America’s bond king just had his worst quarter ever, thanks to a wily Ben Bernanke

It’s not always good to be the king.

It’s not always good to be the king.

These have been tough days for Bill Gross, whose position as skipper of the megalithic Pimco Total Return Fund—the world’s largest mutual fund with over $295 billion in assets—has earned the camera-ready manager the nickname of “Bond King,” making him an authority on the the bond market and interest rates.

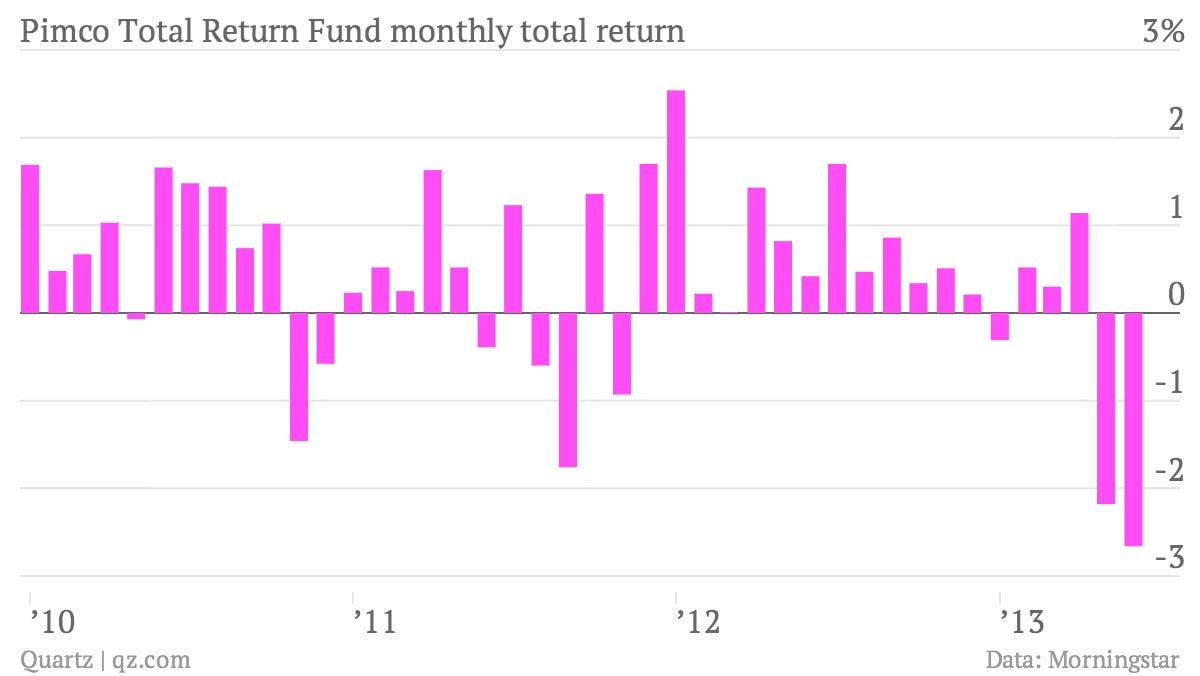

But as it turns out, the Pimco Total Return Fund has had some of its worst months on record recently. Including both interest payments and capital losses, the fund was down 2.6% in June. According to mutual fund data company Morningstar, June was the worst performance for the total return fund since its 3.2% decline in September 2008, the month that Lehman Brothers declared bankruptcy and the country plunged deeper into financial crisis. Here’s a look at the recent monthly returns.

June was preceded by a miserable May, when the fund fell by 2.2%. In fact, the second quarter of 2013 was the worst-ever quarterly performance of the Pimco Total Return fund—down 3.6%—since its inception in May 1987, according to Morningstar.

What does this mean? The short version is that the Bond King—and his underlings—failed to foresee a significant shift coming from the Federal Reserve. (It was that Fed shift that ignited the recent selloff in the bond market.) As of May 31, 37% of the Total Return fund’s holdings were in Treasurys. Some 34% of the fund was in mortgage bonds, another asset class that was badly beaten up by the recent bump in interest rates. Gross’s failure to foresee the shift is an even bigger mis-step than his earlier high profile bet that rates would rise back in 2011, which didn’t pan out.

Others in the bond market have suffered from the recent turn in rates. But the Bond King’s crown has clearly taken a few dents.