US student-loan interest rates just doubled because Congress went on vacation: 10 things to know

Yet another dismaying performance by the US legislative branch, which left Washington for the Independence Day recess without cobbling together a solution on interest rates for subsidized student loans. Those rates doubled today from 3.4% to 6.8% on certain loans, although a retroactive fix is foreseen after the July 4 break. Here’s what you need to know.

Yet another dismaying performance by the US legislative branch, which left Washington for the Independence Day recess without cobbling together a solution on interest rates for subsidized student loans. Those rates doubled today from 3.4% to 6.8% on certain loans, although a retroactive fix is foreseen after the July 4 break. Here’s what you need to know.

1. All student debt interest rates are not rising. The increase from 3.4% to 6.8% applies only to new, subsidized Stafford loans, which are for undergrads who demonstrate financial need.

2. Stafford loans account for a quarter of all new student loans directly from the government each year, according to the nonpartisan Congressional Budget Office.

3. There were 7.9 million subsidized Stafford borrowers in 2011-12 academic year, according to the College Board. Total undergraduate enrollment that year was 25.5 million. (Many US students have loans from more than one source.)

4. Rates are already higher on the other kinds of US federal student loans, such as unsubsidized and Plus loans.

5. We’re talking about this now because the rates on variable-rate Stafford loans reset on July 1.

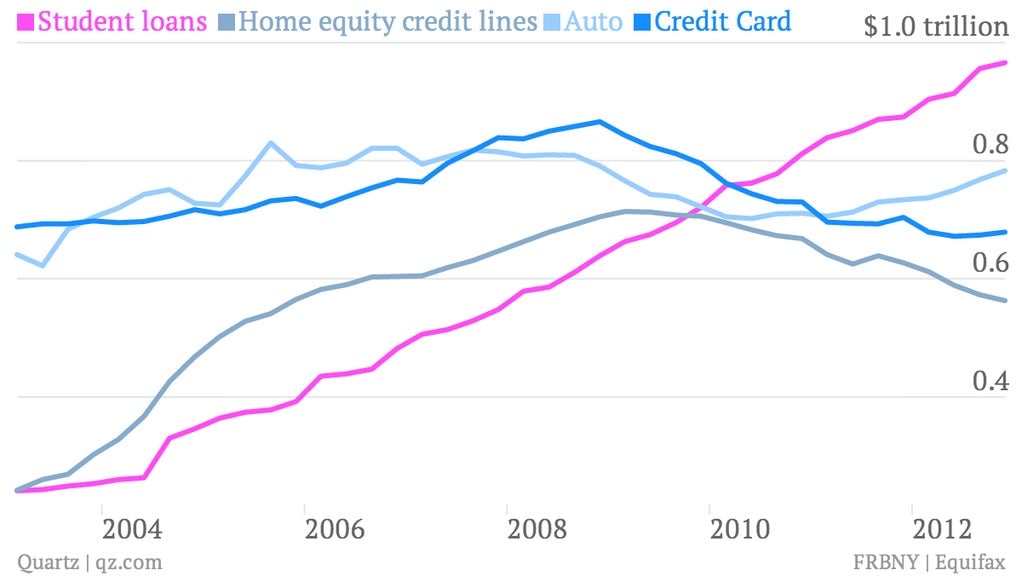

6. The backdrop to this battle is the rising tide of US student debt, which is now the second-largest category of consumer debt in the country after mortgage borrowing. There’s nearly $1 trillion in student loans outstanding, according to the Federal Reserve Bank of New York.

7. Subsidizing loans costs money. The CBO estimates that keeping rates at 3.4% instead of letting them double “would increase the cost of the student loan program to the government by $41 billion between 2013 and 2023.” Plain and simple, this is a fight over spending priorities.

8. But it keeping the rate at 3.4% would make student debt payments cheaper for borrowers. A borrower seeking to repay $23,000—the borrowing limit—over a typical 10-year period would pay roughly $226 per month with rates at 3.4%, versus $265 per month with rates at 6.8%, according to the same CBO report. That’s a $38 monthly difference.

9. Don’t sign anything for a couple more months. Most students don’t sign on the dotted lines for their loans until August. And that’s allowing Congress some wiggle room to do something on interest rates. In other words, Congress could fix them retroactively, according to the Times.

10. A proposal being circulated by a group of senators from both parties would peg student annual student borrowing rates—on unsubsidized, as well as subsidized Stafford loans—to the yield on the 10-year note, plus 1.85 percentage points. That’d be around 4.40% at current rates.