Does rising volatility herald the end of the big stock market rally?

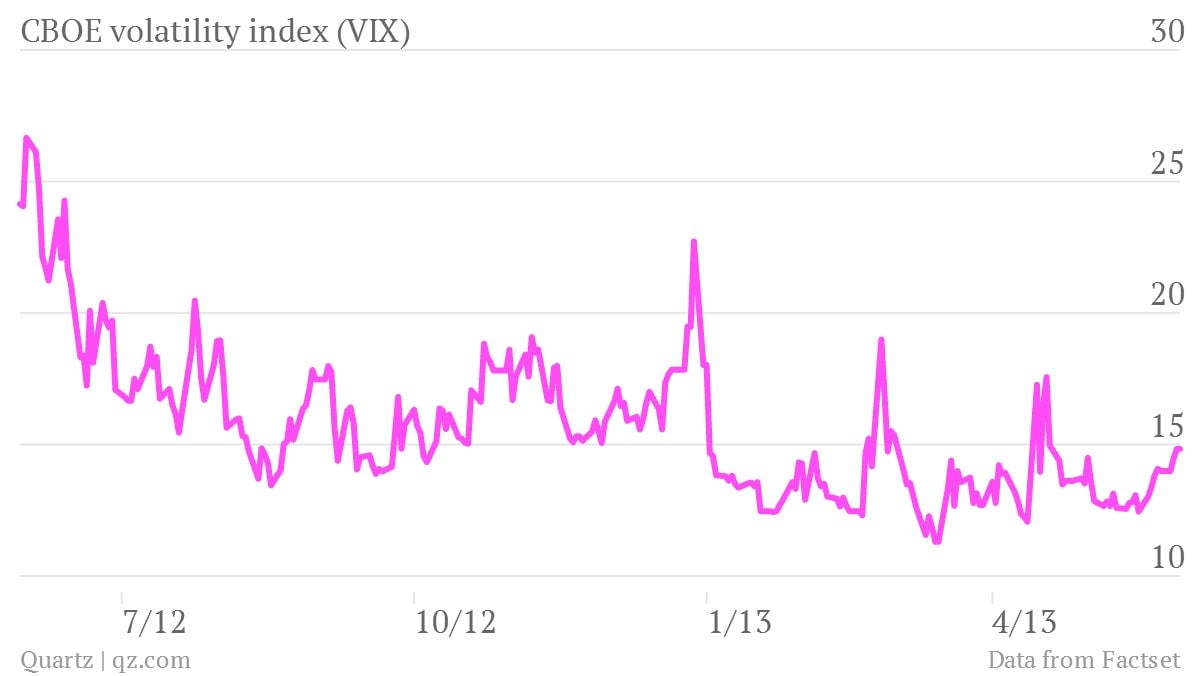

Traders have been fussing about rising interest rates on US Treasurys, steep declines in the Nikkei, and increasing market volatility. The VIX, Wall Street’s “fear index,” had been hovering at all-time lows recently, but then it turned around and steadily rose over the last month.

Traders have been fussing about rising interest rates on US Treasurys, steep declines in the Nikkei, and increasing market volatility. The VIX, Wall Street’s “fear index,” had been hovering at all-time lows recently, but then it turned around and steadily rose over the last month.

It’s hard to predict market behavior based on a single indicator, but ultra-low volatility periods tend to correspond with market peaks historically. Conversely, markets lows tend to correspond with peaks in the VIX. Coincidentally, stock markets have been hitting all-time highs. That raises the question: is the era of low volatility ending and taking the bull market with it? If so, is this the moment to get out of stocks?

Possibly, but several factors may continue weighing on volatility, prolonging the rally: Easy monetary policy has kept the VIX extremely low. Traders are fretting about a shift in monetary policy, given recent remarks by Federal Reserve Chairman Ben Bernanke and his cohorts about dialing back quantitative easing (or in Fedspeak, “tapering” it).

But even if the Fed tapers bond purchases, it’s not about to completely pull the plug on QE. The central bank has been highly reactive to economic data. If the US economy blinks, the Fed will come to the rescue. Plus, Europe’s flagging economy is bad but less risky than it was a year ago, and the effects of Abenomics in Japan aren’t likely to rock markets soon.

Deutsche Bank’s equity analysts hold a similar view (emphasis is ours):

An exit of QE is a necessary precondition for a stronger equity markets and a more robust underpinning to global growth. It does not change our fundamental view on the attractiveness of the equity asset class. We expect episodic volatility to provide attractive entry points for equity investors in coming months.