For months, South Africans have fretted about the possibility of a credit-ratings downgrade, concerned it would affirm that president Jacob Zuma’s leadership and infighting in the ruling African National Congress were dragging the country in the wrong direction.

On April 3, ratings firms confirmed their worst suspicions.

Following Zuma’s decision to fire finance minister Pravin Gordhan, Standard and Poor’s stripped South Africa of its BBB- investment-grade credit rating and assigned it a “junk” rating of BB+. The ratings firm also changed its outlook on South Africa to negative, given the political tumult.

On news of the downgrade, the rand immediately slumped 3% against the dollar and #junkstatus started trending on local social media (it didn’t help that there was a tremor in across South Africa around the same time either, due to an earthquake in Botswana).

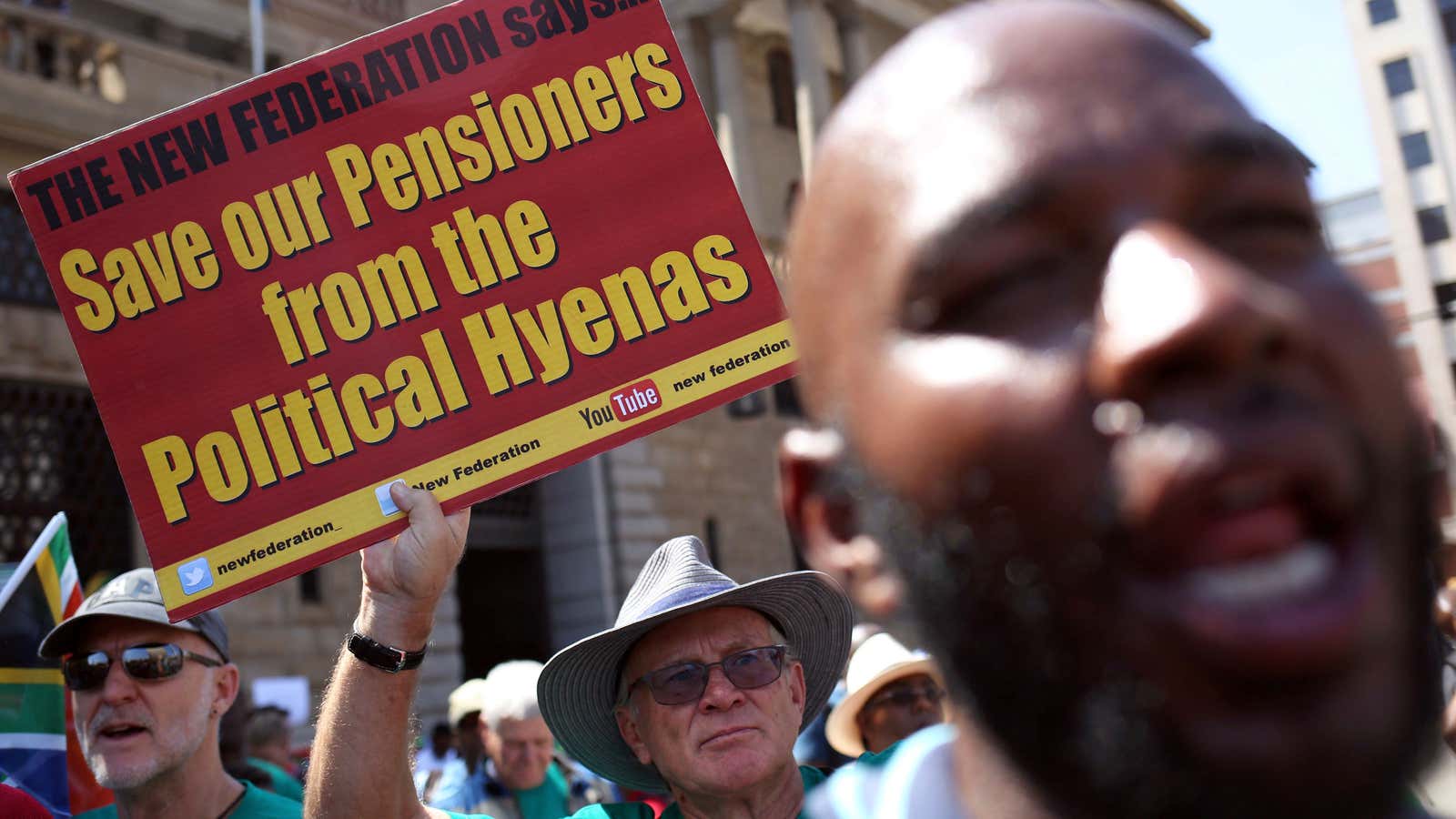

The review was directly attributed to Zuma’s decision to fire Gordhan and deputy finance minister Mcebisi Jonas in a midnight reshuffle on March 31. The initial fallout was immediate: the rand plummeted, senior party leaders accused Zuma of acting unilaterally, and people began to protest. Next came the response from S&P, which was scheduled to review South Africa’s economy in June, but found the recent developments too risky to ignore.

“In our opinion, the executive changes initiated by president Zuma have put at risk fiscal and growth outcomes,” the ratings firm said in a statement. “The negative outlook reflects our view that political risks will remain elevated this year.”

Ratings firm Moody’s soon followed suit, saying it was placing the country’s BAA2 rating on review, which is already just above non-investment grade, or “junk.” Like S&P, Moody’s attributed its decision to Zuma’s decision to shuffle his cabinet.

“Changes within a government do not generally signal material changes in a country’s credit profile,” Moody’s said in a statement. “Here, however, the timing and scope of the reshuffle raises questions.”

Just hours before the ratings announcement, new finance minister Malusi Gigaba sounded convinced South Africa would not be downgraded: “There’s so much going on in our country that changing a certain individual won’t cause a credit downgrade,” he said in his first day at national treasury.

In an about-turn on April 4, Gigaba told reporters that he’d known about the S&P decision since March 31, but said the ratings company had taken him into their confidence. He added that he has already met with Moody’s and Fitch and hoped to “address perceptions” about South Africa’s political climate. If anything, he said the downgrade was an opportunity to “ignite growth.”

“We acknowledge yesterday’s setback,” he said. “Despite our challenges now is not the time for despondency.”

He also tried to assure South Africans that he would steer the economy on a steady growth path, a tough task considering the economy grew by just 0.3% last year. Gigaba listed all the positive economic features he could think of—a floating exchange rate, effective tax collection, a sound banking system and more—but that would bring little comfort to South Africans anxiously watching the currency.

In a year-long political feud between the presidency and treasury, Gordhan has faced possible arrest, fraud charges and political isolation. Each time, the rand has suffered, driving national anxiety. It probably didn’t help that Gordhan was pulled out of planned meetings with ratings firms before his axing. After he was finally fired, the former finance minister was hailed as a national hero against corruption.

The political uncertainty has real economic consequences. South Africans are already in debt, nationally and individually: public debt was 50,1% last year and 20% of consumers were three months in arrears (pdf). South Africans—and the markets—were already wary of Gigaba taking the reigns.

The ratings downgrade will make borrowing more difficult for the South African government and international markets will take their money to more attractive economies, according to economists.

For ordinary South Africans, the downgrade will likely drive up interest rates. It could force the government to increase value added tax, which would hit the poor, or raise taxes on the already over-taxed middle class.

This story has been updated with Moody’s announcement of its review and Gigaba’s latest comments.