US businesses still look pretty cautious on spending

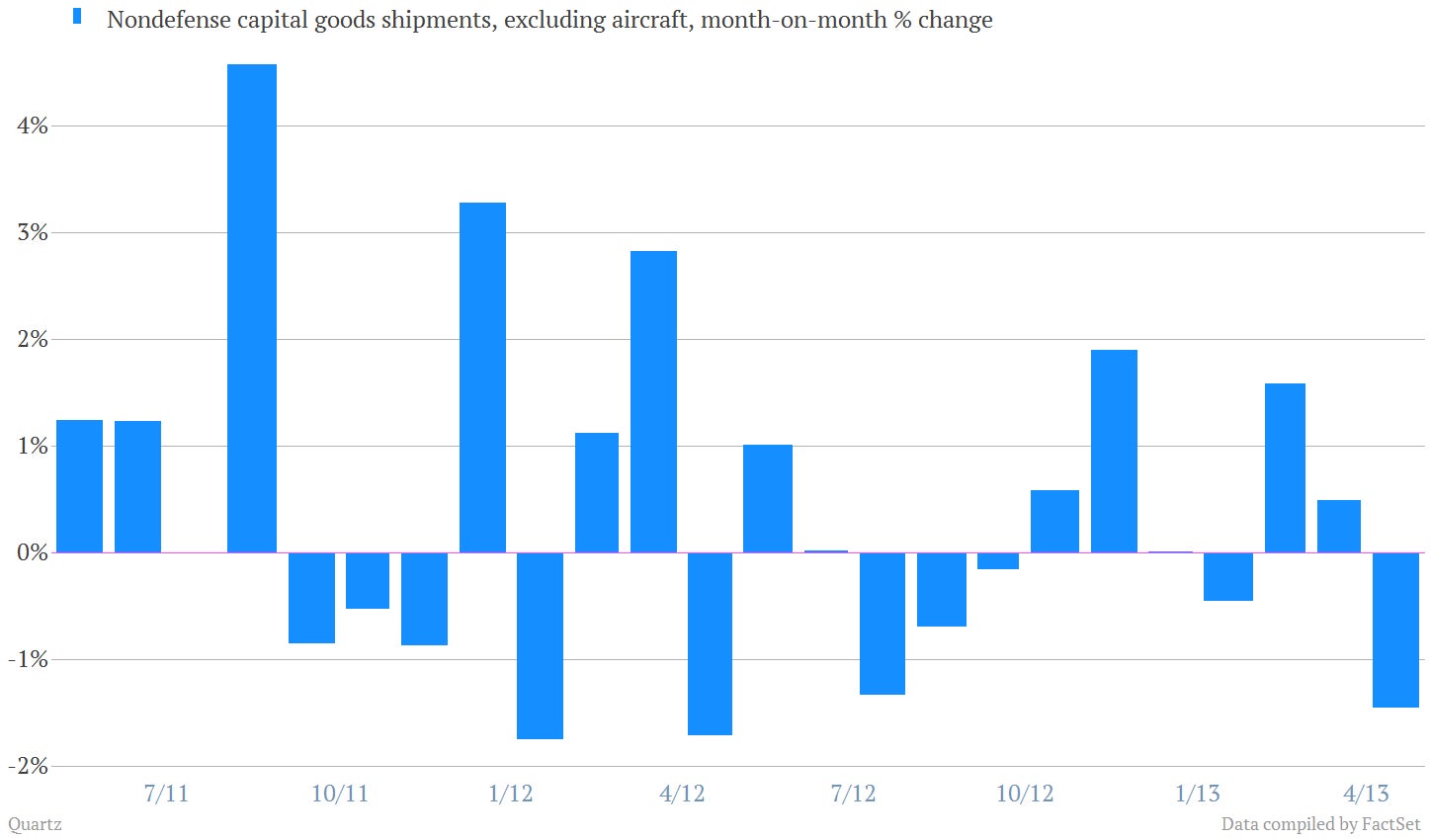

The most important number in today’s report on US durable goods—which tracks items intended to last at least three years like cars, washing machines, ovens and manufacturing machinery—is something called “nondefense capital goods excluding aircraft.” While it’s a choppy data set, economists like to look at it as a proxy for capital expenditures from businesses. Actual shipments of such business equipment have been somewhat soft lately, including a 1.5% decline in April versus March. Here’s a look.

The most important number in today’s report on US durable goods—which tracks items intended to last at least three years like cars, washing machines, ovens and manufacturing machinery—is something called “nondefense capital goods excluding aircraft.” While it’s a choppy data set, economists like to look at it as a proxy for capital expenditures from businesses. Actual shipments of such business equipment have been somewhat soft lately, including a 1.5% decline in April versus March. Here’s a look.

