Bitcoin and crypto have a lot of terms. We've got a glossary for what you need to know

Cold wallet vs. hot wallet, DeFi, NFTs — all the important cryptocurrency vocabulary to know

Since its inception, Bitcoin has captured the attention of countless individuals, which has led to the creation of a bustling cryptocurrency industry. As the crypto industry is new, its terms and jargon are often unfamiliar, which makes it difficult to understand what’s going on in the business.

In this slideshow, let’s break down the terms to better understand their meanings.

2 / 10

What is blockchain?

Blockchain is a digital and decentralized ledger spread out across a network. Think of it as a publicly accessible and secure database shared by everyone on the network.

Blockchain can be understood through a simple analogy.

Have you ever worked on a group project using Google Docs? When you create a document and share it with others, you’re not making copies or transferring the file. Instead, you’re distributing it so that everyone can participate and contribute their ideas together.

This way, a Google Doc creates a decentralized distribution chain where everyone has simultaneous access to the document. The entire network sees the change when one person adds or deletes the content on Google Docs.

In a similar way, whenever a block is added or deleted from the blockchain network, the change is visible to everyone in the network.

3 / 10

Cryptocurrency vs. digital asset vs. token

Tokens, cryptocurrencies, and digital assets are often used interchangeably but are different from each other.

Digital asset is a broader term that refers to assets that exist in digital form and can be stored, transferred, and managed electronically. Examples include cryptocurrencies, tokens, and NFTs (non-fungible tokens).

Cryptocurrency is a digital asset that relies on cryptography to facilitate secure financial transactions. It is decentralized and operates on a distributed ledger technology called a blockchain. Bitcoin is an example of a cryptocurrency.

All cryptocurrencies are digital assets, but not all digital assets are cryptocurrencies.

The token, on the other hand, is created on top of an existing blockchain network. For example, Shiba Inu, a popular meme-based coin, was created on the Ethereum blockchain network. It doesn’t have its own network.

That means one blockchain network can support multiple tokens. Ethereum, for instance, is the foundation for several tokens.

4 / 10

What are NFTs (non-fungible tokens)?

An NFT (non-fungible token) refers to a unique digital asset that can take the form of art, music, in-game items, videos, and other types of digital content stored on a blockchain network and traded using cryptocurrency as a means of exchange.

NFTs such as CryptoPunks, created by Larva Labs on the Ethereum blockchain, are among the most expensive. One art piece, CryptoPunk #5822, was sold for $23 million in 2022.

It is natural to question why someone would spend $23 million on a digital photo that can easily be downloaded for free. The answer is arguably the same as it is for Monalisa’s paintings. Monalisa’s paintings are so valuable because there is only one original, despite the fact that many copies were made by different artists. It doesn’t matter how many copies are made; the value of Monalisa will remain the same.

5 / 10

What are memecoins?

Memecoins are a type of cryptocurrency inspired by popular internet memes, viral online trends, and pop-culture references. Memecoin creators use these themes to attract attention and boost crypto trading.

Among the most popular memecoins is Dogecoin, which was created as a joke in 2013 by software engineers Billy Markus and Jackson Palmer. Dogecoin features the likeness of the Shiba Inu dog, which is popularized in the Doge meme. What initially began as a joke transformed into one of the world’s most valuable cryptocurrencies.

6 / 10

What is a stablecoin?

Stablecoins are cryptocurrencies whose value is tied to that of another currency, or commodities such as gold, or any financial instrument. In other words, stablecoins pegged to the U.S. dollar are worth $1 each.

Stablecoins have been developed to address the high volatility associated with the most widely used cryptocurrencies. A currency must remain relatively stable to be used as a medium of exchange, thereby guaranteeing the parties involved that it will retain its purchasing power in the short term.

Tether (USDT) is the top stablecoin that acts as a medium for investors to trade Bitcoin and other cryptocurrencies. Tether accounts for over 50% of the daily trading volume of Bitcoin and up to 70% of some other major cryptocurrencies.

7 / 10

What is DeFi?

Decentralized finance, or DeFi, refers to a variety of financial applications in cryptocurrencies or blockchains that aim to remove intermediaries. It can be understood by an example.

Typically, if A wants to transfer $1 to B, then 1) A can either make a bank transfer or use a payment service like Venmo or Paypal or 2) give cash to B. This kind of transfer always involves fiat currency, which is controlled by a central bank.

DeFi challenges the concept of centralized finance, and its philosophy is that there is no need for a third party. Blockchain and cryptocurrency enable decentralized finance by allowing direct money transfers (or peer-to-peer transfers) of a digital currency on the network that is not controlled by any authority and without any intermediaries, such as banks.

