Worrying signs for Abenomics: iPads in Japan just got more expensive

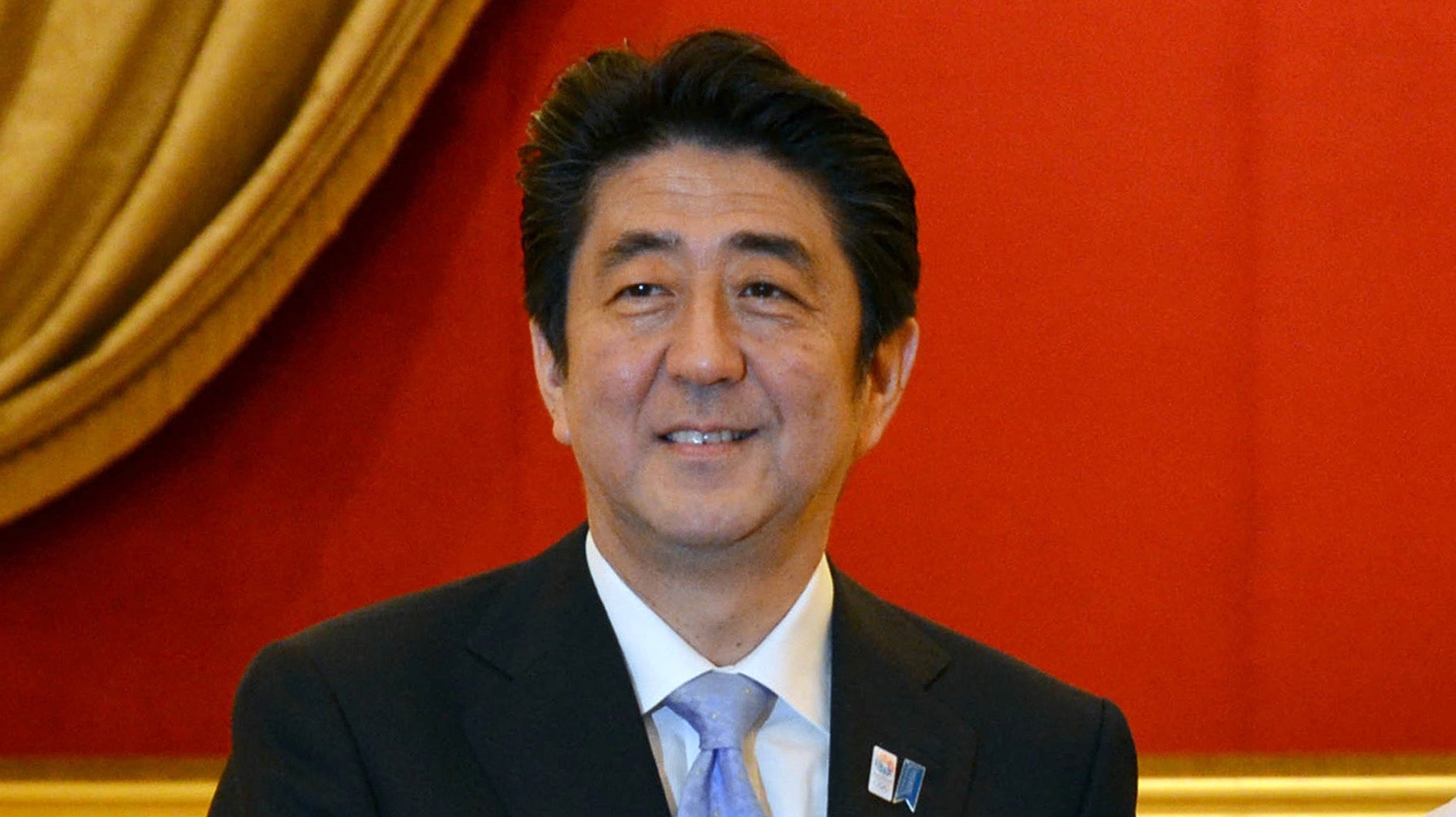

A recent cover from The Economist imagines prime minister Shinzo Abe as Superman. Ok, Abe in a crimson lounge singer jacket is cringe-worthy; so is the “super yen” emblazoned on his chest. But still, the image captures a big misunderstanding about Abenomics: that it’s all about the weakening of the yen.

A recent cover from The Economist imagines prime minister Shinzo Abe as Superman. Ok, Abe in a crimson lounge singer jacket is cringe-worthy; so is the “super yen” emblazoned on his chest. But still, the image captures a big misunderstanding about Abenomics: that it’s all about the weakening of the yen.

