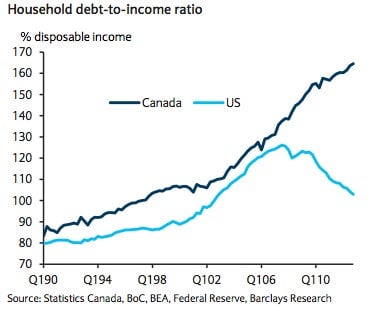

Canadians are now much deeper in debt than Americans

In the immediate aftermath of the financial crisis, Canadians were feeling pretty good about themselves. And that was their right.

In the immediate aftermath of the financial crisis, Canadians were feeling pretty good about themselves. And that was their right.

Canada’s banks weathered the crisis well and bolstered their reputation as some of the world’s soundest financial firms. As US debt government debt levels surged, Canadian government bonds became an investor darling. And the Canadian economy bounced back faster than the US after the crisis, as Canadian consumers and borrowers took advantage of rock-bottom interest rates.

But then a funny thing happened. As the US has struggled with a half decade of piddling growth, housing foreclosures and a credit crunch, US household debt has dropped sharply. Meanwhile, Canadians continued borrowing. Check out this chart from Barclays which captures the dynamic.

Canada’s steady climb is worrisome. Earlier this year Moody’s chopped ratings on a slew of Canadian banks, citing “exposure to the increasingly indebted Canadian consumer and elevated housing prices.” In recent speeches, former Bank of Canada head Mark Carney—who will be taking over at the Bank of England shortly—has issued sharp warnings about the country’s over-reliance on consumer debt. (Never mind that the whole thing happened on his watch.)

What’s caused the spike? A report from published in the Bank of Canada Review suggests that Canadians are responding to rising housing prices by borrowing against the value of their homes.

Significant gains in house prices over this period have eased borrowing constraints for some households by raising the amount of collateral available to support borrowing against home equity. Financial innovation that made it easier for households to access this type of borrowing has probably been another important factor.

Note the two scariest words in that excerpt: financial innovation. Practically every financial innovation since the birth of automated teller machine has involved banks making risky loans to people who can’t pay them back, and then watching the government pick up the tab.