US economic data: Yes, it’s still good

There’s only one way to describe today’s US economic data. Good. (Or possibly, darn good.)

There’s only one way to describe today’s US economic data. Good. (Or possibly, darn good.)

Granted, the reports received today aren’t exactly top quality releases. But they’re still worth spotlighting.

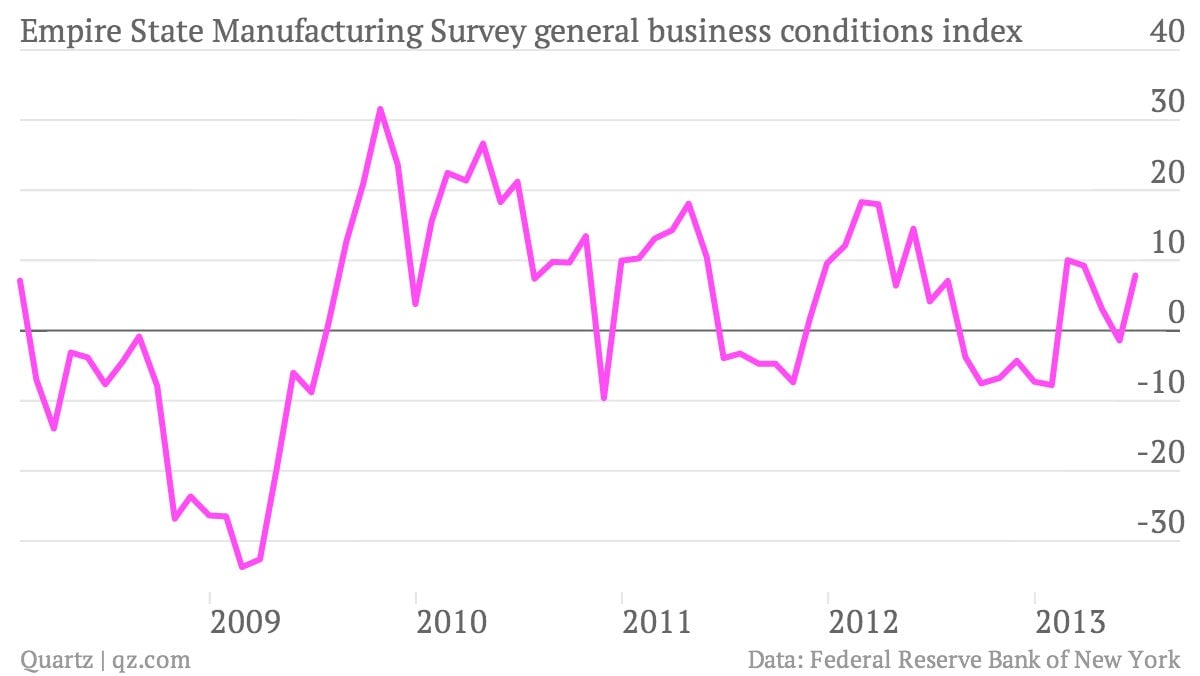

Despite its name, the New York Fed’s Empire State manufacturing survey queries factory managers in Northern New Jersey, Connecticut as well as New York about business conditions. That’s a relatively limited geography, but the survey results are also some of the first economic reports in the monthly cycle to comment on the current month. The Empire survey’s general business conditions index bounced back into positive territory in June, rising to reading of 7.8 in June, up from -1.4 in May. (Anything above zilch reflects expansion.) Calculated Risk points out, however, that some key sub-indexes in the report didn’t look so hot.

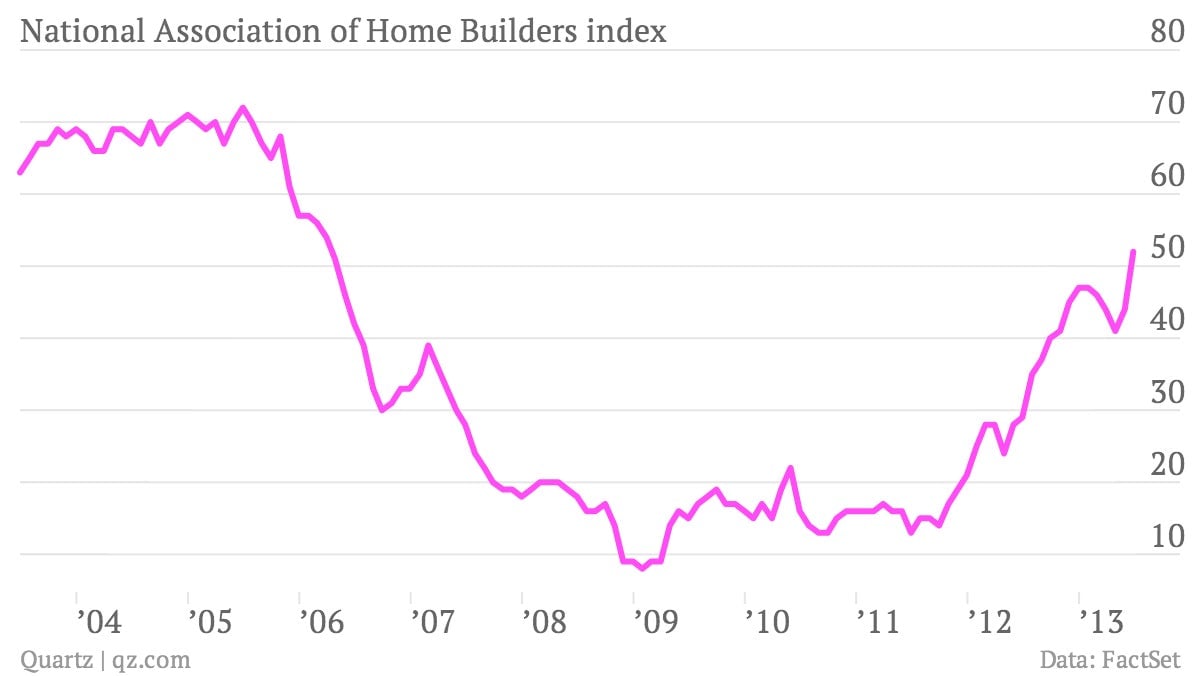

Meanwhile, over in the US housing market things seem to be developing nicely. So nicely, in fact, that sentiment among US homebuilders is hitting highs not seen since some of the boomiest days of the housing boom. The National Association of Home Builders sentiment index jumped to a reading of 52 in June. That’s the highest since back in March 2006. With housing at the crux of US economic issues in recent years, this is really good to see and bodes well for construction hiring.

As a result of the economic data, US stocks are having a decent day. And in the bond markets, interest rates are up a bit, but not a ton. That suggests investors don’t expect that the ongoing improvement in economic data means that the Fed is going to suddenly abandon the support its been offering to the economy. Of course, Fed Chairman Ben Bernanke’s presser on Wednesday—after the Fed publishes its most recent monetary policy statement—is going to be the main market mover of the week.