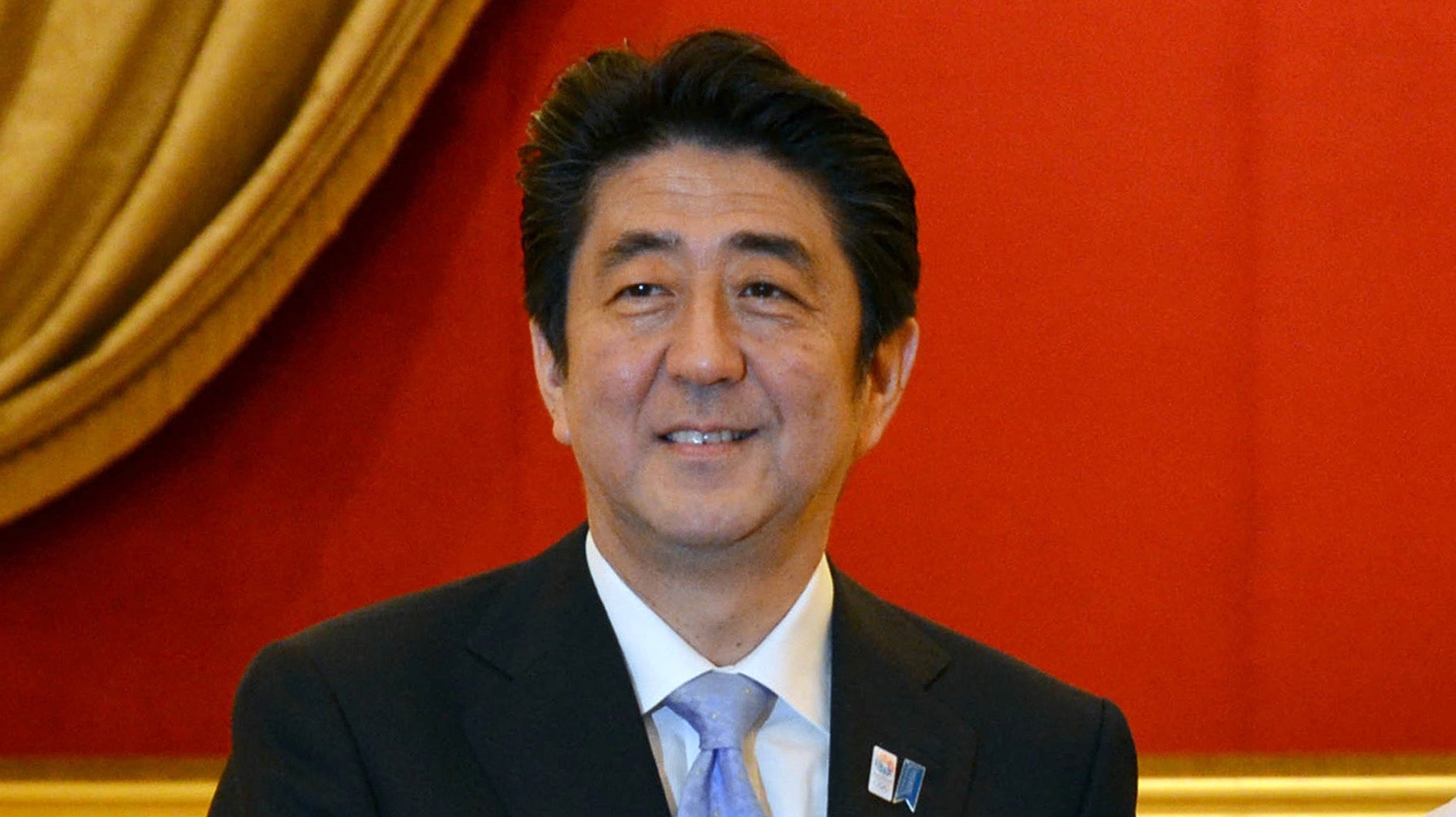

The point of Abenomics is to beat deflation in Japan, not drive up exports to juice growth. Its seismic structural reforms aim to boost household and private sector wealth. In this context, the weaker yen isn’t that important, even though it does boost Japanese exports and stock prices. Why? Because a weaker yen also makes imports more expensive. And Japan imports nearly all of its energy. Unsurprisingly, imports are soaring, even as exports pick up:

Right now, most of those rising imports are probably goods that are priced in dollars—things like commodities, which make up around half of Japan’s imports by value. That import share may continue ticking up if foreign retailers that typically price their goods in yen start raising prices.

