Even the Fed says the QE-fueled stock surge helps the rich the most

The Fed has been pretty clear. The whole point of its plan to create new money and push it into the economy—quantitative easing—was to lower borrowing costs and raises the price of assets like houses and stocks.

The Fed has been pretty clear. The whole point of its plan to create new money and push it into the economy—quantitative easing—was to lower borrowing costs and raises the price of assets like houses and stocks.

And rise they have, especially stocks. The stock market is some 145% higher than it was during March 2009, some of the bleakest days following the financial crisis.

Risings stocks have done a lot of good. For one thing, the climbing market has done wonders for consumer sentiment over the last few years. That’s no small thing; consumer sentiment is closely tied to spending. And in the US, consumer activity accounts for roughly 70% of the economy. In short, if the consumer didn’t recover, neither would the US economy.

But for the record, feeling good doesn’t necessarily make you rich.

The cold hard fact is that the rich have benefitted the most from the Fed-fueled surge in stocks. Even the Fed says so.

In its annual report, the Federal Reserve Bank of St. Louis looks at the net worth of American households and comes to this conclusion:

The recovery of wealth has not been uniform across families. Of the total recovery of $14.7 trillion between the first quarter of 2009 and the fourth quarter of 2012, $9.1 trillion, or 62 percent, of the gain was due to higher stock-market wealth. Stock wealth is unevenly held, with the vast majority of stocks owned by a relatively small number of wealthy families. Thus, most families have recovered much less than the average amount.

Roughly 50% of all US families hold stocks either directly or indirectly, according to the most recent 2010 edition of the Fed’s survey of consumer finances. (It conducts the survey every three years.) But among the richest 20% of American households, 91% hold stock. And they own a ton of it. The median value of the holdings among the richest 20% of families is $268,000, dwarfing the median $29,000 stock portfolio held by all US families.

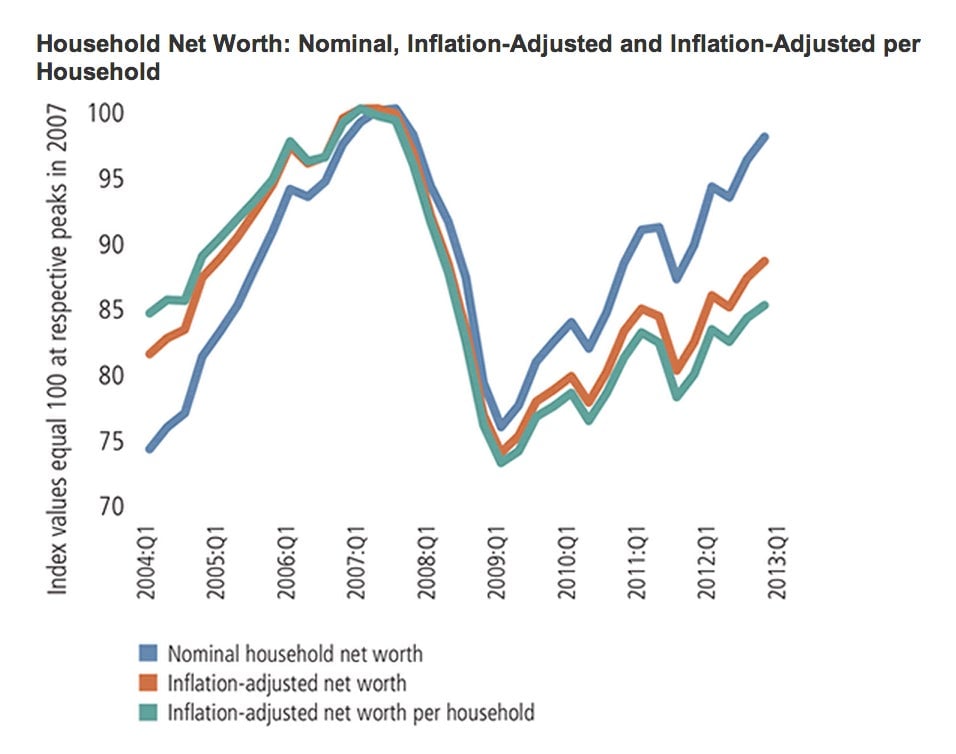

In other words, there’s reason to be wary about assertions that the US consumer balance sheet is healing fast. St. Louis Fed economists use this chart, below, to argue that less affluent Americans still have a lot of healing to do.