Mark Wahlberg and Steve Case are two of the many star investors in a “stock market for sneakers”

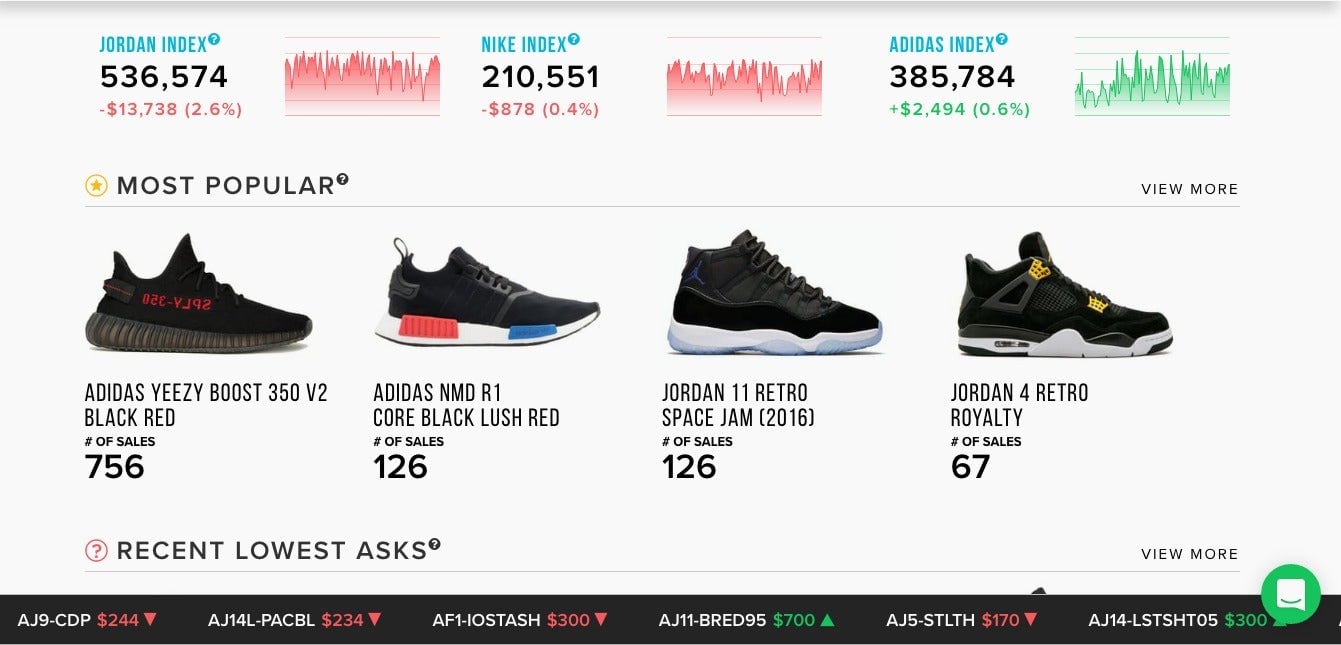

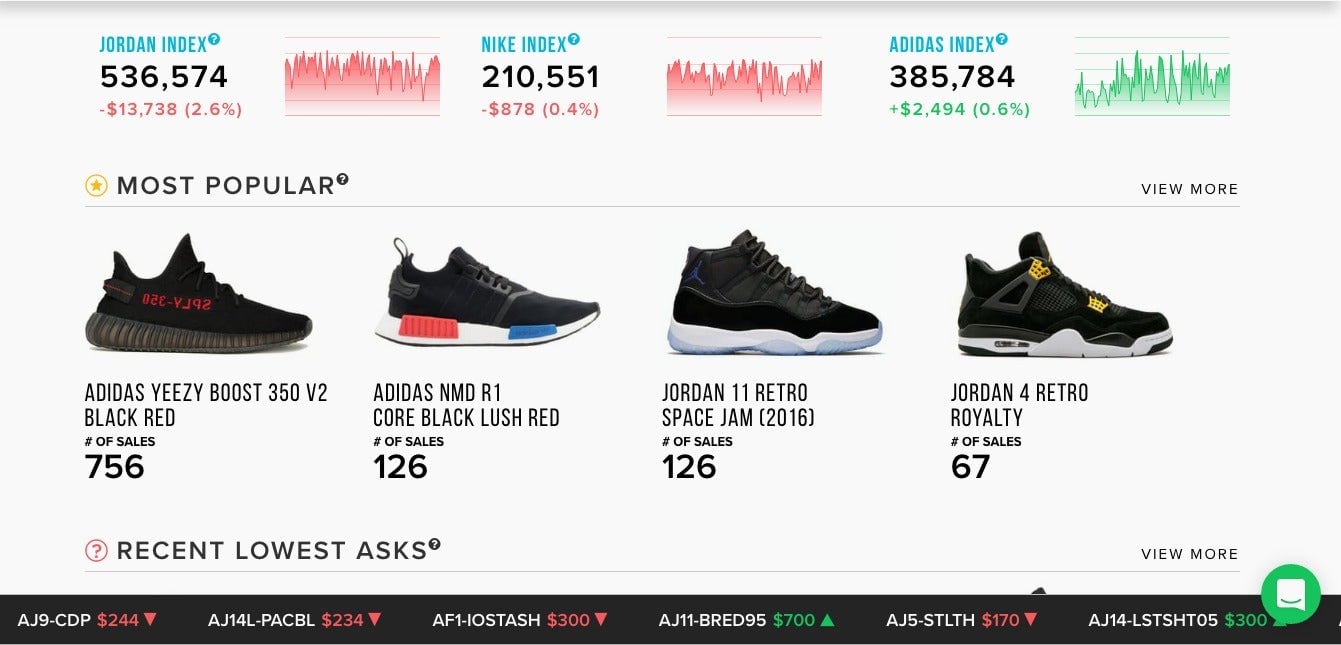

StockX is an unusual company. It bills itself as a stock market for sneakers, and works by allowing people to buy and sell highly sought shoes, such as Jordans or Kanye West’s Yeezy Boosts, in new condition through an anonymous bidding system that helps to ensure products sell at the going rate. That rate fluctuates depending on what people are willing to pay, like a stock market. It even has a ticker that runs across the bottom of the site showing current prices.

StockX is an unusual company. It bills itself as a stock market for sneakers, and works by allowing people to buy and sell highly sought shoes, such as Jordans or Kanye West’s Yeezy Boosts, in new condition through an anonymous bidding system that helps to ensure products sell at the going rate. That rate fluctuates depending on what people are willing to pay, like a stock market. It even has a ticker that runs across the bottom of the site showing current prices.

It grew out of site called Campless that acted as the premier data clearinghouse on the sneaker resale market, which the highest estimates value at around $1 billion, but its ambitions are bigger than shoes. It wants to be a stock market for all sorts of things, and it has attracted an all-star stable of investors who appear to believe it can be.

The company announced today (Feb. 15) it had closed a $6 million round of funding. Among those who have bought in so far are:

- Steve Case, cofounder and former CEO of AOL

- Tim Armstrong, current CEO of AOL

- Mark Wahlberg, actor and hamburger tycoon

