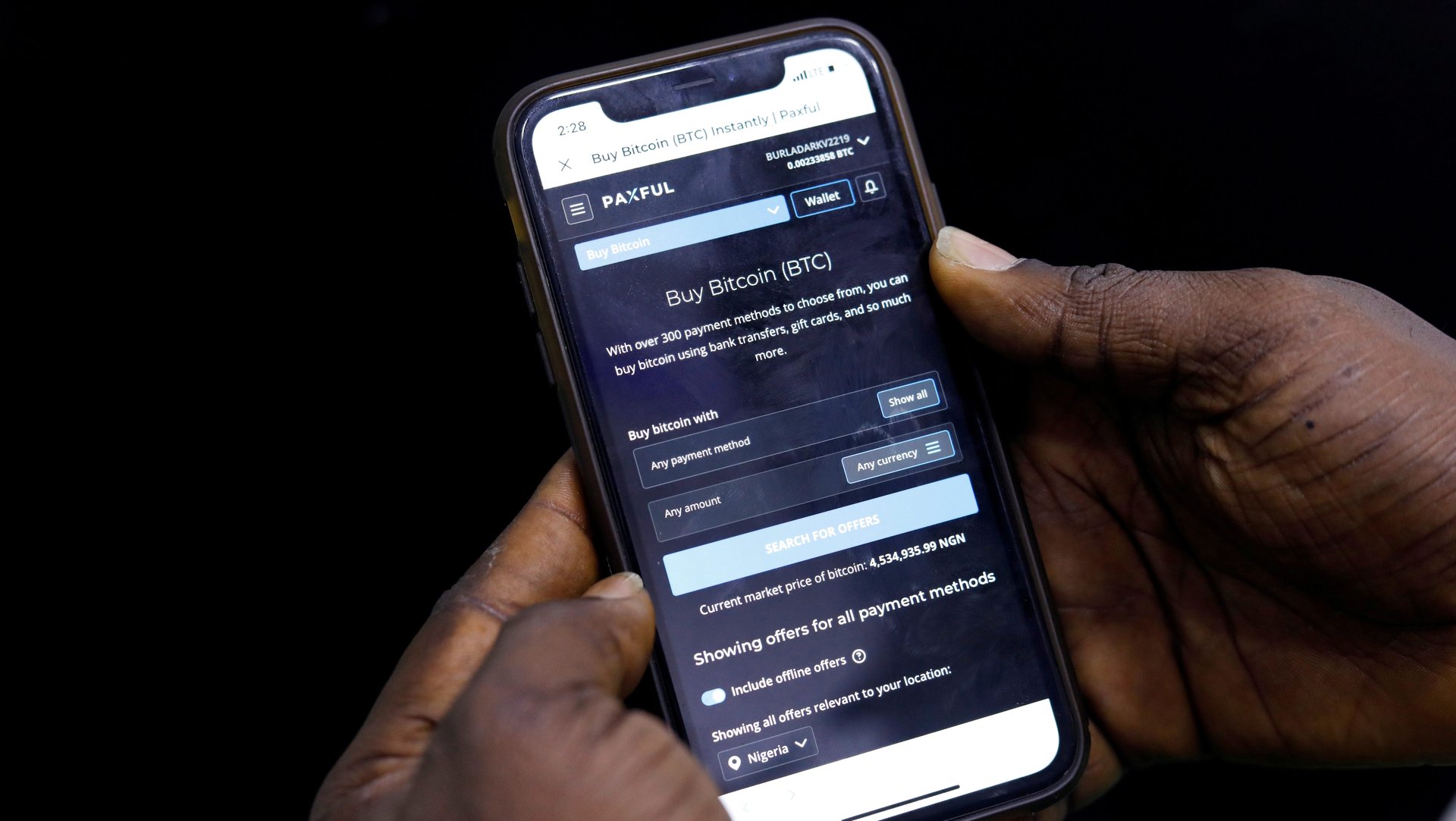

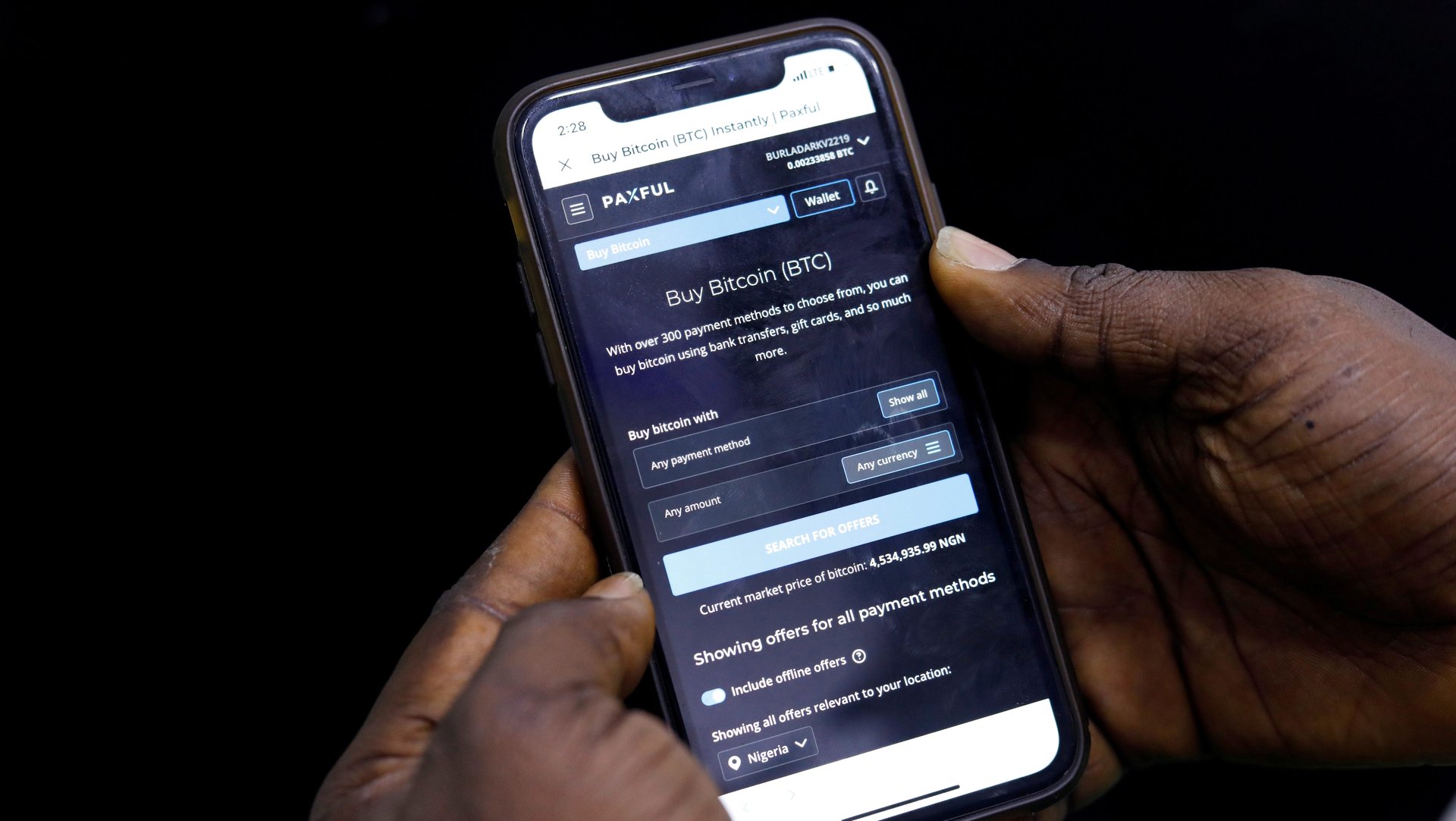

Peer-to-peer trading is driving Africa’s digital money revolution

Peer-to-peer (P2P) cryptocurrency trading platforms are now the engine of growth as Africa pulls ahead of the rest of the world in grass-roots adoptions of virtual cash.

Peer-to-peer (P2P) cryptocurrency trading platforms are now the engine of growth as Africa pulls ahead of the rest of the world in grass-roots adoptions of virtual cash.

Retail-sized transfers make up a larger share of the continent’s cryptocurrency activity on the continent with P2P enabling the practical use of digital money.

In countries like Nigeria and Kenya, consumers have been documented buying commodities and services, as well as paying debts using digital currencies.

This remains a mirage in most of the Americas, Europe, and parts of Asia where cryptocurrency is still viewed as a highly speculative asset, or simply, the future of money.

P2P platforms are popular in Africa especially for remittances and commercial transactions

Cryptos’ biggest onslaught came recently when China launched a crackdown effectively banning cryptocurrencies in a move that roiled digital cash spot prices worldwide.

The ban had little impact on Africa’s small scale crypto investors, though, where most are using P2P platforms to navigate legal and regulatory headwinds.

Those platforms have struck a chord with users across the continent where consumers, specifically in Nigeria and Kenya, use them to sidestep stringent financial regulations that curtail cash transfers from banks to cryptocurrency businesses.

Regulators in the two states have been advising banks not to allow these transfers but P2P platforms, which are non-custodial, let customers trade cash for cryptocurrency amongst themselves.

“P2P platforms are especially popular in Africa compared to other regions, and many African cryptocurrency users rely on P2P platforms not just as an on-ramp into cryptocurrency, but also for remittances and even commercial transactions,” a recent Chainalysis report said.

Chinese citizens can therefore take a cue from Africans who are using P2P to trade cryptos.

The original version of this story was republished with the permission of bird, a story agency under Africa No Filter.

Sign up to the Quartz Africa Weekly Brief here for news and analysis on African business, tech, and innovation in your inbox.