The plunging Hang Seng suggests another awful year for Hong Kong IPOs

Hong Kong isn’t a friendly place for companies looking to raise capital. As the Hang Seng tumbled 2.19% today, China Harmony Auto Holding Ltd—a dealership shelling Rolls Royces, Ferraris and other posh rides—lost 15.6% in its first day of trading today, following its IPO last week. And Hopewell Hong Kong Properties, a real estate developer, decided against the $780 million IPO it was planning for today. Hopewell’s was the biggest IPO to be shelved in more than a year.

Hong Kong isn’t a friendly place for companies looking to raise capital. As the Hang Seng tumbled 2.19% today, China Harmony Auto Holding Ltd—a dealership shelling Rolls Royces, Ferraris and other posh rides—lost 15.6% in its first day of trading today, following its IPO last week. And Hopewell Hong Kong Properties, a real estate developer, decided against the $780 million IPO it was planning for today. Hopewell’s was the biggest IPO to be shelved in more than a year.

That’s a stark reversal in market sentiment since just weeks ago, when investors rushed into the IPOs of Galaxy Securities, a mainland brokerage, and Sinopec Engineering, yet another business unit of China’s state-owned oil giant. Both were about 30 times oversubscribed.

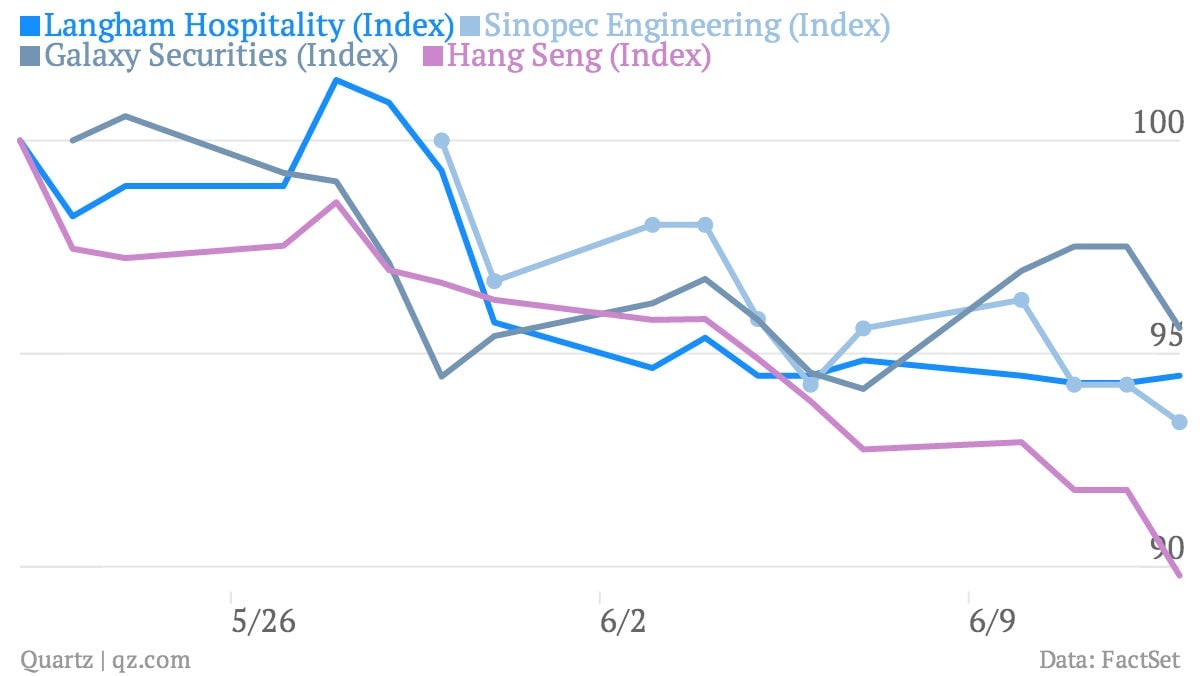

The Hang Seng has fallen 9.3% in the last month. Here’s a look at the trend so far in 2013:

Too bad for the 20 companies that, unlike Hopewell, have gone ahead with their IPO plans this year. And after raising a combined $5 billion, those firms have fallen an average of 2.2% since their openings, according to Bloomberg data.

Some have fared worse. Langham Hospitality Investments lost 9.2% on its debut. That’s the worst opening day of all global IPOs valued at over $400 million so far this year, reports the Wall Street Journal. Galaxy Securities and Sinopec Engineering, two other prominent Hong Kong IPOs, are down 5.8% and 4.7%, respectively. As you can see from this indexed look at a few of these new listings, the broader market has performed even worse:

The Hang Seng is tied closely to China’s economic performance. The weaker the Chinese economy, the more companies may hesitate to list on the exchange.

So will other companies be scared away from a Hong Kong IPO? There are many big IPOs scheduled for the Hong Kong Exchange. The most prominent is the IPO for Alibaba, which is rumored to be listing on the exchange within the year. Macau Legend Development Ltd, a casino operator, and NW Hotel Investments are also expected to roll out major public offerings later this year.

Hong Kong had another terrible IPO season last year, when only 62 companies listed on the exchange, down 30% from 2011. KPMG reports that only in 2003 and 2008—the year when SARS broke out and the year of the financial crisis, respectively—did Hong Kong host fewer. The size of the offerings also fell 67% from the previous year.