- Ted Leonsis, owner of a sports empire including the Washington Capitals hockey team and the Washington Wizards basketball team (and former president of AOL)

- Scooter Braun, owner of a talent management and media venture firm with clients such as Kanye West, Justin Bieber, and Arianna Grande

- Eminem and Paul Rosenberg, the prominent rapper and his manager, who additionally handles acts including Action Bronson

- Jon Buscemi, fashion and sneaker designer

StockX was founded a year ago by Josh Luber, the creator of Campless, and Dan Gilbert, founder of Quicken Loans and majority owner of the NBA’s Cleveland Cavaliers. Luber’s connections and knowledge of the healthy secondary market for sneakers quickly helped it get established. A spokesperson for the company says it now does thousands of trades per week, and averages millions of visitors across its site and mobile apps each month. Every sale earns it a 9.5% transaction fee from the seller, though it drops that fee after three successful sales.

StockX announced Eminem’s involvement in June, saying at the time that he was ”the first of what is [sic] expected to be several high profile investors.” And Luber has also been doing his part to raise awareness of the company, appearing on The Daily Show, for instance, in a segment that poked fun at the rabid sneaker collectors called sneakerheads.

But StockX says it wants to become the platform for any product with a viable secondary market. It has a long way to go before that happens, but its investors are apparently optimistic. In a press release, Leonsis said a “‘stock market of things’ has the power to transform both commerce and finance, and we will help however we can.”

It certainly doesn’t hurt to have so many big names on board.