Europe’s banks are once again the weak link in Europe

Since the US Federal Reserve spooked markets last week, causing a general rise in interest rates, some of the hardest hit have been yields on bonds in peripheral Europe—particularly Italy and Spain. Some speculate that the European Central Bank (ECB) could be forced to act to quell the unease.

Since the US Federal Reserve spooked markets last week, causing a general rise in interest rates, some of the hardest hit have been yields on bonds in peripheral Europe—particularly Italy and Spain. Some speculate that the European Central Bank (ECB) could be forced to act to quell the unease.

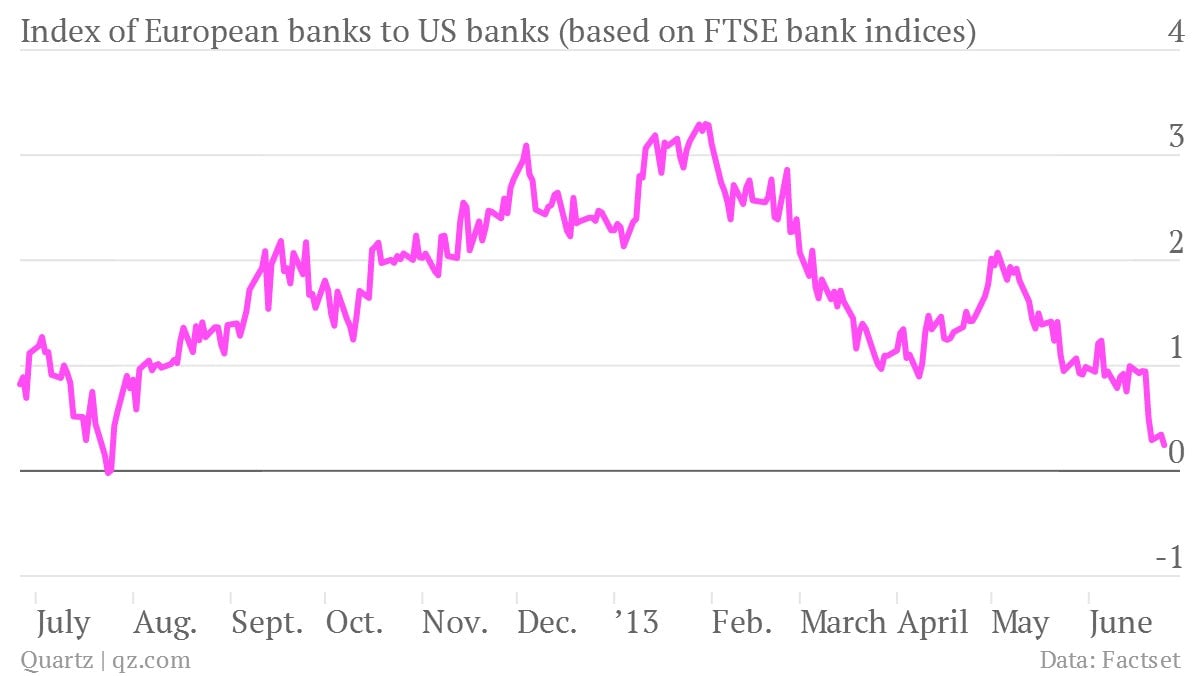

But yields aren’t the real worry coming out of Europe; the banks are. As Citi FX analyst Steven Englander points out in a client note yesterday—and as the chart above shows—since early May, the gains that European banks had been making relative to US banks in the past year or so have been wiped out. (The chart shows the ratio of FTSE’s “total return index”, a measure of a bank’s overall performance, for European banks relative to US banks; it’s been re-indexed so that the ratio is 1 a year ago.) European banks’ performance has declined especially sharply since last week, when the Fed said it would likely start tapering its quantitative easing program later this year.

That’s significant because, as Englander points out, it’s a year since ECB president Mario Draghi famously promised to “do whatever it takes to save the euro.” That speech, and his subsequent announcement of the Outright Monetary Transactions (OMT) program—in which the ECB offered to buy bonds of countries like Spain and Italy without a full-scale bailout so long as they took on certain reforms—did much to buoy confidence. And now that confidence might be gone.

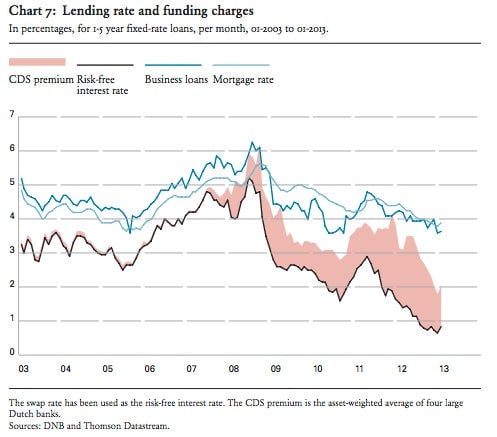

Unfortunately, the data suggest that the ECB might not be able to do much about this. OMT has never been used, and is under fire from Germany’s constitutional court. And the usual tool of central-bank policy, a rate cut—from 0.5% to 0.25%—probably wouldn’t help. A rate cut is supposed to let banks, in turn, set lower rates for lending money to people and businesses. But rate cuts in the euro area aren’t really working more, as we’ve previously explained. Even in core European countries like the Netherlands, banks aren’t lowering their lending rates because they remain scared of risks in the financial system.

In short, European financials are rapidly declining against US ones. For the banks, at least, the magical effect of Draghi’s promise may have finally worn off.