If you’re in the jewelery business, Shinzo Abe is your new best friend

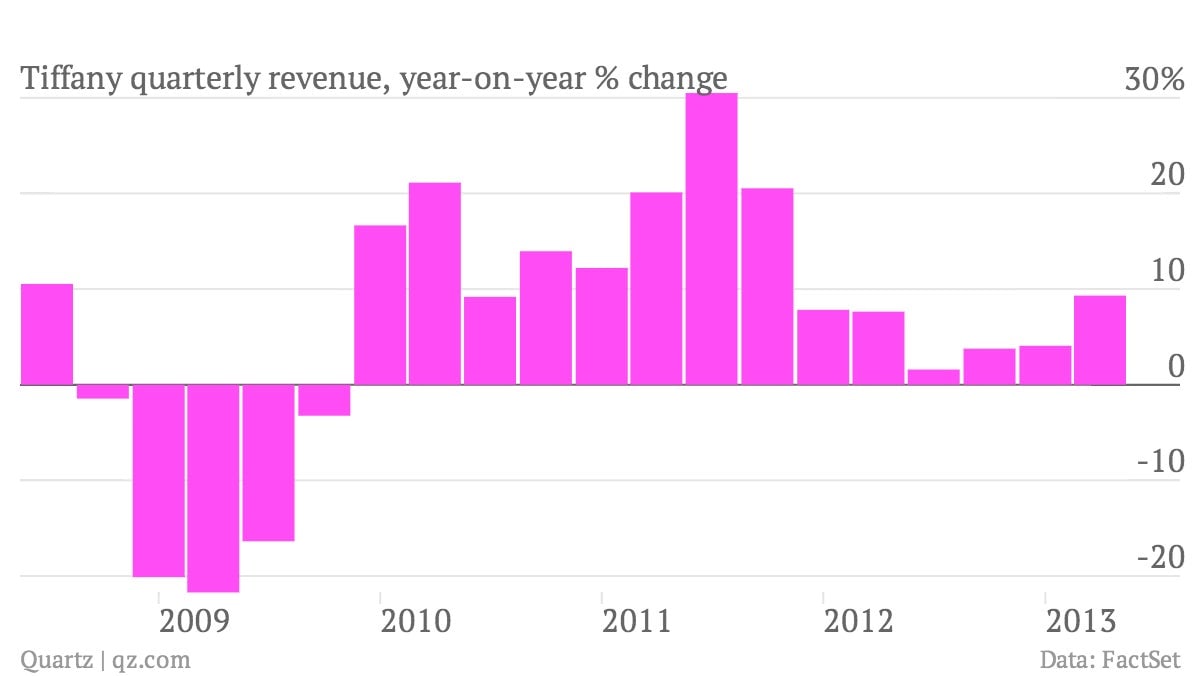

The numbers: Strong. Tiffany’s profit rose 2.5% year-over-year. Sales jumped a much better than expected 9.3%. The stock shot up.

The numbers: Strong. Tiffany’s profit rose 2.5% year-over-year. Sales jumped a much better than expected 9.3%. The stock shot up.

The takeaway: There’s little sign that demand for luxury goods from affluent Asian consumers is tapering off. Asia-Pacific sales were up 15%. Greater China sales ramped up 14%. Same-store sales in the region grew a bit more slowly, at 9%.

What’s interesting: The real story buried in Tiffany’s earnings is Japan, where there are increasing signs that prime minister Shinzo Abe’s combination of stimulative monetary and fiscal policy—known universally as Abenomics—is changing consumer behavior. Same-store sales in Japan surged 21% over the same period of the year before, on a constant exchange rate basis.

Of course, this looks less impressive in dollar terms because the yen has been weakening so much. Tiffany executives said Japan sales in dollars were up only about 2%. But even so, the bump in Japan sales suggests that Abenomics really might be having its intended effect, which is to encourage Japanese consumers to spend more by convincing them that higher inflation is on the way. “We believe a portion of the first-quarter sales growth certainly reflects the strength of our brand,” Tiffany executives told analysts on its post-earnings conference call. “We also attribute the unusual strength to recent reports of a surge in household spending in Japan, likely tied to the Japanese government’s efforts to stimulate their economy.”

And this seems to be something that could bode well for luxury brands especially, as Japan is one of the world’s largest markets for luxury goods. Check out this chart from a Barclays research note, which spotlights a surge in Japanese spending on luxuries lately.