More and more CEOs are expecting a recession as tariffs rattle the economy

Almost two-thirds of respondents in a new survey predicted an economic slowdown in the next six months

Fears of a recession are looming larger among some of the country’s top businesspeople. In fact, according to a recent survey, more than 60% of CEOs expect a U.S. recession in the impending future — as the country deals with trade wars, tariff fallout, wild swings in the global markets, and more.

Suggested Reading

Of the 300-plus CEOs polled in Chief Executive’s April confidence survey, 62% said they foresee a slowdown or recession in the next six months — up from 48% in April. And the percentage of CEOs who think the recession will be severe is up, too: 14% this month compared with 3% last month. Overall, respondents’ ratings of current business conditions were at the lowest level since the COVID-19 pandemic, and the CEOs’ yearly outlook is at a multiyear low.

Related Content

Tariff concerns lead CEO’s economic uncertainty

President Donald Trump’s tariff policies have rattled the financial markets. Stocks seem to be hitting highs and lows in the blink of an eye as the president announces changes to his erratic tariff policies.

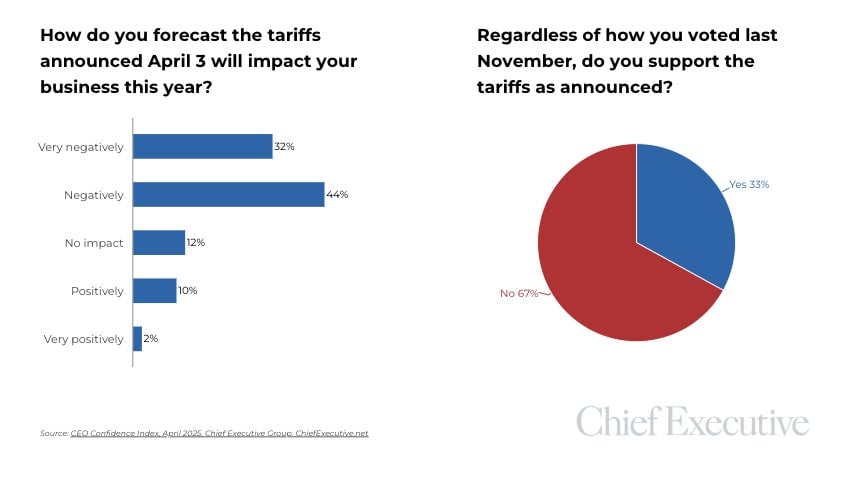

Two-thirds of CEOs in the survey said they don’t approve of Trump’s tariffs, and three-fourths said the tariffs would negatively or very negatively affect their businesses this year. CEOs responded to the survey from April 8-10, during which the president announced a 90-day pause on most of his sweeping tariffs but imposed a hike on imports from China (145%).

Bridgewater founder Ray Dalio, who predicted the 2008 recession, said over the weekend that he’s worried about “something worse than a recession” because of the country’s current economic policies. Jamie Dimon, the CEO of JPMorgan Chase (JPM), recently said a recession was a “likely” outcome of the tariff policies, while Delta (DAL) CEO Ed Bastian said last week that “we’re acting as if we’re going into a recession.”

Other economic indicators paint a grim picture

The survey’s largest monthly decline came in outlooks for revenues, profits, capex, and hiring — all of which saw sharp declines from March’s survey and even steeper drops from the start of the year.

In this most recent study, only 49% surveyed said they anticipate their revenues to grow in 2025 (versus 54% in March and 84% at the start of the year). Meanwhile, 39% of respondents said they’d be decreasing their headcount in 2025 (versus 11% in March).

More than 80% of CEOs project their costs (goods, services, and labor) to spike this year as compared with last year — with half predicting that their increase in expenses will be in the double digits. Only 37% of respondents said they believe their company’s profits will increase (versus 43% in March and 76% in January).

There might be a light at the end of the tunnel for some CEOs, at least, who seemed hopeful Trump’s tariffs would be resolved within a year. When asked what they forecast as the country’s business conditions a year out, 51% said conditions would be improved, compared with 39% in April — though the range in improvement is expected to be a more muted (less than 10%).

“Short term pain will result in long term gains,” Tom McGuire, CEO of Air Hydro Power, told Chief Executive. “We have to be put on a level playing field in world economy.”