Case in point, from a Bloomberg report today: Apple is now selling its fanciest iPad model for ¥49,800 ($493), a 16% increase from its previous price of ¥42,800, or about $424. If you bought one on December 31, when the yen was trading at 86.75 to the dollar, Apple would have brought back to the US (or Ireland?) $493—exactly what it happens to be worth right now at the current exchange rate. Apple declined to share its rationale with Bloomberg, but it’s pretty obvious that the company is trying to keep its prices stable in dollar terms.

Some think that this amounts to “importing inflation”—a purported cure for deflation. In other words, Japanese consumers might start spending if they feel their purchasing power is declining. The thinking goes: “iPads just got pricier—better get one before they get even more expensive!”

But here’s why that won’t work: Yes, a strong yen coupled with deflation boosted purchasing power in Japan. But juicing consumer spending by reducing purchasing power runs the risk of stagflation (aka, prices rise but the economy still fails to grow). It also risks scaring consumers into saving more, if they start worrying about inflation eating into their savings.

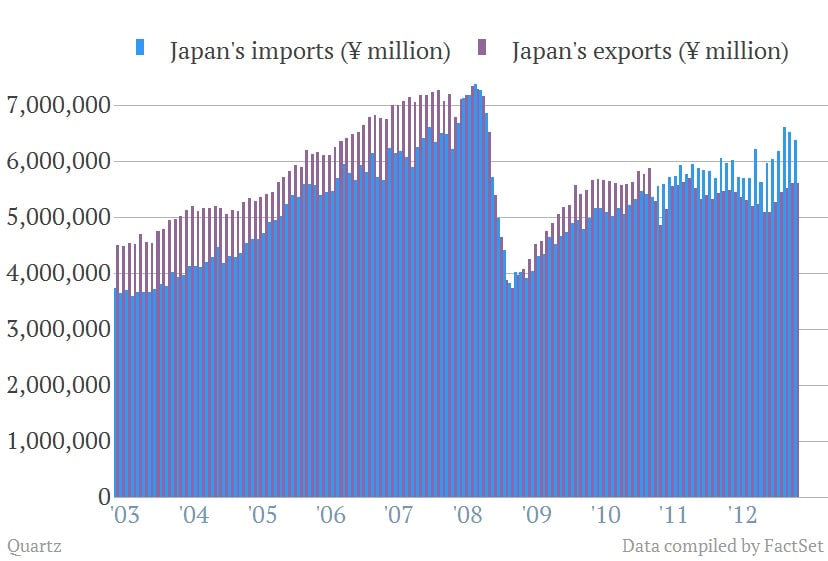

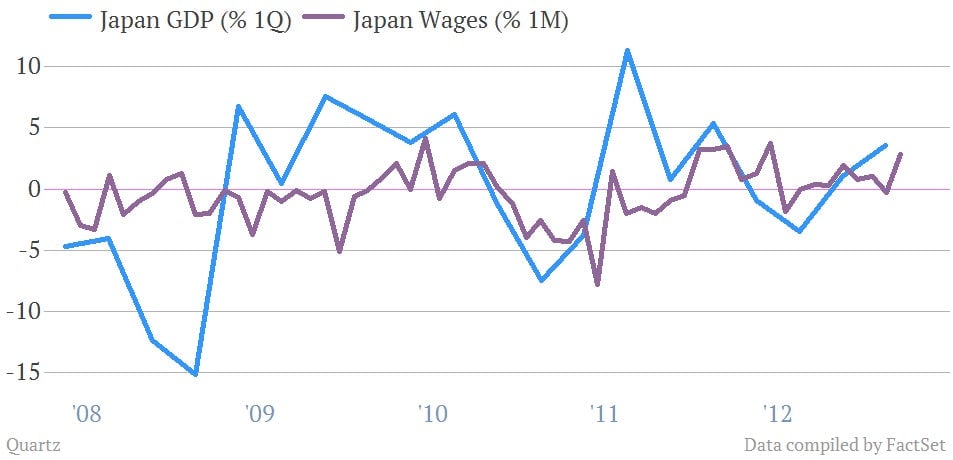

Fixing Japan’s economy requires making Japanese households and businesses feel wealthier. And that comes down to wage growth, which, incidentally, isn’t happening. See below, data out today (the big spikes, by the way, are bonus payouts):

Rising stock and housing markets help consumer confidence to some degree. But to really feel wealthy, workers need their wages to grow faster than the economy. And that hasn’t happened even when Japan’s economy has been tanking:

If the trend continues (Japan is expecting 2.9% growth in its upcoming fiscal year), workers will just keep saving. Cue the next Lost Decade—and an Economist cover of Shinzo Abe falling from the skies.