income, beating expectations. Net sales increased by 7% to $3.7 billion. But analysts had forecast higher annual profits than Gap’s estimate of at least $2.52 in earnings per share. Gap blamed the weakening yen for its conservative forecast, since that decreases the profitability of its Japanese sales in dollar terms. As a result, the stock dropped in after-hours trading.

The takeaway: After struggling during the past decade because of boring clothes, the Gap appears to be back in fashion. Sales improved at Gap stores, while same-store sales rose at Old Navy, which the company also owns. Its Asia strategy is also working. Sales at Gap stores in China are strong, while Old Navy is growing in popularity in Japan. Gap also owns Banana Republic, which had flat same-store sales compared to last year.

What’s interesting: So far, Gap doesn’t seem to be hurt by calls to boycott the retailer because it has yet to sign an industry agreement to improve worker safety in Bangladesh. H&M, Inditex (the parent of Zara stores), and other retailers signed the measure after a fire at a Bangladeshi garment factory that killed more than 1,000 people. Gap has said the agreement would expose it to unlimited legal liability. Not signing the agreement hasn’t had a visible impact on Gap’s image or its bottom line, leaving little incentive for the retailer to change its position.