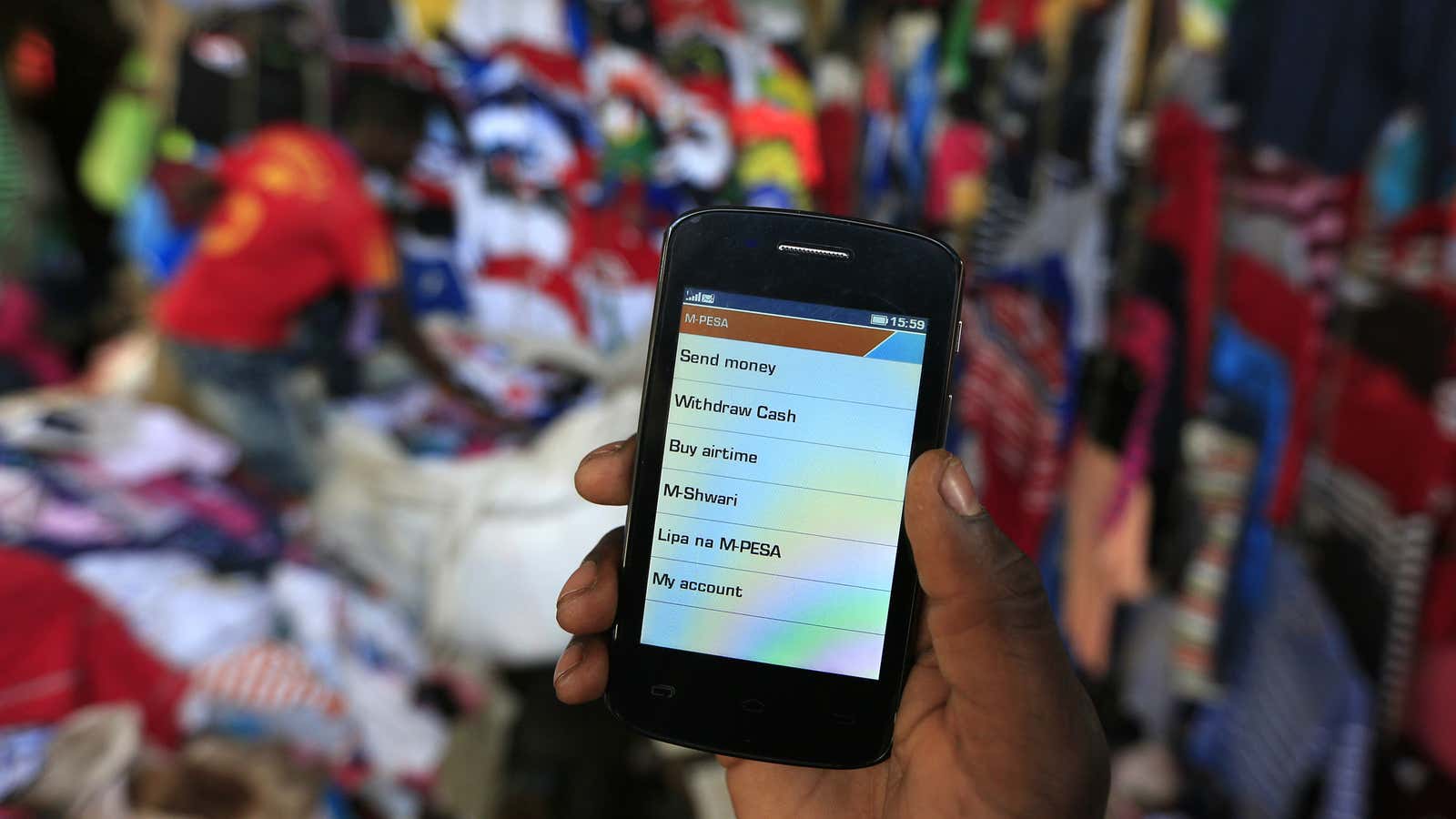

Nearly ten years after its launch, M-Pesa finally has what could be a major competitor in the multi-billion dollar mobile money transactions business.

Kenyan banks, who petitioned regulators to prevent M-Pesa’s launch in 2007, have now launched PesaLink, a mobile and electronic money transaction service.

After regulators quashed banks’ concerns and gave M-Pesa a chance in Mar. 2007, banks were amongst the first players to strike partnerships with the service after its run-away success from the onset. At least 40 banks used it to grow their deposits, issue out loans and facilitate bills payments serving over 3.1 million customers every month. In 2012, the banks estimated they were losing up to $22 million annually in commissions to mobile money providers such as M-Pesa and Airtel.

While M-Pesa limits daily money transfer amounts to 140,000 Kenya shillings ($1,400), banks have set the limit at up to $10,000 meaning they are likely to attract a larger constituency of high value transfers. PesaLink transactions can also be initiated from the mobile phone, the banks’ branch, at the ATM, at agency banking outlets or via the Internet.

“The banks can deliver scale because as a customer, you get to keep your bank account and still transact with people having accounts in other banks in real time,” says Eric Musau, an analyst at Nairobi-based Standard Investment Bank.

“It is certainly a much stronger proposition and competitor to M-Pesa.”

Kenyan Bankers Association chief executive Habil Olaka sees PesaLink as a “complementary tool” to existing financial products including mobile money.

Users can transact up to $5 free of charge unlike M-Pesa’s feeless limit of $1. They also don’t have to rely on M-Pesa or other mobile money services and can simply transfer money from one bank account to another in real time using the banking sector platform.

George Bodo, head of banking research at Ecobank says the costs and waiting period associated with transacting large value transactions of say, $10,000 will decline significantly. The previous process involved drawing of cheques or making electronic funds transfers, which are lengthy and costly.

“This is just an enhancement in the retail payments space. It is what the banks should have done a while back,” he tells Quartz.

But, a crucial competitor advantage with M-Pesa is its ubiquity and the ease with which it has helped millions of people access financial services. In the past many of these people were locked out because the cost of owning a bank account was way too high for them.

“Like most products that go on to dominate their respective sectors, Safaricom’s M-Pesa is synonymous for mobile money transfer and for this reason we think it will be difficult for the banks to significantly disrupt this relationship,” analysts at Exotix Partners observe (pdf).

Currently, M-Pesa controls 85% of person-to-person money transfer valued at over $7 billion in the first half of 2016. In second place is Equitel, a mobile money service operated by Equity Bank, at 15% with $1.1 billion in transfers in the same period.