8 / 10

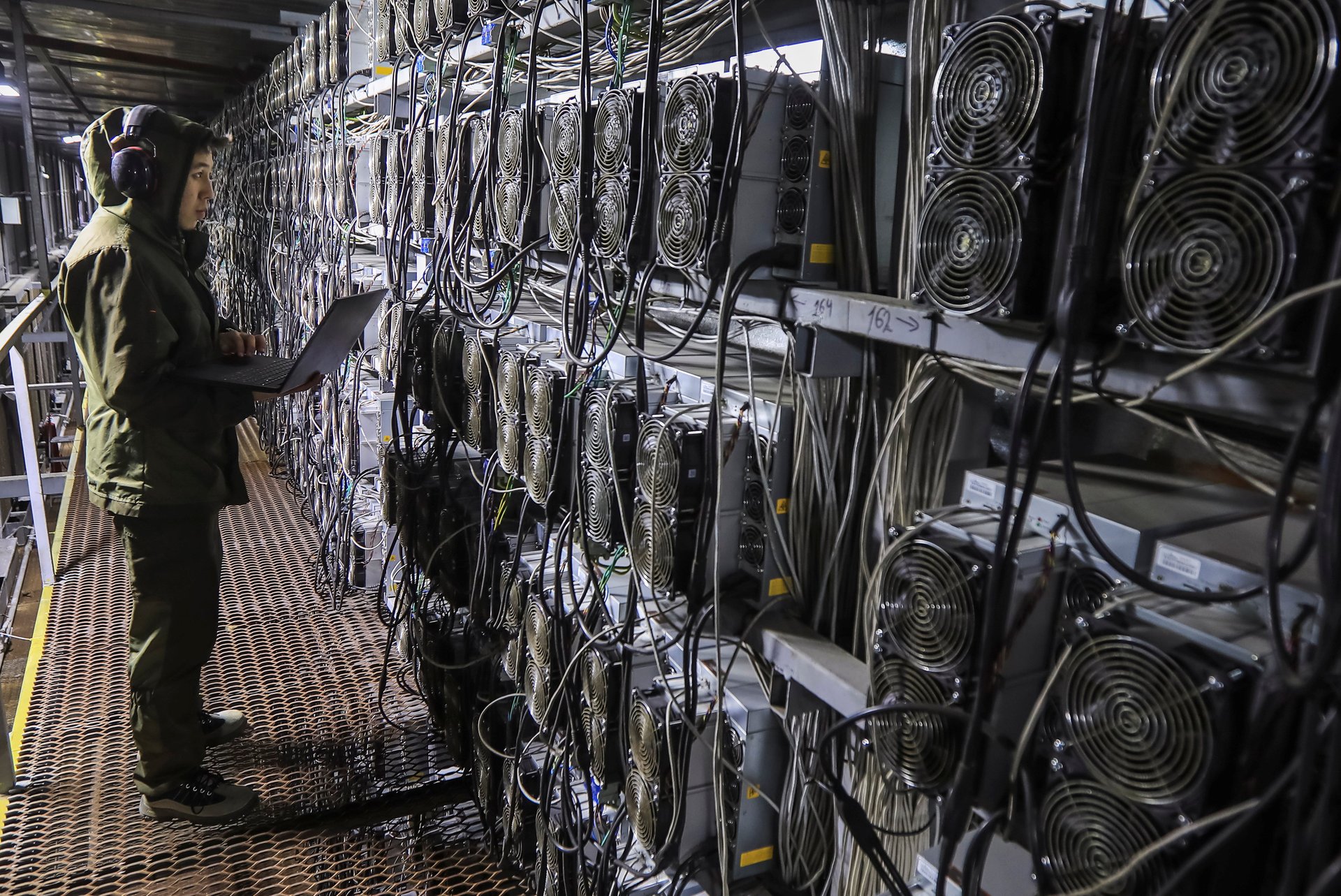

What is the hash rate?

Miners verify cryptocurrency transactions using mining hardware or equipment. When more miners compete to verify the network, the process becomes more difficult, which makes the network more secure.

The hash rate measures the computational power per second of a blockchain network. The hash rate of a blockchain increases with the size of the network.

