In the past, if there was one thing consistent across the entire Republican Party, it’d be a shared hatred of taxes. That’s what makes a meeting to be held today (Feb. 8) between officials of the US government and a group of Republican policy wonks so interesting. In the meeting, the conservative thinkers will propose that the best solution to fighting the threats of global warming is to implement a carbon tax.

The group includes members of Republican governments led by Ronald Reagan, George W. Bush, and Richard Nixon. Their report calls for a four-step plan, as summarized in the Wall Street Journal:

First, creating a gradually increasing carbon tax. Second, returning the tax proceeds to the American people in the form of dividends. Third, establishing border carbon adjustments that protect American competitiveness and encourage other countries to follow suit. And fourth, rolling back government regulations once such a system is in place.

Scientists and economists have been making a case for implementing carbon taxes for decades. So this isn’t a radical idea, but it is courageous. Did I mention Republicans hate taxes?

To attempt to convince the Republican government to accept a tax, they’re spinning it as a sort of insurance policy that hedges against the risks associated with climate change. Carbon emitters would pay $40 per ton of carbon-dioxide emissions to start—and the money would be dispersed to the American public. The proposed plan would provide every four-person family about ”$2,000 in carbon dividends in the first year, an amount that could grow over time as the carbon tax rate increased.”

Instead of bloating government spending and repealing regulations slowly to make government smaller, the group of Republicans are suggesting dividends. And because national carbon taxes can make a country less competitive, they perform another neat trick:

When American companies export to countries without comparable carbon pricing systems, they would receive rebates on the carbon taxes they have paid. Imports from such countries, meanwhile, would face fees on the carbon content of their products. Proceeds from such fees would also be returned to the American people through carbon dividends. Pioneering such a system would put America in the driver’s seat of global climate policy. It would also promote American competitiveness by penalizing countries whose lack of carbon-reduction policies would otherwise give them an unfair trade advantage.

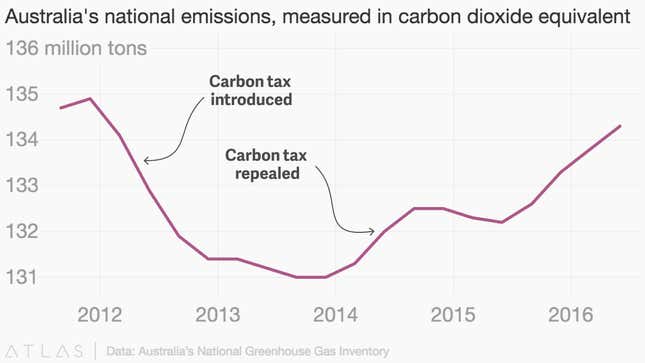

But US president Donald Trump doesn’t even need to read the four-page report to be convinced that the plan could work. He just needs to look at what happened in Australia when the country levied a carbon tax:

Although carbon taxes have existed in many countries going back as far as 1990, Australia’s move attracted a lot of attention because it was one of the most comprehensive executions of the idea yet. The country implemented a tax of AUD$23 (about US$19 in 2012) per ton of carbon emissions on 500 of the country’s biggest emitters.

Soon after the implementation, as the chart above shows, Australia’s emissions fell rapidly. It was the steepest recorded emissions decline in a decade of Australia’s attempts to implement better environmental policies. (The trailing fall and subsequent rise may have been caused by the anticipation of the tax coming into force and then being repealed, respectively.)

Sadly, however, the perception of the tax caused huge problems for then-prime minister Julia Gillard. “The heat, anger and vitriol directed at her as a leader—and as Australia’s first woman to be prime minister—coalesced around the promise and the tax,” said the New York Times after Gillard was replaced by a right-leaning government, which repealed the tax.

The experiment lasted for a very short time, but it shows that if a country is determined to cut its carbon footprint drastically, there’s a way. Of course, they’ll still need to convince Trump’s fact-denying advisers that climate change is real.