Elon Musk made a stealth visit to China this week

Over the past two years, American tech CEOs eager to break into the elusive China market have made a habit of posing for the cameras with Chinese government officials. Yet the most recent instance of a staged photo op has occurred in relative stealth.

Over the past two years, American tech CEOs eager to break into the elusive China market have made a habit of posing for the cameras with Chinese government officials. Yet the most recent instance of a staged photo op has occurred in relative stealth.

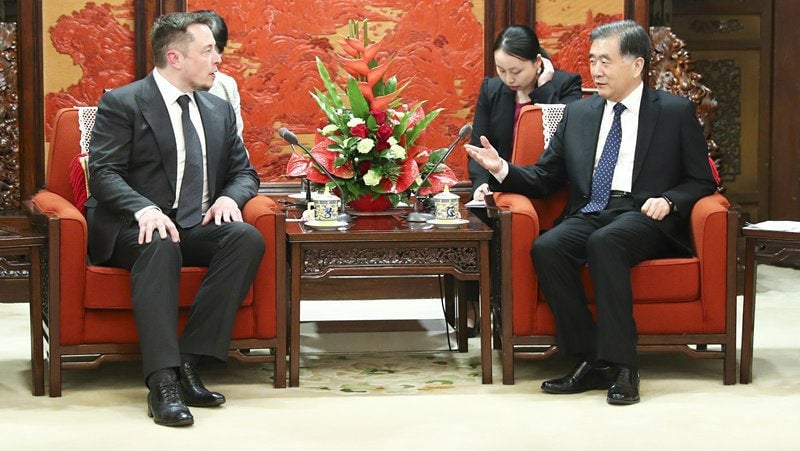

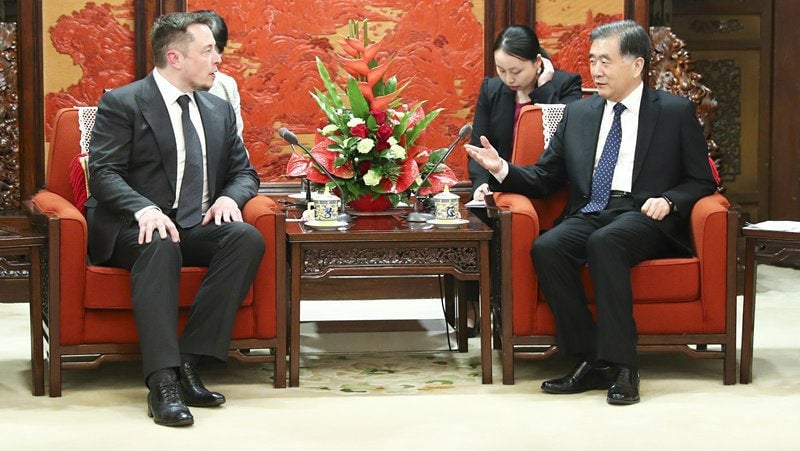

On Tuesday (April 25), state newswire Xinhua tweeted a photo of Tesla founder Elon Musk meeting in person with Wang Yang, one of China’s vice premiers. Wang isn’t well known internationally, but he’s one of the most important political figures in China—reporting to premier Li Keqiang, the nominal second-in-command to president Xi Jinping.

Domestic Chinese media outlets have not reported extensively on the meeting. Quartz reached out to Tesla, but the company declined to provide further information, though it confirmed Musk indeed took a trip to China this week.

Despite the hushed nature of the trip, the photo itself is telling enough. After years of operating on the margins of China’s auto market—the world’s largest—Tesla is beginning to act more aggressively in hopes of selling more cars there.

Tesla has been selling its vehicles in China since April 2014 but has achieved only middling success there, despite enjoying high name-recognition with Chinese consumers (paywall). It recently reported $1 billion in revenue in China last year, though the blog CleanTechnica wrote that it occupied just 2% of China’s electric car market as of June 2016.

China’s steep duties and taxes can raise an imported vehicle’s sticker price by as much as 50%. As a result, most foreign automakers choose to manufacture their cars inside China. But if they do so, Chinese law requires them to form joint ventures with state-owned manufacturers, in which the foreign entity can accept an equity stake of no more than 50%.

Tesla, unusually, has so far stuck to importing, making its cars considerably more expensive in China than in the US. The sticker price for the most basic Model S is $104,972 in China, compared to $69,500 back home.

In early 2016 Musk confirmed that Tesla is mulling opportunities to manufacture in China. A deal has yet to be announced, but signs have emerged that one might be soon. Last month, news broke that Chinese social networking giant Tencent had purchased a 5% stake in Tesla. While the investment was deemed non-strategic, the comparatively large stake suggests that some form of partnership could be imminent.

As for the stealth China visit, it’s not uncommon for American tech CEOs to meet with high-level Chinese officials in hopes of earning the good graces of the government. In Tesla’s case, there’s a lot to ask for. It’s possible Musk met with Wang in order to make the case for Tesla to circumvent the standard joint-venture requirement. There have been consistent reports over the past year that Beijing would revise the decades-old rule, or even abandon it altogether.

It’s also possible that Tesla will seek permission for a less conventional partnership, one more true to its roots as a Silicon Valley tech company. Michael Dunne, an industry analyst who has followed China’s car industry for decades, says that Tesla might attempt to partner with Tencent instead of a stodgy government automaker.

Either way, Tesla will likely need some increased form of government support if it hopes to grow in China. As of June 2016, 96% of electric vehicles sold there originated from domestic brands, which receive subsidies, government orders, and other benefits. “Winning in China gets much easier when the [Communist] Party is on your side,” says Dunne.