9 / 10

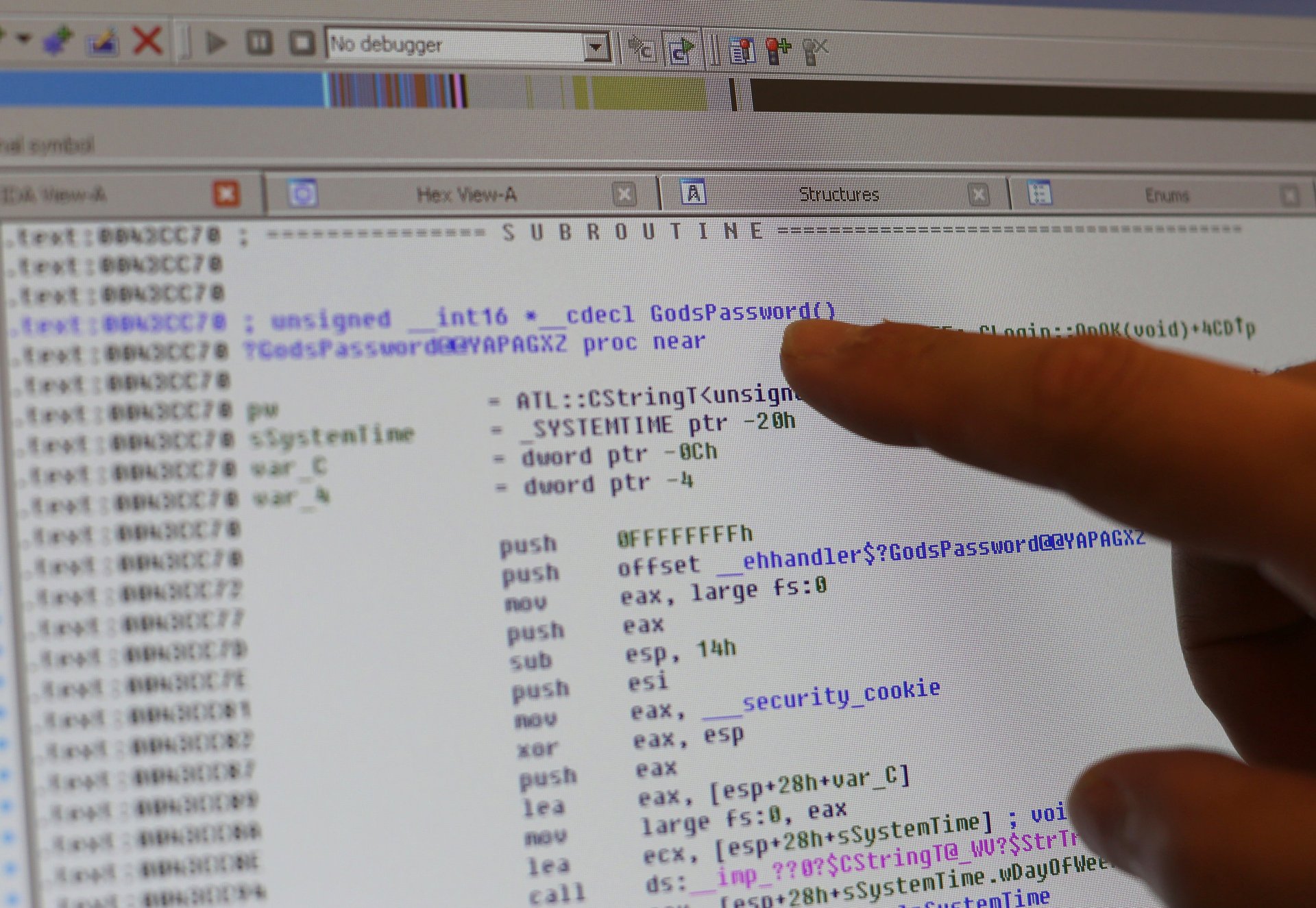

What is a private key?

A private key is a combination of letters and numbers that is used in cryptography, similar to a password. It is essential for authorizing transactions and proving ownership of a cryptocurrency.

Sharing private keys with anyone is equivalent to sharing access to your cash locker, and it must not be done. If your keys get lost or stolen, you will lose your cryptocurrency.

Private keys should be kept in a non-custodial wallet without internet access. This way, the keys are safe and secure, and the user has full control over them.

10 / 10

Cold wallet vs. hot wallet?

Hot wallets are crypto wallets connected to the internet. These are easily accessible through devices like cell phones, tablets, and laptops and have become popular among cryptocurrency users as they offer an easy way to send and receive cryptocurrency.

On the other hand, cold wallets are more like safe deposit boxes and are not connected to the Internet. This makes them more secure since they are less vulnerable to hacking and cyber-attacks.