African fintech startups still face major funding gaps

The number of early-stage deals among African fintech startups is increasing, but the average size of the deals remains low compared to that of other regions, and funding gaps persist at the early stages, according to a new report on the industry in emerging markets. Creative funding solutions may go some way to overcoming these obstacles, it says.

The number of early-stage deals among African fintech startups is increasing, but the average size of the deals remains low compared to that of other regions, and funding gaps persist at the early stages, according to a new report on the industry in emerging markets. Creative funding solutions may go some way to overcoming these obstacles, it says.

While the average amount for African startup seed rounds is $1.5 million, those of India and Latin America are around $4.6 million and $5.7 million respectively, says the report by Briter Bridges, a data-driven research firm, and Catalyst Fund, a global tech accelerator. Seed rounds refer to initial investments in a new company, often by so-called “angel investors,” usually in exchange for partial ownership or equity. They help to grow the business by funding research, a team, and product development for example.

The researchers surveyed 177 fintech startups and 33 investors in Africa, Asia and Latin America.

They found that among their African respondents, seed investments are the most common type of deal. The good news is that the volume of early-stage deals for African fintech startups, including accelerator funding, pre-seed rounds, and seed rounds, has gone up over the past five years, amounting to more than $1.6 billion between 2017 and 2021. And the average deal size has grown from $750,000 to $1.5 million in the past five years.

“We can confidently say that there has been massive growth across the African startup ecosystem when it comes to the attention that it’s been receiving from international investors, local investors,” Dario Giuliani, founder of Briter Bridges and co-author of the report, tells Quartz.