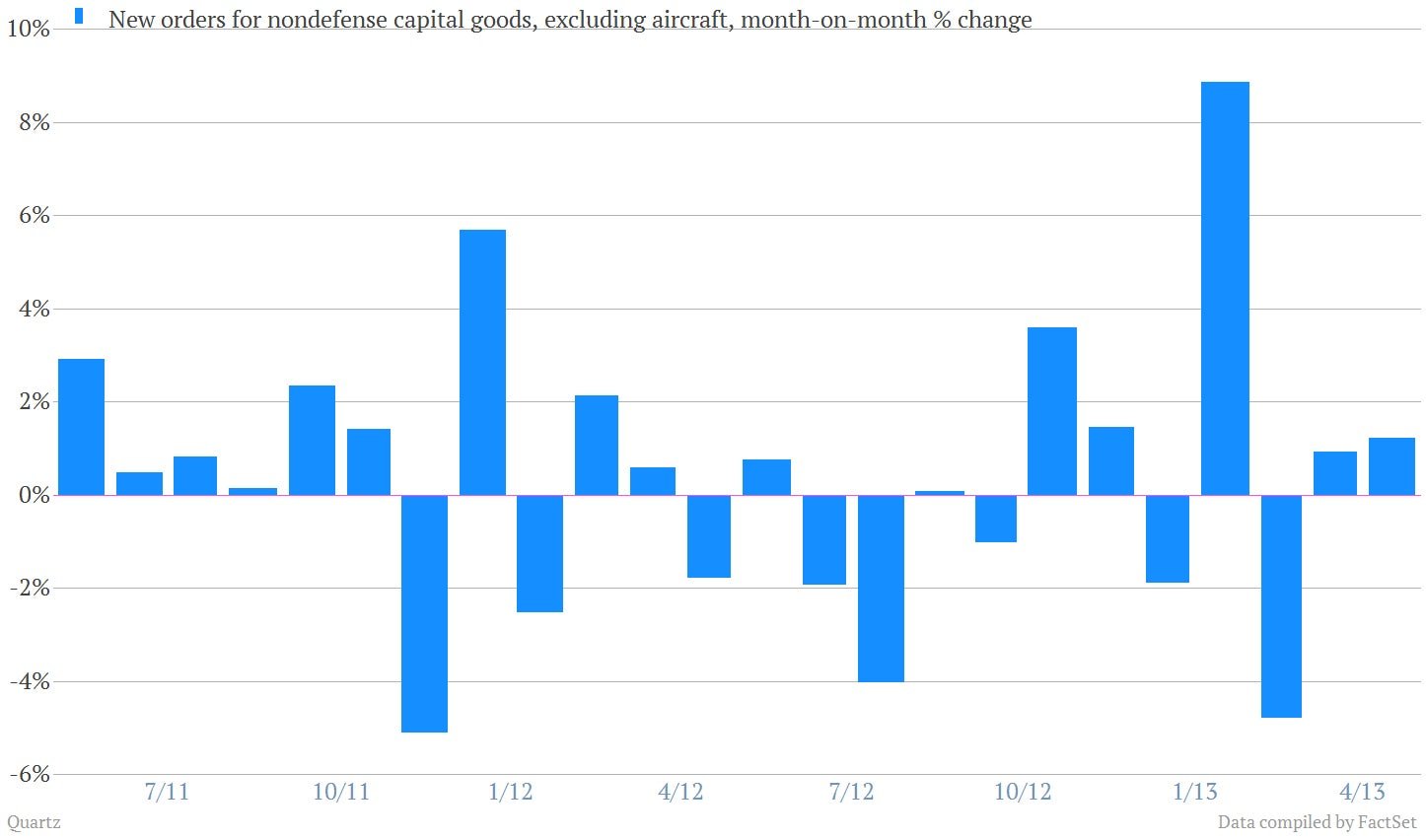

But economists tend to put a bit more weight on the more-forward-looking future orders for such goods, which have been a bit better than expected. Orders rose 1.2% in April and March’s numbers were revised higher to a 0.9% increase.

What to make of it? Here’s the takeaway, according to economists at RBS:

On a three-month annualized basis, orders and shipments of core capital goods both grew at 4.5% in April. In other words, despite some cooling from its pace a few months ago (a development that has been apparent in most other indicators of business activity), business investment in capital equipment continues to advance at a mid-single-digit pace.

In other words, business spending is just kind of puttering along but shows no signs of rocketing up any time soon.