Amazon is pivoting on its order of Nvidia's latest 'superchip'

Amazon Web Services decided to transition from Hopper to Blackwell chips, according to the Financial Times

Months after Nvidia unveiled the next-generation version of its highly sought-after superchip, one of its largest customers is already swapping out its order for the powerful new successor.

Suggested Reading

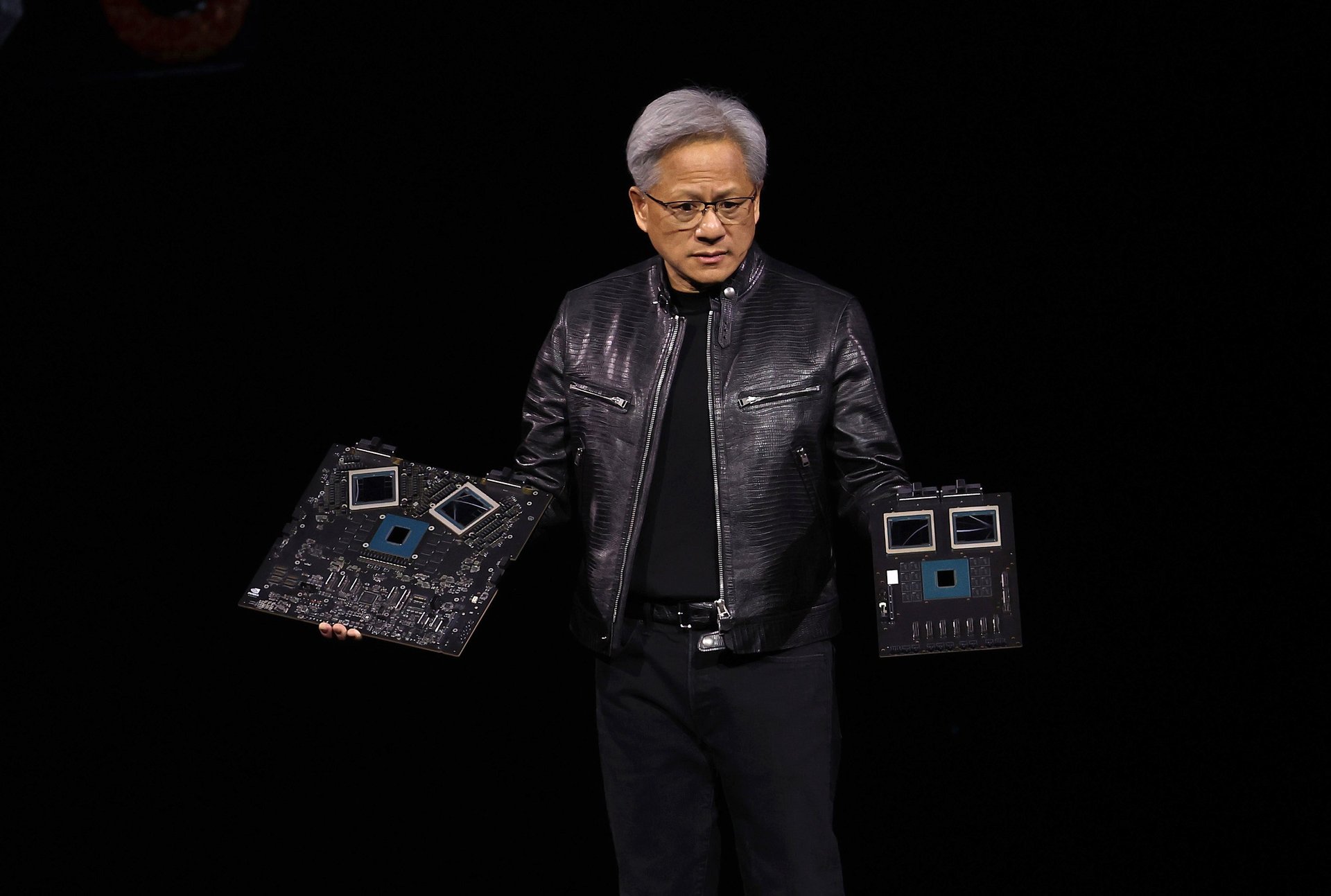

Amazon Web Services has stopped its order of Nvidia’s Hopper chips to wait for the new Blackwell processors, which were announced at Nvidia’s GPU Technology Conference in March, the Financial Times reported. Nvidia chief executive Jensen Huang called Hopper “the most advanced GPU in the world in production today,” but added that “we need bigger GPUs,” or graphics processing units, which are behind the most powerful generative artificial intelligence models today.

Related Content

AWS, which is the largest cloud computing provider in the world, told the Financial Times it had “fully transitioned” its order to Blackwell chips because “the window between Grace Hopper and Grace Blackwell was small.” Neither Nvidia nor Amazon confirmed the price of the Blackwell order with the Financial Times.

Nvidia declined to comment. An AWS spokesperson said in a statement shared with Quartz: “To be clear, AWS did not ‘halt’ any orders from NVIDIA. In our close collaboration with NVIDIA, we jointly decided to move Project Ceiba from Hopper to Blackwell GPUs, which offer a leap forward in performance.”

Meanwhile, investors are worried about a slowdown in demand for Nvidia’s chips between Hopper’s release and Blackwell’s eventual shipments, the Financial Times reported. Nvidia reports its first quarter earnings this week, and Wall Street is setting its expectations high again, after the chipmaker beat fourth quarter expectations in February, reporting revenues of $22 billion — up nearly 270% from the previous year.

“Despite anticipation of next-generation Blackwell GPUs [graphics-processing units] in the second half, we see limited signs of a demand pause and expect Nvidia to report first-quarter results and second-quarter guidance meaningfully above expectations,” KeyBanc equity research analyst John Vinh wrote in a research note last week.

However, analysts at Morgan Stanley wrote in a note to clients this week that “there is anxiety [on Wall Street] about a pause in front of Blackwell,” while analysts at Citi noted a “potential air pocket” in the demand for Nvidia’s chips, the Financial Times reported.