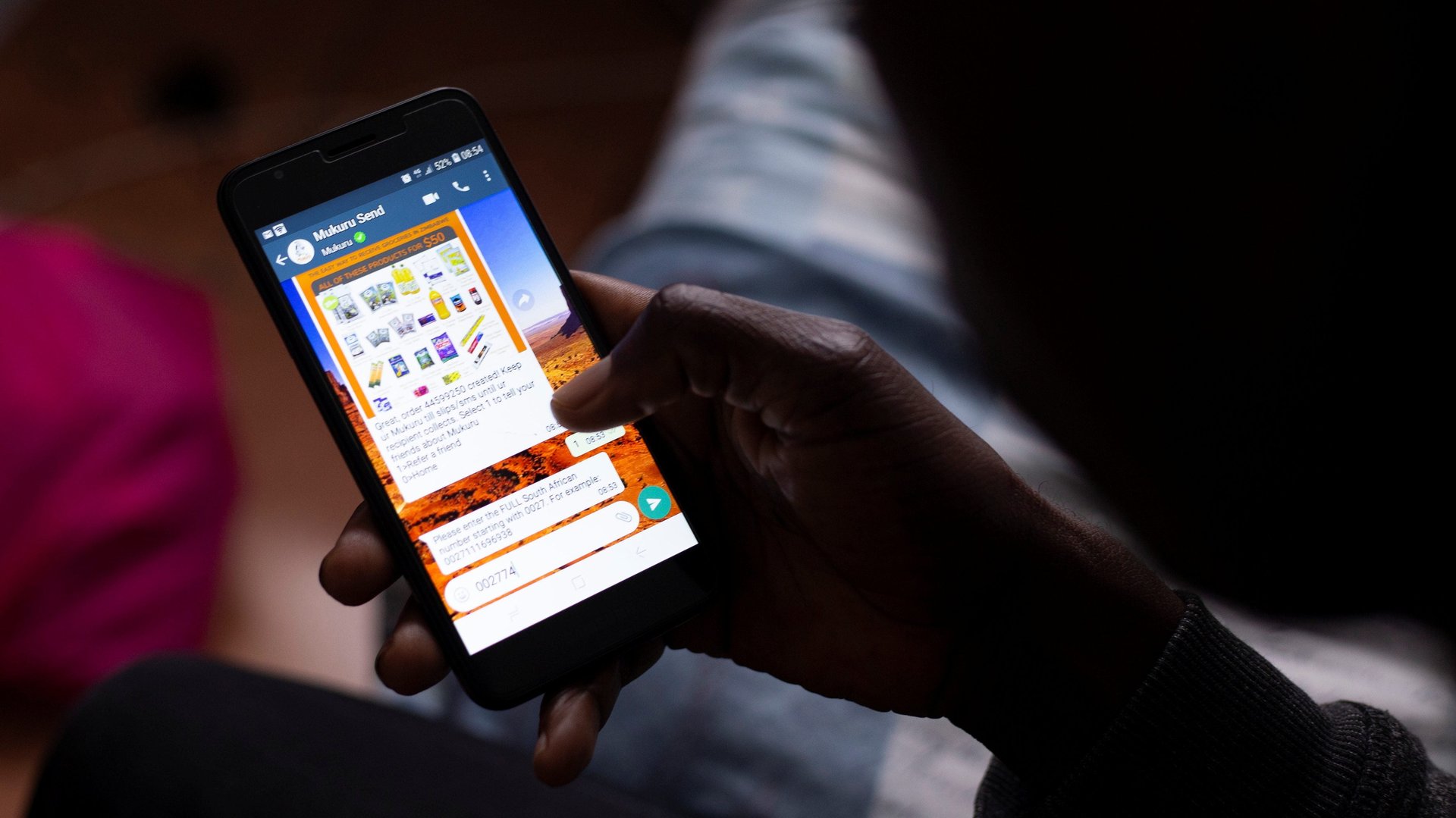

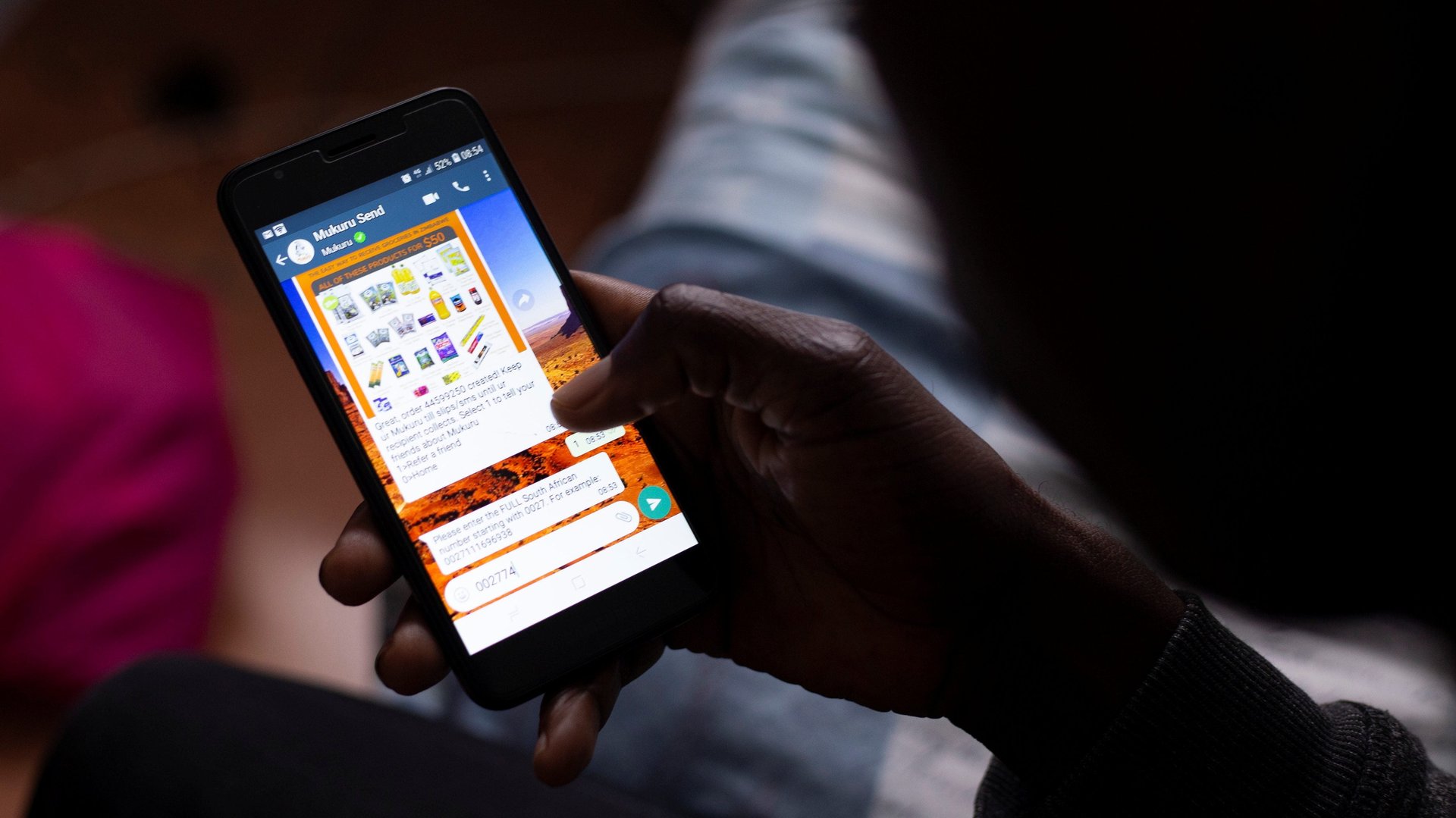

Fintech has long been the most funded startup sector in the continent, as companies look to capitalize on Africa’s flourishing digital payment market and the continent’s drive to increase financial inclusion and cashless payments. Recent standout deals by payment service providers include Flutterwave’s $170 million Series C round in March, and Network International’s acquisition of DPO Group for $288 million last year.

However, early-stage startups are still facing gaps in funding, particularly in the $250,000 to $1 million range, that could help them bridge “the valley of death,” the report says. Maëlis Carraro, managing director of Catalyst Fund and co-author of the report, describes this as the period when a startup has begun operations and has a product in market, but has not yet generated revenue, which is often a prerequisite for getting funding from institutional investors.

The result, she adds, is that the startups don’t get the opportunity to fully scale and provide a benefit to consumers, resulting in a loss of opportunity for potential customers, small businesses, and governments, and ultimately hurting the economy.

“They die in the van before they even are getting the opportunity to reach that stage,” she says.

Despite the presence of accelerators, incubators, mentorship programs, and angel networks, the report says, the African market is still far from having enough support to sufficiently spur more innovation. This is especially because this support appears concentrated in a few leading markets such as Kenya and among specific founder communities, it adds.

Founders who lack connections and influential networks are often excluded from funding flows early in their startup journeys, the report says. But besides capital, it adds, startups need practical and technical support from experts and operators that can help overcome the early hurdles.

To this end, there are many opportunities for blended finance approaches that make use of philanthropic and equity or debt capital to spur more innovation and help startups overcome the “valley of death,” the report says.

“We’re still falling short for the ecosystem to really mature and flourish like it has in other regions, and that’s our message for investors and for other ecosystem players, whether it’s enablers or funders of those types of programs,” says Carraro. “We need to do more for those entrepreneurs, and we need to see more innovative solutions emerge.”

Sign up to the Quartz Africa Weekly Brief here for news and analysis on African business, tech, and innovation in your inbox.